Here we are again.

Here we are again.

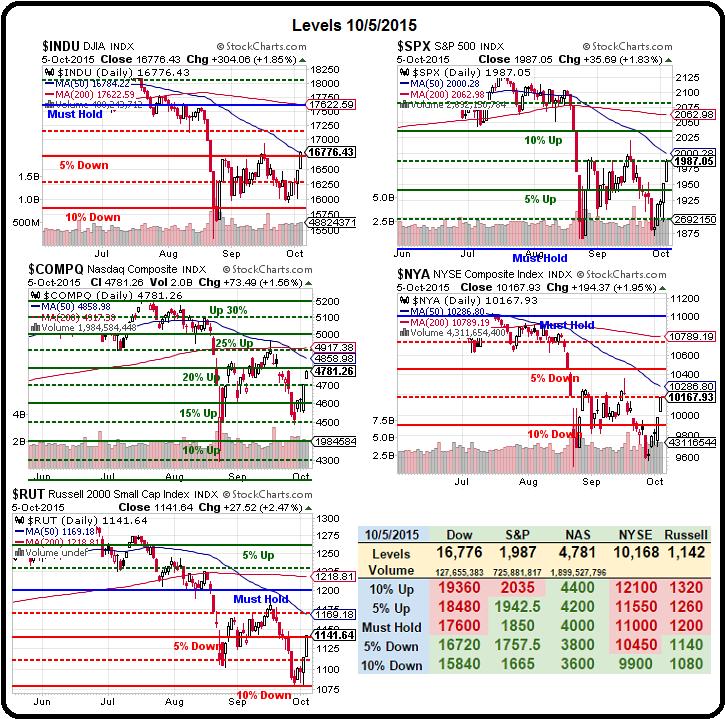

It was only Friday afternoon that we were predicting we'd bounce to our strong bounce lines and then test the 2,000 line on the S&P, where we'd run into the declining 50-day moving average and likely fail. Only we thought that would happen at the end of this week – not Tuesday morning!

Nonetheless, it was fortunate that we expected this as we went into the weekend bullish in all 4 of our Member Portfolios (see weekend reviews) and we had a spectacular day yesterday – especially in our Options Opportunity Portfolio, which blasted up 7.1% in a single day, gaining over $7,000 as the markets spiked higher and rewarded us for our aggressive stance. That led us to consider if, in fact, we are now too bullish – as we're already at the 2,000 level we were playing for.

We cashed out last week's Micron trade with a 200% gain on our bull call spread and we used that money to buy an additional SQQQ hedge (see comments) to lock in some of our quick gains. Today we'll be watching the S&P very closely to see if it's either breaking back over the 2,000 line (50 dma) or failing the 1,950 (strong bounce) line – which would be a BAD sign.

We cashed out last week's Micron trade with a 200% gain on our bull call spread and we used that money to buy an additional SQQQ hedge (see comments) to lock in some of our quick gains. Today we'll be watching the S&P very closely to see if it's either breaking back over the 2,000 line (50 dma) or failing the 1,950 (strong bounce) line – which would be a BAD sign.

As you can see from the Futures chart, the S&P has been rising on less than 1/3 the volume it fell on, which means it's most likely just a pump job driven by TradeBots to sucker the retailers back in so the big boys can start dumping again. Bill Gross has now joined me in calling for CASH!!! and predicts the markets will drop another 10% from here although, at this point, that only brings them back to about last week's lows.

Gross is concerned about earnings and so is Morgan Stanley, who are seeing a 5.1% decline in Q3 S&P earnings – much, much worse than the 1% decline expected by leading Economorons. Of course the Energy Sector is a disasters but Utilities, Consumer Staples, Industrials and Materials have gotten much worse while expectations for Financials have been trimmed by 50% and even Health Care is getting a 25% haircut in estimates.

