It's all very exciting isn't it?

It's all very exciting isn't it?

Well, not when you look at a weekly chart, like this one from Dave Fry but, when you look at and hourly chart, like the ones most people seem fixated on – like this one:

Well, you'd think this was actually the greatest rally ever and everything is all fixed – just like our very short-sighted, know-nothing, cheerleading MSM is telling you.

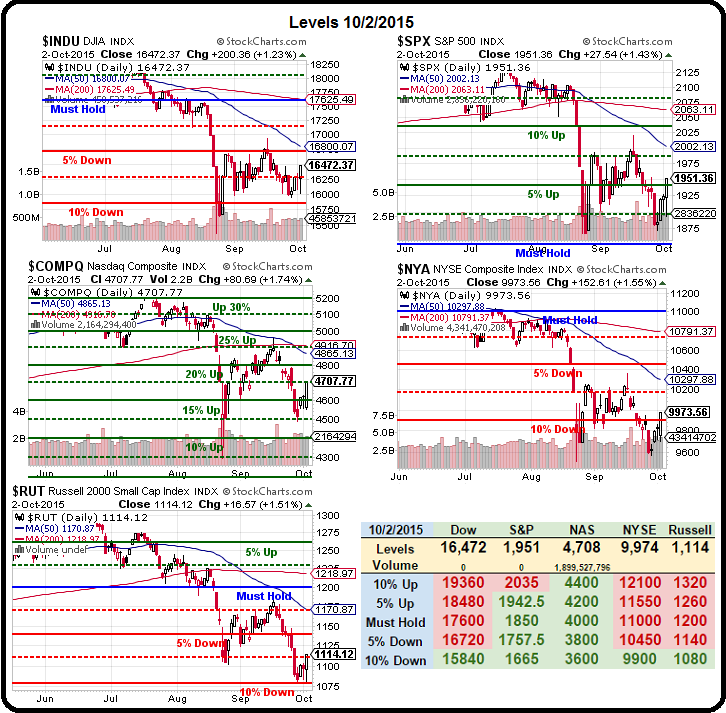

Sure we're still 8.25% below that 2,125 line but we're up 4% from 1,875 so let's focus on the good stuff – even though we actually fell the predicted 10% with a 20% (of the drop) overshoot and now we're bouncing 20% (of the drop) off the 10% line back to -8% line, which the 5% Rule™ tells us is a WEAK bounce. The strong bounce line is still back at 2,000 and that's when we'll turn more bullish. Until then, we're just waiting for this bounce to run out of gas so we can take our next poke short.

While we did start the day bearish on Friday, we knew the Fed speakers would turn things around and I called the flip at 10:17 in our live Member Chat Room, saying:

While we did start the day bearish on Friday, we knew the Fed speakers would turn things around and I called the flip at 10:17 in our live Member Chat Room, saying:

Silver into a new leg up now, Gold flying too. Dollar failing $95.50. /NKD down 500 points for another $2,500 winner!

NONETHELESS – We now have no more data and 3 more Fed speakers coming so I think we may get a bounce here (16,000, 1,890, 4,125 and 1,080 would be the bullish lines to play over – 2 of 4 need to be over and then you can play the 3rd and make sure the 4th follows and make sure NONE go back below).

Those futures plays, of course, made disgusting amounts of money as we turned around and rallied (S&P Futures pay $50 per point, per contract – for example) and we nailed the exact bottom at 1,890 (as noted in the morning post – BEFORE the market even opened) so we maxed out our shorts as well. All in all it was kind of a perfect day – we even caught a little drop into the close (same shorts as we hit in the morning) but those quickly reversed in the final push. You are very welcome for the silver trade I called in Friday morning's post. My comment there was:

This morning we're also long again on Silver (/SI) as it tests the $14.40 line – that's the easiest money you'll see all week…

All these Fed speakers should be great for our silver longs and those suckers pay $50 per penny, per contract – so very exciting if we get a big move but we'll take our money and run if $14.50 is rejected for "just" a $500 per contract gain. Above $14.50, we set that as a stop line and do it again (you're welcome in advance).

As you can see from the chart, it worked out even better than we expected and each unit gained over $2,500 on the run to $15. After that, it plowed higher and is now way up around $15.30 so, if this is the first time you're looking at it since Friday morning – I'd seriously consider taking some of those long contracts off the table as each one is up $4,500 (90 cents x $50)! Aren't Futures fun?

