Courtesy of Tim Knight from Slope of Hope.

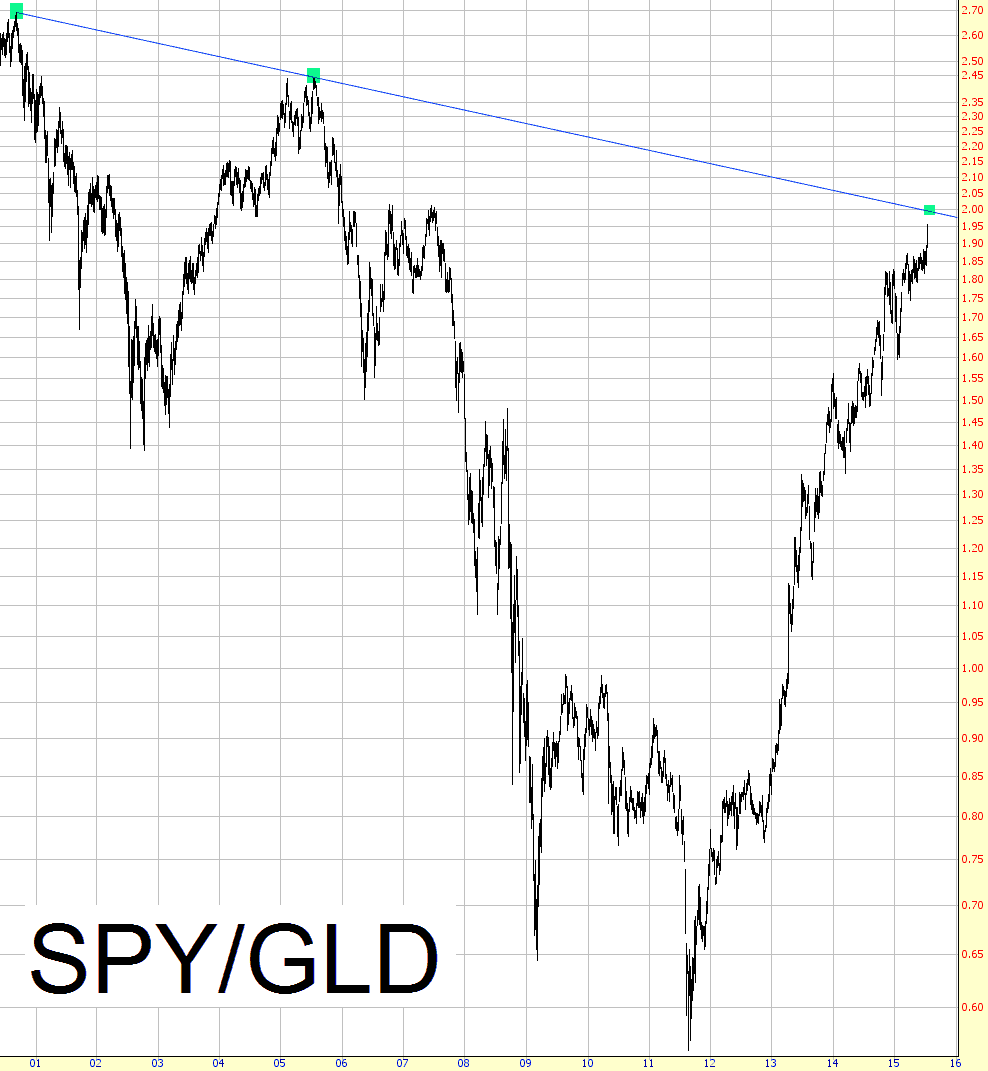

From the Slope of Hope: Two months ago, I did a piece called A Fascinating Ratio, which suggested that a major reversal was coming once the ratio reached about 2.0. At the time I did the post in mid-May, the ratio was a little under 1.8, but thanks to the unflagging strength of equities, as well as the unwavering suckiness of precious metals, this ratio is up to 1.95. We're getting very, very close to what I think will be a major pivot point, and perhaps the pairs trade opportunity of the decade:

What's interesting is that the last major inflection point wasn't precisely before the financial crisis took hold, as you might suspect. It was precisely a decade ago, in mid-2005. Back then, gold was dirt cheap, and as we know now, equities still had more than two years to go flying higher.

