Every mistake, we must surely be learning

Still my guitar gently weepsI don't know how someone controlled you

They bought and sold you

Oh my, this is getting exciting!

As we expected yesterday morning, our Short-Term Portfolio popped a lovely 11.5%, gaining $11,500 on the day and we took that money and went shopping, adding 1,000 shares of NorthStar Realty (NRF) to our Long-Term Portfolio at a net of $10.60 (using options to reduce our costs) – effectively transferring our short-term gains to long-term purchases.

This is how we keep our paired portfolios from tilting too bearish and it puts our ill-gotten gains to good use in a steady, dividend-paying stock that happens to be on sale at the moment (see our Top Trade Alert for details). Very simply, when we make big bearish wins, we buy some bullish positions that are on sale and vice versa – it's not complicated! Balance is very important in any kind of market if you intend to be a long-term investor – as is learning how to take a step back and watch from the sidelines once in while – something we discussed yesterday.

This morning, in our Live Member Chat Room, we already took a poke at shorting the Futures as my comment to Members at 6:46 am was:

They are having more meetings with Greece but who cares with China collapsing. Crazy we should be up this much so I like shorting our Futures at 17,700 on /YM, 2,075 on /ES, 4,440 on /NQ and 1,250 on /TF. Tight stops over, shorting the laggard is always a good plan and then getting out if any of the others cross over.

Russell Futures (/TF) were the laggard but gave us a nice 4-point drop already (+$200), which is enough to pay for our Egg McMuffins while we wait for the market to open. As noted in the comment, there's some overblown excitement as the Troika meets with Greece again but Greek banks and markets are still closed with the Greek ETF (GREK) down 20% since they shut the markets and instituted capital controls and it's VERY UNLIKELY that there will be such good news that this doesn't follow through and slam the economy any day now (when they finally have to open the market).

Speaking of shutting down markets in a desperate attempt to forestall a total melt-down, China has now halted trading on 745 (out of about 3,000) stocks, trapping $1.4Tn (25%ish) of capital in a market that is spiraling out of control. Imagine holding Chinese equities while the market is plunging 20% and being told that you aren't allowed to sell them! That's what's happening now and that's the only reason those markets aren't down 25-30% already.

Speaking of shutting down markets in a desperate attempt to forestall a total melt-down, China has now halted trading on 745 (out of about 3,000) stocks, trapping $1.4Tn (25%ish) of capital in a market that is spiraling out of control. Imagine holding Chinese equities while the market is plunging 20% and being told that you aren't allowed to sell them! That's what's happening now and that's the only reason those markets aren't down 25-30% already.

$3.2Tn has already been lost China's black hole of a market and that's twice as much as India's ENTIRE stock market. The Shenzhen Composite, which is China's 3rd major exchange, is down 38%, despite being stuffed with entities that are controlled by the state. No wonder the state has stepped in with all sorts of desperate measures – none of which are actually helping so far (see yesterday's notes).

The problem with halting stocks and trapping investors in them is it certainly doesn't encourage fresh money to come in and buy new positions and, very possibly, ends up encouraging traders to cash out of your phony-baloney markets. There is of course, no reason to think the Chinese stocks will come back because they never should have been that high in the first place. This is a very major area of congnitive dissonance traders engage in as they think highs "need" be retaken when, in fact, the highs were a ridiculous spike that had no fundamentall underpinnings and are not likely to be seen again.

That's why China is WASTING it's firepower in trying to stop a market that's up 150% from correcting at least 33%, which would still leave it up 100% from last November. Realistically, we shouldn't be surprised to see a 50%+ drop that lasts as the 108 average p/e of Chinese equities is even more out of control than the high 20s the S&P is averaging into earnings. In the past we've already give our cheapskate readers our short positions on FXI (the July $50 puts are now over $6 in the money for a 200%+ gain) and I've mentioned our FXP (2x ultra-short) and short CHAU (2x long) as well – so you know where we stand on those.

Meanwhile, Greece is still a thing and the Dollar is flying back to 97.50 as the Euro gets a bit more relistic and falls back to $1.09 after yesterday's silly move up. The Pound is $1.54 and there's contagion already if the UK can't escape getting sucked down by the Euro. That's pressured gold back to $1,155 and we have the GLD July $111.50/1112.50 bull call spread and this will be a great time to pull the short calls and roll the long calls to August. Silver is also plunging to $15.15 and that's a BUYBUYBUY for us in the Futures (/SI) as long as the $15 line holds.

You can also play it with SLW using options spreads that can give you 100% returns in 30 days – I'll be happy to put out a trade idea for that in today's Live Member Chat Room (sign up here).

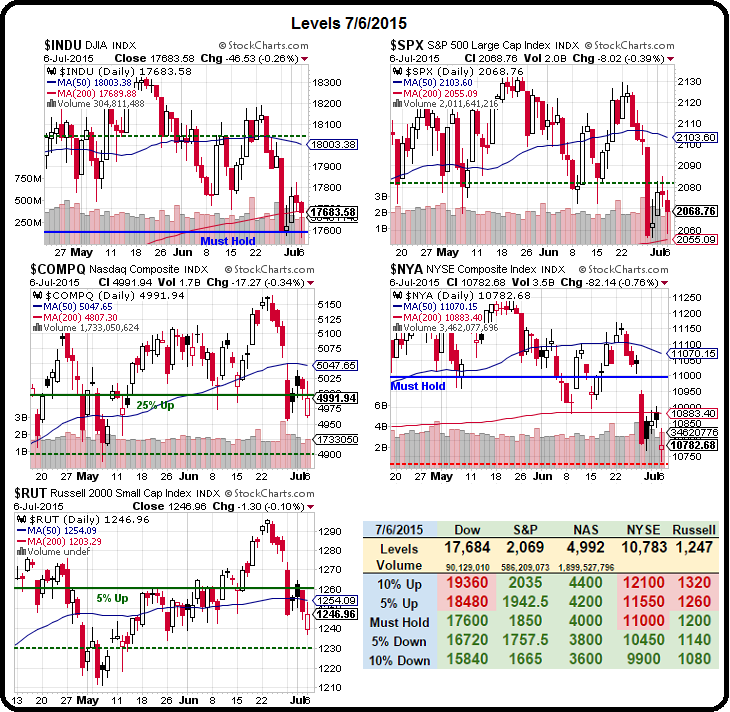

We'll see if our own markets can manage a bounce but, on the whole, I'm not optimistic given all the global headwinds. As you can see from the Big Chart above, we can apply our 5% Rule™ to the indexes and watch the following lines:

We'll see if our own markets can manage a bounce but, on the whole, I'm not optimistic given all the global headwinds. As you can see from the Big Chart above, we can apply our 5% Rule™ to the indexes and watch the following lines:

- Dow 18,200 to 17,600 is 600 points so 120-point bounces (rounded) means we'll look for 17,725 (weak) and 17,850 (strong)

- S&P 2,130 to 2,060 is 70 points so 15-point bounces (rounded) gives us 2,075 (weak) and 2,090 (strong)

- Nasdaq 5,175 to 4,975 is 200 points and we'll look for 50-point bounces to 5,025 (weak) and 5,075 (strong)

- NYSE 11,150 to 10,750 is 400 points and we'll look for 100-point bounces to 10,850 (weak) and 10,950 (strong) but nothing below our Must Hold line at 11,000 is going to impress us.

- Russell 1,300 to 1,240 is 60 points down and we'll look for 15-point bounces to 1,255 (weak) and 1,270 (strong)

It's going to be a wild trading day – be careful out there!