What a joke this market is becoming!

What a joke this market is becoming!

As you can see from Dave Fry's SPY chart, the S&P finished up 0.5% for the day after an amazing 10-point rally that began the second the European markets closed (11:30). It was incredible – as in NOT in the least bit credible but, as we knew, it would be enough to make Europe regret yesterday's 2% sell-off and then Europe would bounce this morning (up over 2%) and that would then boost our Futures (now up 0.66%). This BS was so obvious that we closed our day in the Live Chat Room with this trade idea for our Members:

This will be interesting as Europe finished down 2%(ish) and now we're back flat. Presumably, they'll try to catch up tomorrow (and NKD has reset to 18,800) so I think I like TF long here (1,107) as a fun play on the assumption that Asia and Europe will pop the futures.

Down from 1,200 to 1,100 you'd expect a 10-point bounce anyway so I think it's worth a small gamble.

As you cans see we popped to 1,115 for an $800 per contract gain but now we're flipping short because, as noted, yesterday's rally was complete BS – which is obvious if you look at the internals:

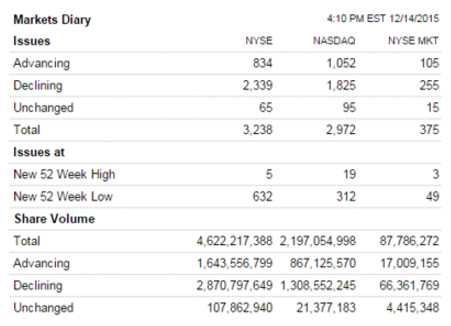

This is why charts don't give you the real story! 2,339 declines vs 834 advance with 632 new 52-week lows and we finish up 0.5%? That's incredible – NOT credible. Still, there was the good old support line at 2,000 so of course bouncy. 2,100 to 2,000 means 2,020 is weak and 2,040 is strong but when you get an air bounce off 2,000 (never quite hit it outside of a brief spike), then minimum expectation is a strong bounce:

At the moment, the S&P Futures (/ES) are at 2,023 and the weak bounce line is holding, as expected. It's the strong bounce line (2,040) that we care about today – anything less than that is a shorting opportunity, not a rally signal. Another fun play from yesterday morning's post (that you can read for FREE) was our suggestion to short the Nikkei Futures (/NKD) at 18,800 "looking for at least a 100-point gain ($500 per contract)."

Yes, you are welcome – Merry Christmas. Of course, this is actually Hanukkah and today is the last of our 8 FREE gifts from Philstockworld. I hope you've enjoyed all the free trades from our December posts – we've certainly made enough money on these Free Trade Ideas to boost the economy into the holidays!

Even better than our /NKD trade idea yesterday was our call to go long on oil (/CL) at $35, that one was good for $2,000 per contract with oil popping all the way to $37 this morning but it was offset slightly buy our too early long call on /NG (Natural Gas) at $1.89, now $1.85 and down $400 per contract there. Oh wait – we also called Gasoline Futures long (/RB) at $1.20 and that's now $1.25 and those pay $420 per penny per contract, so $2,100 there makes for a grand total of +$4,700 PER CONTRACT – just from following yesterday's Futures Trade Ideas.

Over at Seeking Alpha, where you can subscribe to our Options Opportunities Portfolio, we posted a review of our Top Trade Alerts back on October 12th. At the time I noted:

While 30 of our first 45 (66%) Top Trade ideas were winners, 4 of our 15 losers were Lumber Liquidators (NYSE:LL) trade ideas – all of which are now coming back as LL pops back to $20! Hopefully it can break over $20 and we can put all that silliness behind us.

That turned out to be a false alarm and LL quickly faded back into the mid teens but we hung on and actually pressed some of those losing positions as we KNEW, Fundamentally, that the sell-off in LL had been overdone. Well, yesterday our nemesis, Whitney Tillson, the guy who started the witch hunt on LL, finally capitulated and the stock is popping over 20% pre-market, so congratulations to the faithful who held on for this wild ride!

Sometimes, trade ideas take longer to play out than we think they will and PATIENCE, more than hedging or portfolio management, is what I find to be the hardest thing to teach our Members over at Philstockworld. In today's HFT-driven market, people are constantly watching the 5-minute charts or 1-minute charts, which gives a huge advantage to those of us who still pay attention to weekly, monthly or annual trends – but you have to know how to wait!

