The good news is that Apple earned a record $18.4 billion in profit in Q1 2016. Earnings beat estimates, although revenue came short, $75.9 billion vs. the $76.5 billion expected.

Apple Reports Record First Quarter Results (Apple)

Apple® today announced financial results for its fiscal 2016 first quarter ended December 26, 2015. The Company posted record quarterly revenue of $75.9 billion and record quarterly net income of $18.4 billion, or $3.28 per diluted share. These results compare to revenue of $74.6 billion and net income of $18 billion, or $3.06 per diluted share, in the year-ago quarter. Gross margin was 40.1 percent compared to 39.9 percent in the year-ago quarter. International sales accounted for 66 percent of the quarter’s revenue.

“Our team delivered Apple’s biggest quarter ever, thanks to the world’s most innovative products and all-time record sales of iPhone, Apple Watch and Apple TV,” said Tim Cook, Apple’s CEO. “The growth of our Services business accelerated during the quarter to produce record results, and our installed base recently crossed a major milestone of one billion active devices.”

So why is the stock trading down to around $95 today (~ 5% drop)? Although Apple posted its largest quarterly profit ever, it forecast a decline in sales for this quarter. Apple lowered Q2 2016 revenue guidance to $50 – $53 billion (analysts were estimating around $55.5 billion). In Q2, iPhone sales will be lower than in 2015 — marking the company's first year-over-year decrease in iPhone sales. Q2 will also mark AAPL's first sales decline since 2003.

Investors are skeptical about this drop in sales being a temporary glitch in the company's growth.

Tim Cook: iPhone sales will grow again but investors don't believe (Yahoo Finance)

While analysts and investors fret about market saturation, Apple (AAPL) CEO Tim Cook firmly rejected that view on Tuesday, despite having to concede that iPhone sales at the beginning of this year will be significantly lower than in 2015, the company's first ever year-over-year decrease.

"If we make a great product and have a great experience then we ought to be able to convince enough people to move over," Cook said, when asked about market saturation. "There's still a lot of people, a tremendous number of people in the world, that will buy smartphones and we ought to be able to win over our fair share of those."

[…]

