Now before you shovel all your money into 2015's winners, be sure to read Joshua Brown's, The Trouble With Chasing Hot Strategies.

Diversification Is For Dummies – The Nifty Nine Never Mattered More

Courtesy of ZeroHedge

From the 4-horsemen of the dotcom exuberance (and apocalypse), to today's so-called FANG and NOSH stocks, and now 'Nifty Nine', investors could be forgiven for ignoring the benefits of stock market diversification that every commission-taking, fee-gathering asset-collector promotes and going all-in on a few 'easy to select' stocks to make the quick buck that everyone believes is their right as an American taxpayer. While the S&P languishes unchanged in 2015, these small groups of overwhelmingly propagandized stocks are up on average over 60%, but with a collective P/E of 45, they are not cheap (and perhaps should remember that when buying this momo, we are all Thanksgiving turkeys).

The long bull market in US stocks now in its seventh year, has grown much narrower. Previously dominated by smaller companies (which tend also to do better in the longer run), it is now being led by a handful of large stocks that are beginning to earn their own acronyms.

Some talk about the Fang stocks — Facebook, Amazon, Netflix and Google — while Ned Davis Research refers to the Nifty Nine, which adds Priceline, Ebay, Starbucks, Microsoft and Salesforce. (Note that Apple appears on neither list.) If made into indices, research by the FT statistics group shows that either of these groupings would have gained about 60 per cent for this year, while the S&P 500 is up about 1 per cent.

…

What are the implications? The success of the Fangs is a symptom of the rise of a new model for the economy that revolves around services rather than manufacturing.

But it is best not to get carried away. All these companies are richly valued (Ned Davis puts the Nifty Nine’s collective price/earnings ratio at 45, double that of the S&P 500). They also look expensive when compared with their sales.

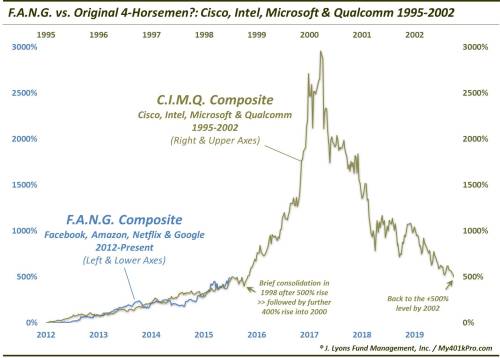

Hype and excitement around a few big companies, and eclipse for riskier small companies, are classic symptoms of the top of a bull market. For comparison, look at the “Nifty Fifty” companies of the early 1970s, or the first wave of web companies during the dotcom boom of the late 1990s — when it was fashionable to talk of a “new economic paradigm”.

* * *

Of course, the exuberant upside of the FANGs or Nifty Nines is always obvious after the matter…

But why let that worry you – you are all smarter than the average investor, right? Just don't forget the lesson from The Thanksgiving Day Turkey… (via SHTFPlan.com),

The Black Swan Theory is used by Nassim Nicholas Taleb to explain the existence and occurrence of high-impact, hard-to-predict, and rare events that are beyond the realm of normal expectations. One example often put forth by Taleb is the life and times of the Thanksgiving Turkey.

The turkey spends the majority of its life enjoying daily feedings from a caring farmer. Weeks go by, and it’s the same thing day-in-day-out for the Turkey. Free food. Open range grazing. Good times all around.

The thinking turkey may even surmise that the farmer has a vested interest in keeping the turkey alive. For the turkey, it is a symbiotic relationship. “The farmer feeds me and keeps me happy, and I keep the farmer happy,” says the turkey. “The farmer needs me, otherwise, why would he be taking care of me?”

This goes on for a 1,000 days.

Then, two days before Thanksgiving on Day 1,001, the farmer shows up again.

But this time he doesn’t come bearing food, but rather, he’s wielding an ax.

This is a black swan event — for the turkey.

By definition, it is a high-impact, hard-to-predict, and rare event for the turkey, who not only never saw it coming, but never even contemplated the possibility that it could occur.

For the farmer, on the other hand, this was not a black swan event. The farmer knew all along why he was feeding the turkey, and what the end result would be.

The very nature of black swan events make them almost impossible to predict. The point of this parable is to put forth the idea that sometimes we are the Thanksgiving turkey and understanding this may make it easier to begin to, at the very least, contemplate the possibility of far-from-equilibrium events.