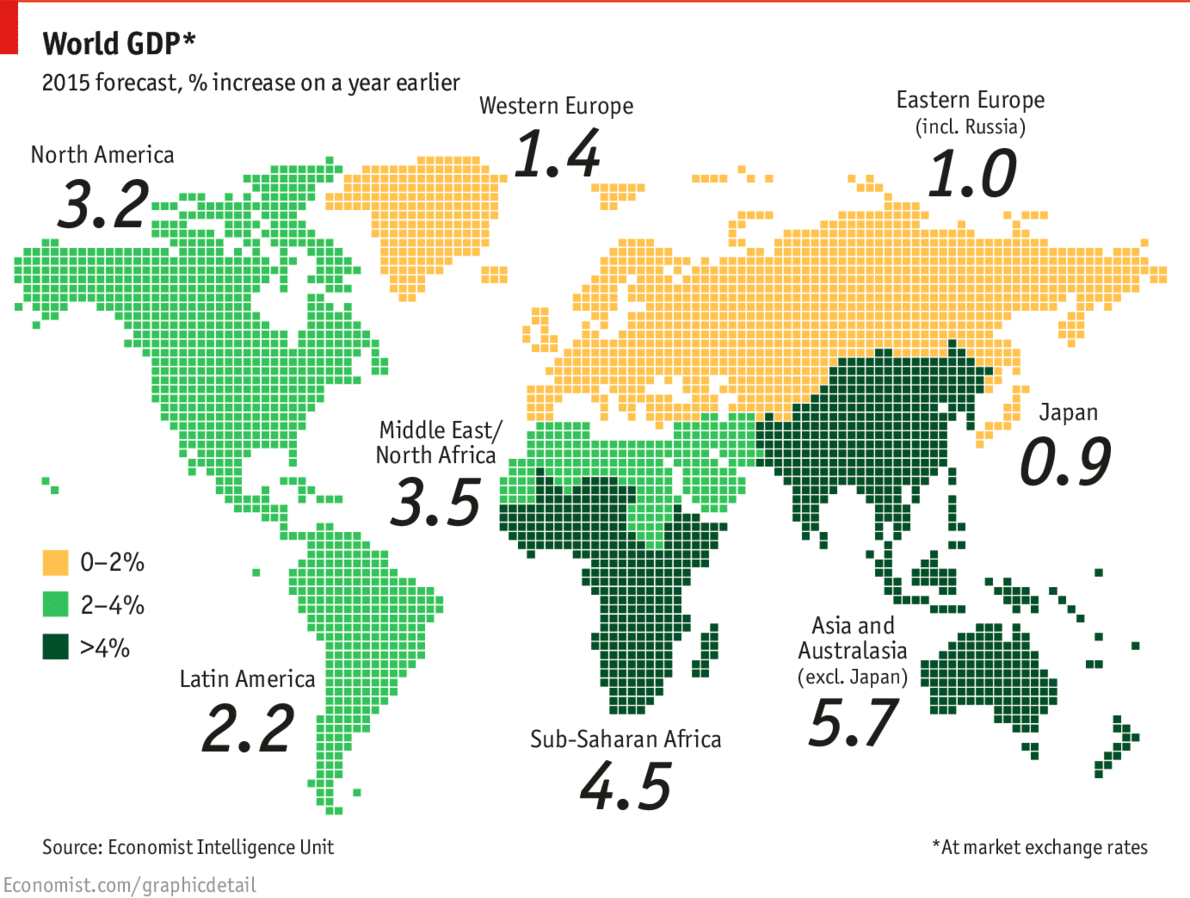

That's why the smart money is moving into CASH!!! So much so that 3-month TBills are trading at 0% for the first time ever – that's just one step above you having to PAY the Government to hold your money! Now BAC is saying China's Yuan may fall 10% on further devaluations as China runs out of ways to prop up their faltering economy and the IMF expected NEGATIVE 0.3% growth in Asia as China's declines spill over to the rest of the region.

China is knocking 1% (at least) off Asia and that's dropping the rest of the World about 0.5% from the above figures and we'll see more and more downgrades to outlook as earnings come in over the next few weeks. No one is going to be surprised by horrific Energy Sector earnings reports but losing the Financials will be pretty traumatic for investors who still have their heads buried deep in the sand.

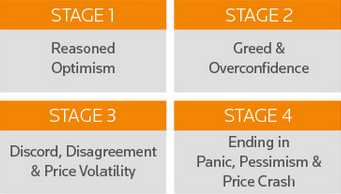

We all know the 5 stages of death are Denial, Anger, Bargaining, Depression and Acceptance (when there is time) but there are also 4 stages of a Bubble and they are listed on this chart. Clearly we're in Stage 3 though yesterday we went back to Stage 2 after testing Stage 4 last week – but that's why Stage 3 says "Discord, Disagreement and Price Volatility" – check, check and check!

