Groundhog Day All Over Again

Courtesy of Wade of Investing Caffeine

It’s that time of the year when the masses gather in eager anticipation of Groundhog Day to predict whether the furry rodent will see its shadow in 2016, thereby extending winter for an additional six weeks.

In the classic movie Groundhog Day, actor Bill Murray plays character Phil Connors, an arrogant, self-centered TV weatherman who, during an assignment covering the annual Groundhog Day event in Punxsutawney, Pennsylvania, finds himself stuck in a time loop, repeating the same day over and over. With a feeling of nothing to lose, Phil repeatedly decides to indulge in reckless hedonism and criminal behavior. After being resigned to perpetually reliving the same day forever, Phil begins to re-examine his life and falls in love with his co-worker Rita Hanson (see scene here). Ultimately, Phil’s pure focus on the important priorities of life allows himself to break the painful monotonous time loop and win Rita’s love.

Stock market investors are lining up in a similar fashion to predict whether the financial winter experienced in January will persist through the rest of the year. The groundhog, equipped with a thick fur coat, certainly would have been more optimally prepared for the icy January financial market conditions. More specifically, the S&P 500 index declined -5.1% for the month and the Dow Jones fell -5.5%.

Unfortunately for many investors, they too have been trapped in a never-ending news cycle, which painfully buries the public with a monotonous loop of daily pessimistic headlines. As a result of the eternally distorted media cycle, many investors have lost sight of important priorities like Phil Connors. Since the beginning of 2011, the investors who have endured the relentless wave of media gloom have been handsomely rewarded. From 2011-2016, the S&P 500 stock index has ascended approximately 54%, even after accounting for the significant January 2016 decline.

Unless you were burrowed in a hole like a groundhog, you will probably recognize a number of these ominous headlines spanning across the 2011 – 2015 headlines:

- 2011: Debt Downgrade/Debt Ceiling Debate/European PIIGS Crisis (-22% correction)

- 2012: Arab Spring/Greek “Gr-Exit” Fears (-11% correction)

- 2013: Fed Taper Tantrum (-8% correction)

- 2014: Ebola Outbreak (-10% correction)

- 2015: China Slowdown Fears (-13% correction)

Similar to the Groundhog Day movie, the headlines of 2016 match the tone and mood we’ve seen in recent years. Here’s an abbreviated list of the recurring worries-du-jour in January:

China Slowdown: Is this something new? As you can see from the chart below, China has been slowing since 2010. Due to the law of large numbers, and as the second largest economy on the globe, it is natural to see such an enormous economic engine eventually slow. Rather than panic over China’s slowing, observers should be applauding. China’s Q4 GDP growth recently came in at +6.8%, almost 10x the level recorded by the U.S. in Q4 (+0.7%). Even if you mistrust the official Chinese government’s reported data, our economy would kill for the still impressive independently reported growth statistics (see chart below). While the concerted effort of the political regime to migrate the country from an export-driven economy to a consumption-based one has caused some growing pains, nevertheless in recent months we have seen China report record automobile purchases, retail sales, oil consumption, and industrial production.

Rise of the U.S. Dollar: This is a legitimate concern that has had tangible negative impacts on the U.S. economy. As you can see from the chart below (blue line), in less than one year, the value of the U.S. dollar spiked by approximately +25%. If you are a multinational company exporting a product to Europe for $100, and consumers wake up a year later having to pay $125 for the same product, it should come as no surprise to anyone that this phenomenon is squeezing profits. The good news is that U.S. corporations have already absorbed the worst of this currency pain dating back to early 2015, so if the stabilizing foreign exchange trends remain near current levels, as they have over the last year, there should be no additional economic drag.

