Courtesy of Mish.

A New York Fed study notes a huge surge in subprime auto loans after taking into account a newer, more accurate methodology.

The new approach takes into consideration new originations as opposed to new accounts. The result was an upward shift in the volume of newly originated auto loans by 25 to 30 percent.

Newly Originated Loans

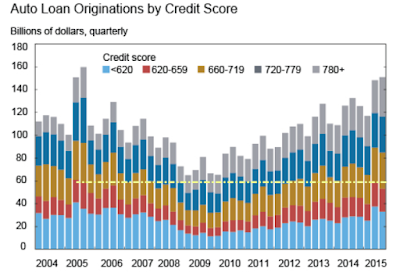

A credit score of 660 is the generally acknowledged line between good and poor credit. Scores below 620 are outright awful.

With those numbers in mind, let’s see how things stack up.

Originations by Credit Score

Originations hit $156.8 billion in the third quarter, the highest level in a decade. Loans to borrowers with scores below 620 jumped to nearly $40 billion in the second quarter.

Loans to borrowers with credit scores below 660 are the highest since 2005.

The reports notes “With the surge in the second quarter, the total number of subprime originations has since reached a ten-year, pre-crisis high, only surpassed by the unique periods in 2005 that were associated with ’employee pricing’ promotions and record sales for the auto manufacturers.“

…