We featured our outlook on gold and silver in last week's Live Trading Webinar (replay available here) and gold had a nice run as well, going from $1,105 to $1,140 (3.16%), but not quite as much fun as silver's record-setting 6.25% run – which is why we were so excited to be able to call it on Friday morning and why I said "that's the easiest money you'll see all week." Remember: I can only tell you what's going to happen in the markets and how to profit from it – that is the extent of my powers – the rest is up to you!

So, moving on to what's going to happen this week (we totally nailed it last Monday!): We did a review of our PSW Portfolios (sorry, PSW Members only) as well as our Options Opportunities Portfolio (Seeking Alpha Members only) and I can't tell you our trade ideas but I can tell you that, in our review, we decided we needed a 10% short ($50,000) to cover the pullback we're still expecting.

Most likely, we'll be shorting using the S&P Ultra-Short (SDS) or the Nasdaq Ultra-Short (SQQQ) because, even though we already have some – they are both the best risk/reward plays out there.

On the Futures, we can talk short pokes on the Dow (/YM Futures) at 16,500, S&P (/ES) at 1,960, Nasdaq (/NQ) at 4,300 and Russell (/TF) at 1,120 and our favorite trick is to wait for 2 to cross under and then short the next one to cross (the "laggard") and then either the last one confirms or we stop out if ANY of the 3 that have crossed comes back over. That way, we limit our losses to small amounts but we let ourselves catch the big moves when they come.

I won't say you're welcome in advance on this one because the situation isn't as clear as it was last week thought the shorts this morning are based on PMI Services coming at 9:45 and ISM at 10:00 (58 expected). We already got Gallup Consumer Spending which was down a touch from August but not so bad if you figure back to school shopping was loaded into Aug. Tomorrow morning we get Gallups Economic Confidence Index (8:30) and the Fed's doveish Williams speaks at 3:30 – in case that doesn't go well.

I won't say you're welcome in advance on this one because the situation isn't as clear as it was last week thought the shorts this morning are based on PMI Services coming at 9:45 and ISM at 10:00 (58 expected). We already got Gallup Consumer Spending which was down a touch from August but not so bad if you figure back to school shopping was loaded into Aug. Tomorrow morning we get Gallups Economic Confidence Index (8:30) and the Fed's doveish Williams speaks at 3:30 – in case that doesn't go well.

Wednesday we have the Job Creation Index, which will be a surprise if it doesn't suck and, at 3pm, we get Consumer Credit, which has risen alarmingly back to pre-crash levels already as consumers have re-borrowed up to their eyeballs to try to maintain some semblance of a lifestyle from the wrong side of the Wealth Gap. Thursday we get Chain Store Sales in the morning along with Consumer Comfort and someone is worried because we have Kocherlakota at 1pm and Williams again at 3:30 to buffer the release of the Fed minutes at 3:30 – probably because they are talking about an October rate hike.

In case the market is still freaking out on Friday, super-dove Charlie Evans speaks at 1:30 to try to keep those plates spinning into a very heavy data week on the 12th. So, overall – it looks like a week we're likely to flatline overall and we'll keep our eyes on those strong bounce lines, which still are:

In case the market is still freaking out on Friday, super-dove Charlie Evans speaks at 1:30 to try to keep those plates spinning into a very heavy data week on the 12th. So, overall – it looks like a week we're likely to flatline overall and we'll keep our eyes on those strong bounce lines, which still are:

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

As you can see – it's still a mixed picture but the pre-market pump job should give us greens on the S&P and Nasdaq but they were right on the lines anyway so we really need to see the Russell crack that 1,130 line and, as I noted above, 16,500 on the Dow makes a better shorting line than a long expecting another 1% gain but certainly they are going to try and we're happy to stop out of our Futures shorts because we have TONS of long positions we'd rather not have to cover – it's just not realistic to expect that to happen.

Be careful out there – it's going to be a crazy week.

If you would like to get this PSW Report every morning while in progress at 8:35 (EST) and, in whole, before the market opens – it's just $3 per day ($995/yr) and you can try it FOR FREE, right here. No credit card is even required.