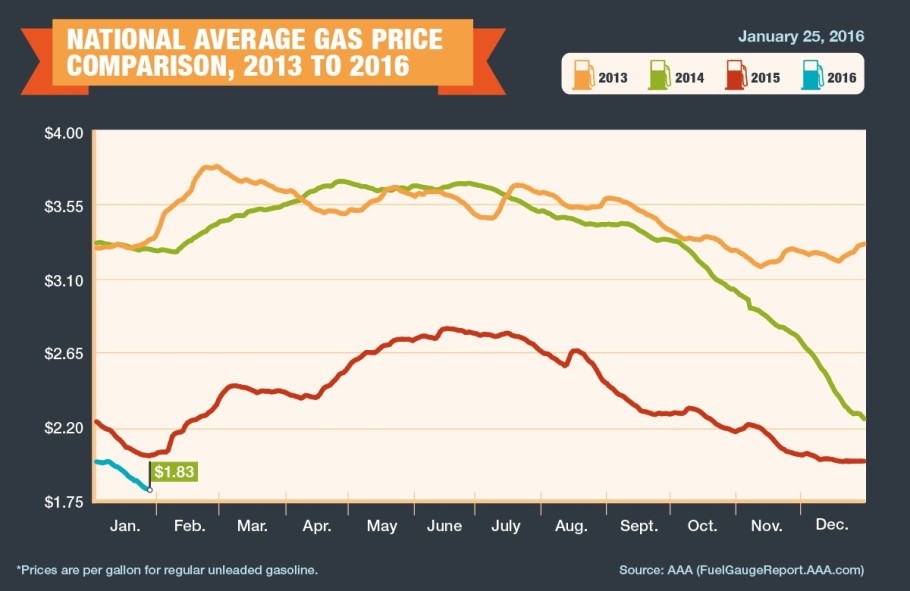

Oil Prices Down: Somehow the U.S. media is trying to convince the public that lower oil prices are bad for the economy. Yes, it is true, the financial restructurings and lost jobs associated with oil price declines will hurt the economy and the banks overall. However, the benefits of lower oil prices on the broader economy (i.e., more money in consumers’ pockets) is unambiguously positive and will overwhelm any indirect damage. Every penny decrease in gasoline prices (now roughly $1.83 per gallon nationally) equates to about a $1 billion tax cut for consumers (see chart below). Many people are worried about oil prices being a signal of weakness, but if you look at the last few recessions, they were all preceded by an oil price spike, not a price collapse.

Source: AAA

Federal Reserve Monetary Policy: The first interest rate hike in nine years took place in 2015, but that did not prevent investors from fretting about the timing of the next interest rate hike. As I’ve written many times (see Fed Fatigue Setting In), the Fed has barely budged its target rate to 0.375%, so this is much to do about nothing. Wake me up when we get to 2.00%, at which point we will still be far below the long-term average but at a more meaningful level (see chart below).

Source: The Wall Street Journal

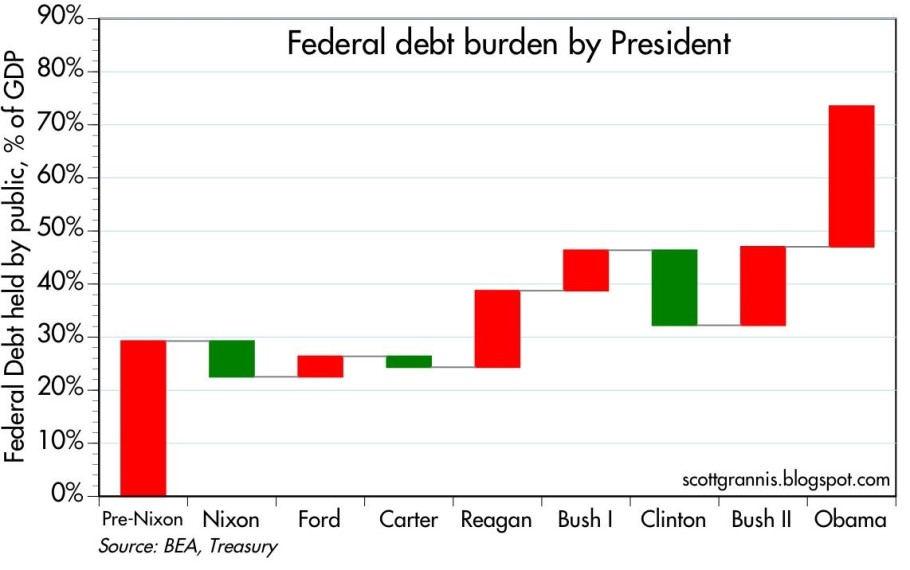

Presidential Elections: Congress’s approval rating is abysmal, but like it or not, primary season is just starting and we are stuck in a presidential election cycle until the second Tuesday of November. Guess what? If you want to know the impact of the elections on the financial markets, then I will give you the short answer…it just does not matter who gets elected. History shows us that the markets go up and down under both Republican and Democratic parties. If you are comparing the track record on the political parties’ track record on debt creation, it is a mixed bag as well (see chart below). Arguably, in half the cases, the nomination of the Federal Reserve chairs will have as large (or larger) an impact than the elected president. If you were to factor in the inevitable splits in Congress to the equation, the result is gridlock. I have contended for some time that gridlock is a positive outcome because it structurally forces a lid on disciplined government spending (see Who Said Gridlock is Bad?). If this isn’t a good enough explanation, see Barry Ritholtz’s take on the subject of politics and the stock market…I couldn’t sum it up any better (click here)

Source: Calafia Beach Pundit

Fortunately for groundhogs, and long-term investors, dealing with challenging and volatile climates is nothing new. Both burrowing marmots and emotional investors need to adapt to ever-changing environments…sunny or overcast. In addition to a cold 2016 start, January was also a chilly month in 2014 and 2015, with the S&P 500 down -3.6% and -3.1%, respectively. Despite this seasonal sour sentiment, there is a silver lining. In both instances (2014 & 2015), the market rebounded significantly in subsequent months after the slow start at the beginning of the year. For the remainder of the year, the S&P advanced +15.5% in 2014, and +2.5% in 2015.

In Groundhog Day the movie, Bill Murray relived the same day over and over again, and repeated the same missteps until he learned from his mistakes. Long-term investors will be served best by applying this same philosophy to their investments. Like a groundhog, investors have a tendency to become scared of their own shadows. It’s easy to succumb to the infinite time loop of worrisome headlines, but rather than burrowing away in hibernation, creating a diversified, low-cost, tax-efficient portfolio customized for your specific time horizon, risk tolerance, and liquidity needs is a better way of celebrating this year’s Groundhog Day.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complementary newsletter (February 1, 2016), www.Sidoxia.com.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.