We all know the 5 stages of death are Denial, Anger, Bargaining, Depression and Acceptance (when there is time) but there are also 4 stages of a Bubble and they are listed on this chart. Clearly we're in Stage 3 though yesterday we went back to Stage 2 after testing Stage 4 last week – but that's why Stage 3 says "Discord, Disagreement and Price Volatility" – check, check and check!

Garry Shilling had a good interview on Bloomberg (thanks Advill) where he explained the Global deflation trends that are merely a reflection of slowing Global growth and this morning we got a TERRIBLE Factory Orders Report out of Germany, that was expected to us (-1.8%) but a shocker to leading Economorons, who were anticipating 0.5% gains. The question is, do they find new idiots every month or do they just keep going back to the same idiots?

Sadly, of course, the answer is yes – for some reason, this country never gets tired of idiocy and never holds the idiots accountable for their actions or opinions. Even this concept that "everyone is entitled to their own opinion" is ridiculous – you can't be entitled to your own opinion when it's clearly contradicted by FACTS! Facts trump opinions – or at least they used to.

That's certainly not in evidence in financial reporting, is it? I can't tell you how many times a week people (including reporters) say to me "Cramer said this", or "Icahan said that" or "Houseman says this" and then they want to know my opinion so they can add it to the pile and then weight the opinions or whatever it is they do with them when there are so many.

The reason we are so good at predicting what is going to happen at PSW is because we focus on FACTS, not opinions and, when we're not sure of our facts – we don't make predictions. I know – it's a shocking concept, especially on TV, where you are required to make a prediction about everything – whether or not you have a clue or are even qualified to opine on the subject.

The reason we are so good at predicting what is going to happen at PSW is because we focus on FACTS, not opinions and, when we're not sure of our facts – we don't make predictions. I know – it's a shocking concept, especially on TV, where you are required to make a prediction about everything – whether or not you have a clue or are even qualified to opine on the subject.

As we move into more and more uncertain times in the market, you will hear more and more OPINIONS about what to do and, the less sure you are about the best alternatives, the more likely you are to listen to the opinion of people who sound certain.

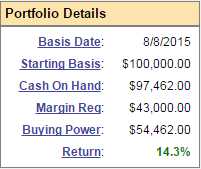

We are NOT certain – that's why we are 90% in cash in our portfolios. That doesn't mean we're not playing – the cash is our hedge and we're pretty aggressively bullish with our upside plays (in case we're wrong about being in cash). We are certain there's a lot of risk out there. Traditionally, when there's a lot of risk – it pays to be cautious. I know this sounds obvious but ARE YOU???

When we're not sure of what's going to happen next, we find it useful to wait PATIENTLY for more data to come in. At a certain point, we will have enough new data (Fed or no Fed, China or no China, Earnings or no Earnings…) to make a more informed decision with a higher percentage chance of success. It may be the same decision we'd make right now as an educated guess – but we're fortunately also educated enough to understand that being right on that guess is LUCK, not skill.

That's why, despite our fantastic portfolio gains yesterday, we're still very cautious today. There are still thousands of stocks trading within 5% of their 52-week lows – it's not like we'll miss anything by being a bit cautious.

That's why, despite our fantastic portfolio gains yesterday, we're still very cautious today. There are still thousands of stocks trading within 5% of their 52-week lows – it's not like we'll miss anything by being a bit cautious.

Our Option Opportunities Portfolio, like our other PSW Portfolios, is over 90% in cash – using option plays to get great upside leverage and, as I noted above – we did a review yesterday and it turns out that almost all of our positions have plenty of room to run.

The same is true in our Short-Term and Long-Term Portfolios, while our Butterfly Portfolio, like the honey badger, don't care what the market does – as long as time keeps chewing on all the premium we sell to suckers who have an opinion about which way the market is going.

If you would like to get this PSW Report every morning while in progress at 8:35 (EST) and, in whole, before the market opens – it's just $3 per day ($995/yr) and you can try it FOR FREE, right here. No credit card is even required. ?