Total insanity!

The S&P went down 2.5% and then up 2.5% in less than 48 hours, ostensibly driven down by Mario Draghi first failing to provide the QE measure he had been promising at the actual ECB meeting and then going back up on Friday because he promised more QE at the next meeting. The man is a serial liar yet EVERY SINGLE TIME the markets take him at his word – it's MADNESS!

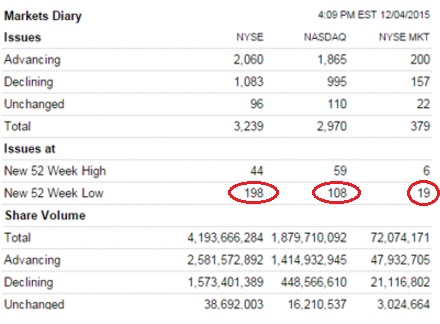

What was really strange about Friday is so many more stocks making new lows than new highs during a 2% rally. Also, in a real rally – there's usually a LOT more advancing than declining volume.

Money if flowing into equities because, like Richard Gere, it simply has nowhere else to go. With negative interest rates, if you put your money in the bank, it's GUARANTEED to get smaller. The Housing and Commercial Real Estate markets are still fairly dead and usually perform poorly in rising rate environments, Precious Metals aren't precious anymore, Energy Investing is suicide and the last time the Fed had a tightening cycle in the 90s, the value of 10-year notes slipped 75% – no one wants to be caught in that trap again.

Still, I don't believe in a rally that has no Fundamental basis. Just because money is being forced into the market – that doesn't mean I should follow it when I'm not being forced. That's just lemming-like behavior and we, as humans, strive to be better than that, don't we? I know it's hard when ALL of your friends are jumping over a cliff not to do so yourself – especially when you can hear them shouting "wheeeee!" on the way down so you're sure they are having fun and things can only get better at the bottom, right?

OPEC failed to curtail production at Friday's meeting and oil is diving below the $40 mark and the biggest economic issue we are ignoring in the US is the impact these prices will have on the US energy sector, whose costs are significantly higher than OPEC's overall. Probably about half the oil in the US is not profitable under $40 and, when recalculating the value of reserves and asset to loan ratios next year – using the 2015 average vs the 2014 average is going to probably put a lot of companies into a technical default by Q116:

According to the WSJ: For the past year, U.S. oil companies have been kept afloat by hedges—financial contracts that locked in higher prices for their crude—as well as an infusion of capital from Wall Street in the first half of the year that helped them keep pumping even as oil prices continued to fall. The companies also slashed costs and developed better techniques to produce more crude and natural gas per well. The opportunity for further productivity gains is waning, experts say, capital markets are closing and hedging contracts for most producers expire this year. These factors have led some analysts to predict that 2016 production could decline as much as 10%.

But others predict rising oil output, in part because crude production is growing in the Gulf, where companies spent billions of dollars developing megaprojects that are now starting to produce oil. Just five years after the worst offshore spill in U.S. history shut down drilling there, companies are on track to pump about 10% more crude than they did in 2014. In September, they produced almost 1.7 million barrels a day, according to the latest federal data.

Since most of the money to tap this oil and gas was spent before crude prices cratered, and since pipelines and other infrastructure to bring it to market are already in place, it makes economic sense for the companies to go ahead with the projects despite the glut, they say.

“It’s either free or very little marginal cost,” said Anadarko CEO Al Walker. “For some of us, the Gulf of Mexico is still a very viable place for us to make investments.”

We talked about the day the hedges on oil would run out back in the spring and now that day is rapidly approaching and soon, many oil companies will begin fully realizing the low costs of the oil they are selling. How is that going to be a positive for the market? It won't make oil much cheaper – it will just crush the Energy Sector, which is 10% of the S&P 500.

So we're still shorting the top (2,100) on the S&P and this morning we're at 2,090, which is close enough to begin adding a few short positions on the /ES Futures. 17,850 is our spot on Dow Futures (/YM) 4,725 on the Nasdaq (/NQ) and 1,185 on the Russell (/TF) but if ANY of the indexes are over those lines – we pull the plug on the shorts because this market is irrational and our favorite position is still CASH!!! until we can finally put 2015 in the rear-view mirror!

If you are Futures challenged, for one thing you can plan on joining us this Tuesday at 1pm, EST for a FREE Live Trading Webinar, where we'll be discussing Futures trading techniques and, for another thing, you can go back to last Wednesday morning's post, where we had a fantastic spread to protect your portfolio using the ultra-short S&P ETF (SDS) in a nice spread that returns up to 477% on cash by March if the S&P fails to hold 2,050.

That spread made over $1,000 (100%) just on last week's little dip, so we know it works as planned and it's our favorite hedge at the moment (we cashed in our FXI puts on last week's dip – not wanting to risk the weekend, where China failed to provide new stimulus – adding to our negativity to start this week).

Speaking of the week ahead, Friday we'll get the Retail Sales Report (8:30) along with PPI in an otherwise slow data week but next week is the BIG Fed decisions and that's going to be CRAZY – so buckle up for that, in any case. More importantly on Friday, get ready for the deadline for Congress to pass a $1,100,000,000,000.00 Spending Bill or, as usual, our Government shuts down. So far, the Senate has passed a bill that de-funds Planned Parenthood and, of course, Obama will veto that – so we're not even close as of Monday AM…

Also, we're putting unicorn investors on alert as FTC Chair Edith Ramirez is speaking in Washington Wednesday on "Competition and Consumer Protections Issues for the On-Demand Economy" and this will be her first speech since she said in October that "targeted" regulation might be needed "soon." Also scheduled to appear is Sen. Mark Warner (D-Va.), who has said that workers in the on-demand economy need a better safety net.

Let's be careful out there!