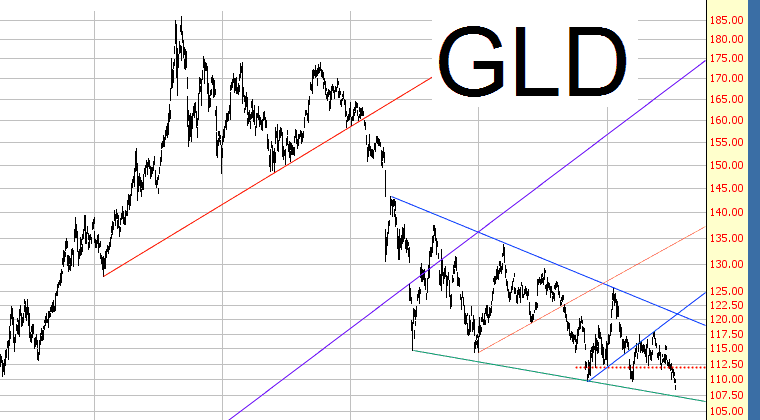

Looking at the individual components, it's obvious that gold has been a piece of trash for almost four solid years now, but we might be reaching an important support point, which is at about 107.50 defined by GLD, shown below:

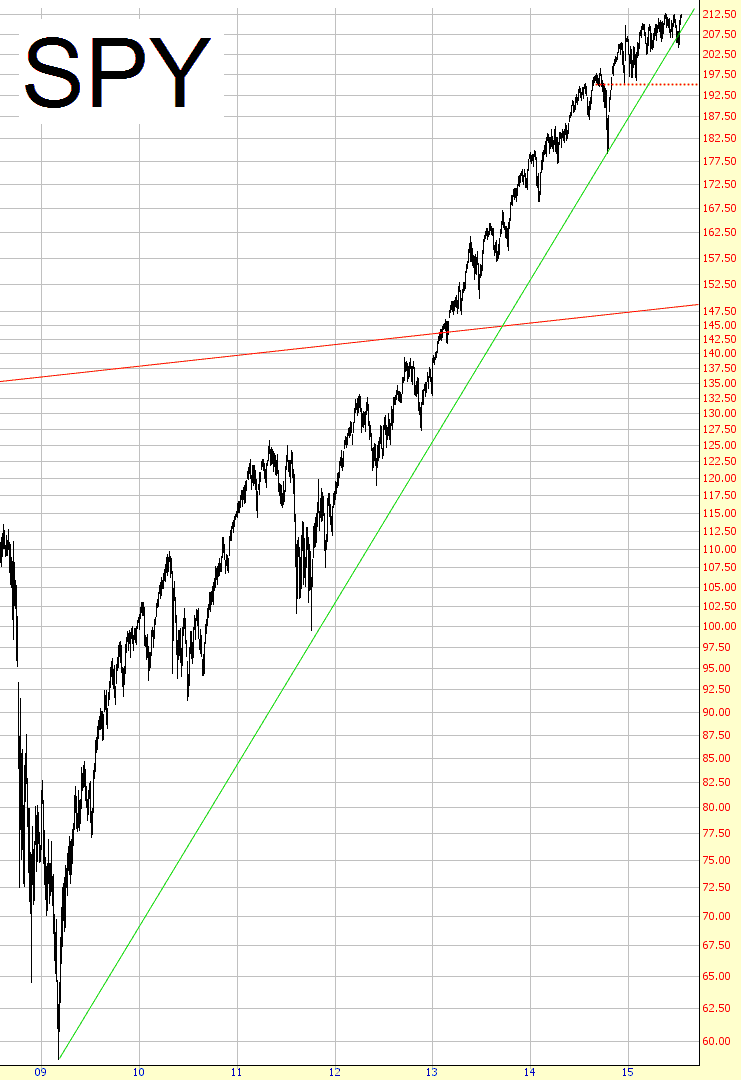

At the same time, the S&P 500 ETF, symbol SPY, has already fractured its long-term ascending trendline. This violation, which took place on June 29, is something I don't take lightly. In my experience, once a financial instrument starts "chipping away" at a trendline, its days are numbered.

In sum, the closer we get to a 2:1 relationship between SPY and GLD, the more powerful an opportunity is made available to go short the S&P and go long gold. Believe me, I realize what garbage gold looks like right now, and how powerful equities (think NFLX, GOOGL, AMZN, EBAY, etc.) appear to be. In spite of this, this contrarian play could be one of the most potent and profitable strategies in years.