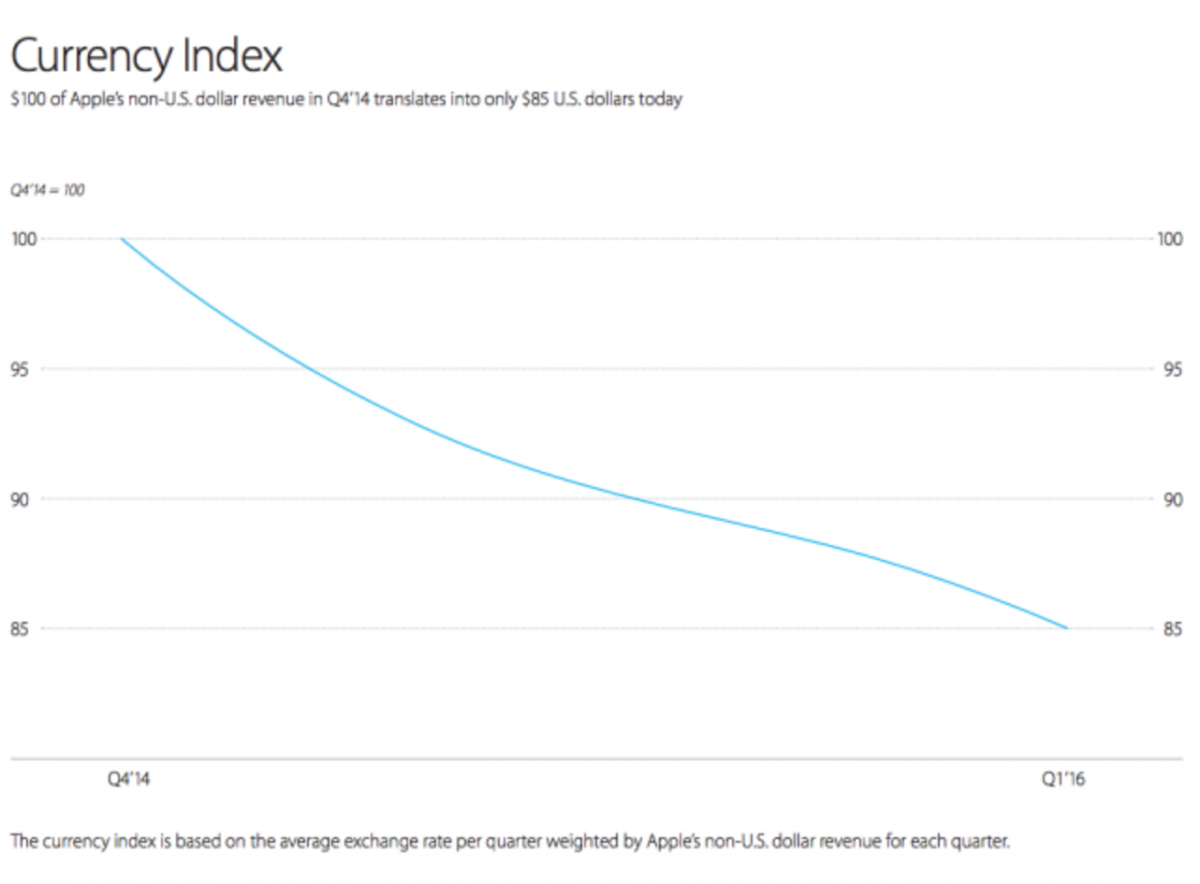

Cook chose to go on the defensive, noting that Apple's anemic 2% revenue growth would have been 8% if the major currencies around the world hadn't lost so much value to the dollar. "The Brazilian real is down more than 40% and the Russian ruble has declined more than 50%," Cook, noted, heading into the weeds amid one of several lengthy digressions about the state of the world's economies, currencies and consumer markets.

Two-thirds of Apple’s revenue is generated outside of the US, so foreign currency fluctuations have a significant effect on results. The impact of currency exchange rates has been negative due to the US dollar's recent strength.

Tim Cook Blames the Dollar for Not Making More Dollars (Wired).

Today, Apple CEO Tim Cook started off an earnings call with analysts by talking about everyone’s favorite subject: foreign currency markets! Yes, we know you care more about Apple’s plan to vary the hue of your iPhone’s backlight. But Cook took pains to explain that the dollar was to blame for Apple not making more dollars.

In effect, Apple seems eager to convey that, because the dollar has been so strong, US goods (including the iPhone) are expensive for consumers overseas. At the same time, the volatility of foreign currencies make it so that citizens in those countries have less money to spend.

Cook explains how "the turbulent world around us" is making Apple's products more expensive overseas. Conditions are "extreme."

Apple CEO Tim Cook: 'We're seeing extreme conditions, unlike anything we've seen before' (Business Insider).

"We're seeing extreme conditions unlike anything we have ever experienced before," Cook said on a conference call discussing Apple's earnings report.

Those conditions show up foreign-exchange rates.

Cook pointed out that, for example, the Brazilian real is down more than 40%, and the Russian ruble is down more than 50%.

Cook shared the following chart to demonstrate that $100 of Apple's non-US dollar revenue in Q4-14 translates into $85 US dollars today.

Apple’s Tim Cook sounds incredibly depressed about the global economy (Quartz)

The world’s largest publicly traded company offered an incredibly depressing assessment of the state of the global economy whilst updating investors on its most recent quarterly earnings Tuesday.

[…]

But Apple offers a case study of how the slowing global economic backdrop is having an impact on even the strongest companies located in the relatively robust US economy. For instance, Apple’s revenue from its Americas group—which includes Brazil—declined 4% during the quarter, thanks in part to Brazil’s ugly economic conditions, which have sent the currency cratering by roughly 38% over the last 12 months. (That means sales made in Brazil are worth less and less once they are translated back into US dollars.) And in Greater China sales slowed sharply to 14% during the first quarter, compared to a growth rate of 70% in the first quarter of 2015.

On the bright side, Quartz notes:

“Even in the markets where today, grantedly, it looks fairly bleak, from Russia and Brazil and some of the other economies that are … oil-based economies, we do believe that this too shall pass and that these countries will be great places and we want to serve customers in there,” Cook said. “And so we’re not retrenching. That’s not—we don’t believe in that. We are fortunately…strong enough to continue investing, and we think it’s in Apple’s best long-term interest to do so.”