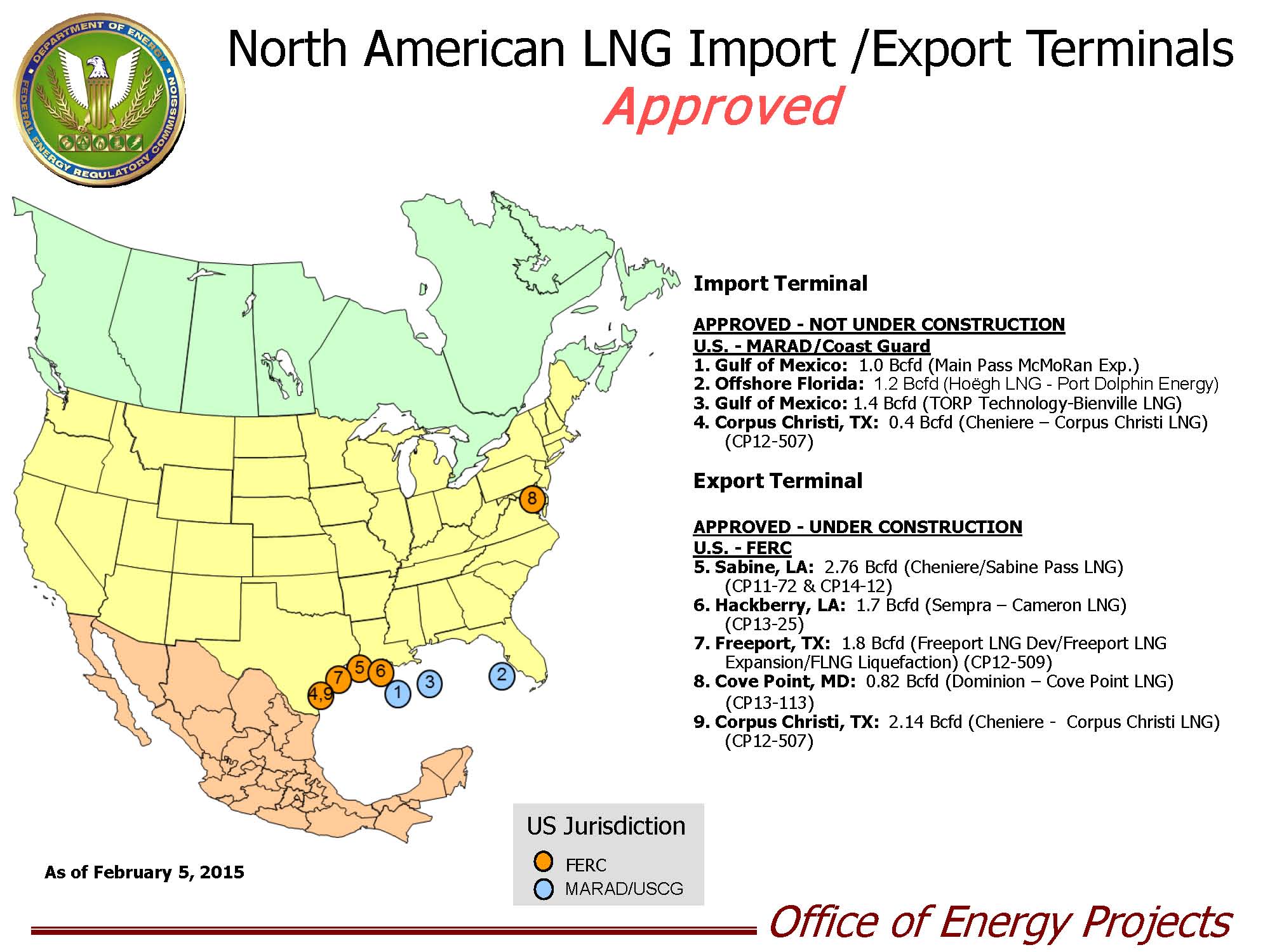

Our next big wait is for Natural Gas (UNG) to turn around and I wrote about that and had an LNG play for you as well last Tuesday and today both UNG and Cheniere Energy (LNG) are cheaper because both went the wrong way so far. Nonetheless, they are 2017 trade ideas we firmly believe in and we hope /NG is bottoming at $1.85. The warm weather is killing December demand for Nat Gas but, as we outlined last week – the Fundamentals are going to drastically change in 2016 as the US begins exporting natural gas for the first time ever.

Our next big wait is for Natural Gas (UNG) to turn around and I wrote about that and had an LNG play for you as well last Tuesday and today both UNG and Cheniere Energy (LNG) are cheaper because both went the wrong way so far. Nonetheless, they are 2017 trade ideas we firmly believe in and we hope /NG is bottoming at $1.85. The warm weather is killing December demand for Nat Gas but, as we outlined last week – the Fundamentals are going to drastically change in 2016 as the US begins exporting natural gas for the first time ever.

If it wasn't so risky – I'd make it our 2016 Trade of the Year (IBM is) – that's how much I believe in the export premise.