When Will The Fed Resume QE?

Courtesy of Lee Adler

Primary Dealers were sellers last week in both the coupons and the futures as they continued to hold larger long positions in Treasury coupons than they have for several years. Conversely, their long position in the futures continues its downtrend of the past year, reaching a new low. They remain moderately long the futures, but they appear to be persistently selling futures into strength while they maintain a modest net long position in the coupons.

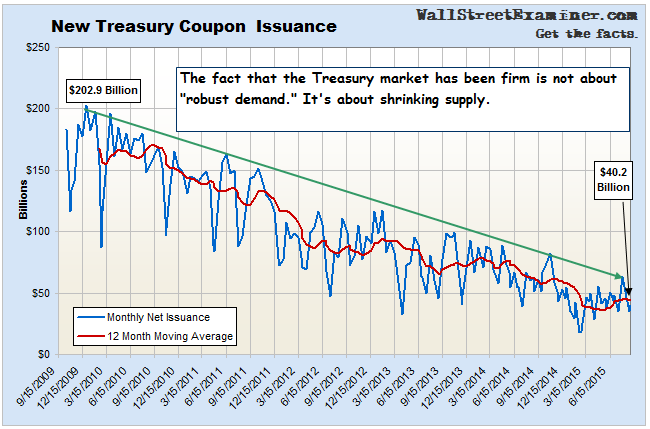

August is usually a month where Treasury supply pressures both stocks and bonds but this year Treasury supply was light. Lighter than usual supply should continue through September. This would normally be a bullish factor for both stocks and bonds. However, other sources of supply, or demand depressants, have pressured prices, particularly money destruction in commodities, emerging markets, and especially China.

As long as Treasury supply remains relatively light, tracking the various classes of buyers, particularly dealers, US commercial banks, and foreign central banks, will give us key insights into the outlook for both stocks and bonds. Supply may be a benign influence, but if buyers are pressured elsewhere, they’ll pull their bids and prices will decline. The longer that dynamic continues, the more likely it becomes that the US economy would weaken, the US deficit would widen, and Treasury borrowing would increase, putting more pressure on securities prices.

The issue at that point would be when would the Fed resume QE.

Subscribe to Lee's report as part of the Treasury Supply and Demand Pro Trader Weekly or Treasury Supply and Demand Investor Monthly on a standalone monthly or weekly basis.