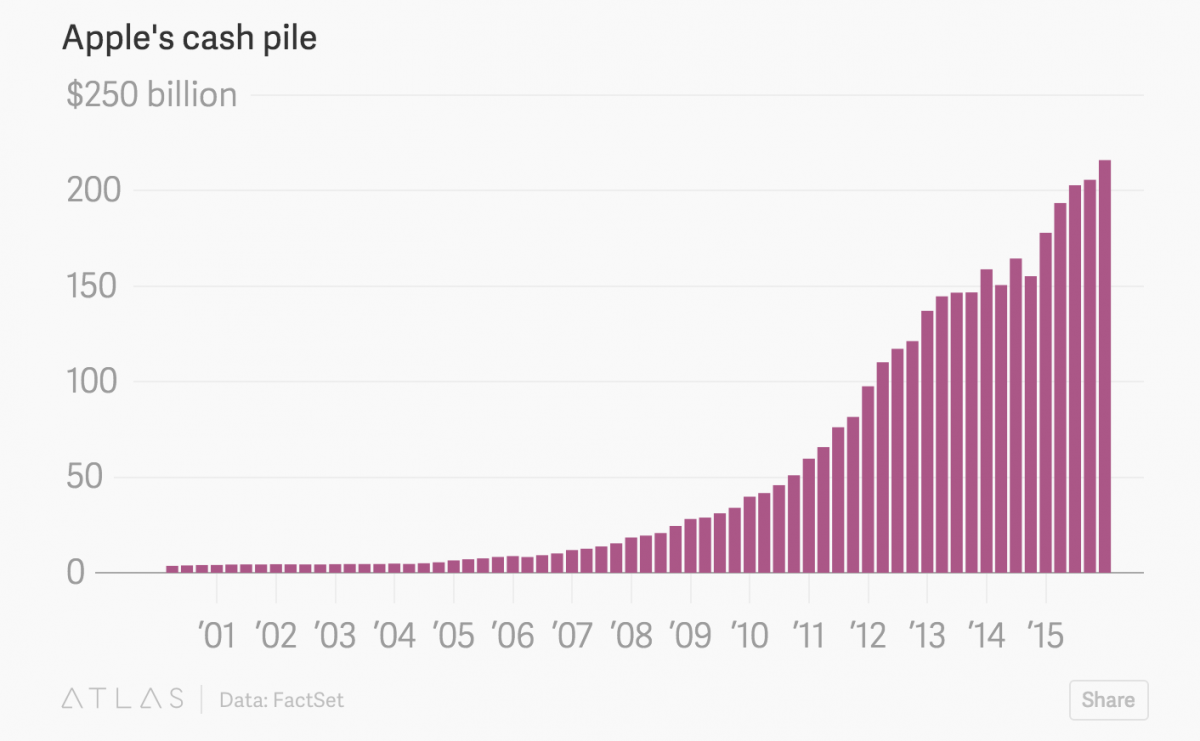

Of course, the decision to invest in the face of weak global demand is easier to make when you’re sitting on $216 billion in cash.

Zero Hedge's take on the numbers is decisively negative. Here's Zero Hedge's analysis in its entirety.

AAPL Earnings Beat Despite Missing Sales, iPhone Expectations; US Revenues Decline

Expectations were hardly sky high for AAPL heading into a quarter in which most of its suppliers had already announced iPhone sales would be disappointing, and moments ago AAPL validated many of these concerns. While beating on the bottom line, with an EPS of $3.28 compared to expectations of a $3.22 print, it missed not only on the top line, with revenue coming shy of the $76.5 billion expected at $75.9 billion, but across every single product line, most notably iPhones, of which AAPL sold 74.78 million in the quarter, below the 75 million expected.

iPad and Mac sales also came in below expectations, at 16.12mm vs expectations of 17.3mm, and 5.31mm vs 5.8mm expected.

Also of note: US sales of $29.3 billion were an actual decline of 4% compared to the $30.6 billion in US revenue one year ago.

The good news: AAPL did not post a year over year decline in revenue as some had feared. The top line printed a little over $1.2 billion higher compared to a year ago, while the margins of 40.1% also beat the 39.9% expected, and reported one year ago.

There was some more bad news, however, in the company's guidance which came as follows:

- revenue between $50 billion and $53 billion, below the consensus estimate of $55.5 billion, and a steep drop compared to $58 billion the quarter prior suggesting a dramatic slowdown in iPhone sales.

- gross margin between 39 percent and 39.5 percent, below the estimate of 40%

- tax rate of 25.5 percent

As the FT notes, Apple signalled that the iPhone would see its first ever decline in sales in the current quarter, as a slowing smartphone market and wider economic pressures finally began to take their toll after almost a decade of expansion.

So overall a muted quarter, with perhaps the last saving grace being China's sales of $18.4 billion, an increase of 14% y/y which at least superficially confirms that China sales are not crashing.

A breakdown by some of the key charts:

Revenue:

Gross Margin:

Sales by product line: each one missed expectations:

Sales by geography: China stepped up to compensate for the US sales decline:

And finally, AAPL's cash rose to $215.7 billion in the quarter on a gross basis:

While cash net of debt remains virtually unchanged for the past three years:

And the result is a lot of sound "but but but" and fury in the stock after hours…

My take: AAPL is facing a difficult environment, including issues with market saturation, weakness in certain countries it sells to, and a strong US dollar weighting on the company's ability to sell products. However, the stock is cheap by metrics such as P/E, and the PE/Growth ratio is 0.88. So while AAPL is not likely to demonstrate much growth, with declines in at least the first part of 2016, AAPL is not priced for growth. At least a substantial portion of AAPL's malaise is priced into the shares.