Why the olds want to continue working

Courtesy of Joshua M Brown

Is there a (meaningful) correlation between the rise of people working past retirement age and the paltry amount of income they’re able to earn on their lower-risk savings accounts?

Probably.

People over the age of 65 are a growing portion of the labor force participation rate and they’re increasingly unwilling (or unable) to stop working. This is, in part, an unintended consequence of the Fed’s ZIRP policy over the last 7 years.

It’s also partially a health story – there is a large and growing body of scientific research that suggests working is healthier than a sedentary lifestyle as we grow older. Keeping the mind sharp and remaining in a position where others are counting on you can have a salutary effect on your mental and physical health.

Additionally, we’re living longer and the costs of retirement living and healthcare are only headed in one direction. It makes perfect sense that those who are able to earn income and stave off drawing down their savings for a few extra years would want to do so.

In CLSA’s new Greed & Fear note, Christopher Wood pairs the ideas of lower interest income and higher rates of labor participation among the older demo:

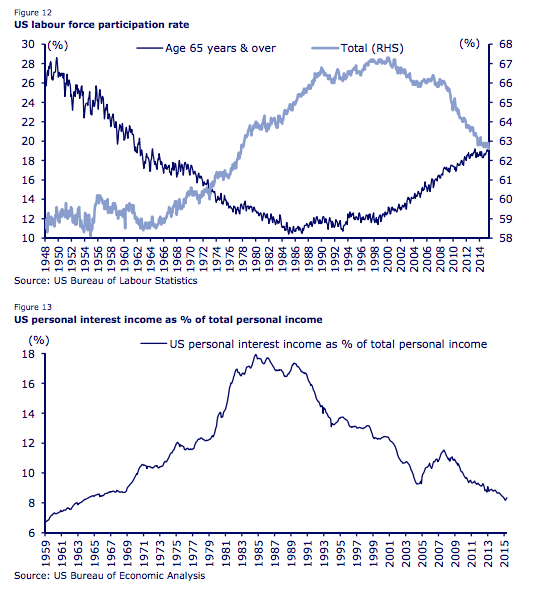

[Note: the scales for participation among Americans over 65 years (left) vs. the total labor participation rate (right) are different in the figure below.]

While the total labour participation rate has fallen from a peak of 67.3% in 2000 to 62.6% in June, the labour participation rate for Americans aged 65 or above has risen from 12.5% to 18.8% over the same period (see Figure 12).

As for older people, GREED & fear’s view is simple. Many elderly people who can afford to retire do not want to. While in many instances those who do want to retire cannot afford to. The Japanese style collapse in interest income in America since the implementation of zero rates is clearly one issue here. Thus, interest income accounted for only 8.3% of total personal income in May, down from 11.5% in 2007 (see Figure 13). While in absolute terms, total personal interest income has declined by 9% since peaking in September 2007.

Source:

Greed & Fear

CLSA – July 31st 2015