"The Future is ours so let's plan it

If there's one fool for you then I am it

I've one thing to say, and that's

Dammit Janet, I love you!"

Will Janet Yellen love us back today? We'll find out if she still has the touch when she gives her semi-annual address to Congress at 10am but already the markets are up 1% in antici—–pation in Futures trading.

Of course that means that, if you followed yesterday's morning post (subscribe here for pre-market Emailings and LIVE intra-day commentary) you are already making a fortune as our bounce targets were set at:

- Dow Futures (/YM) long at 15,840, now 16,090 – up $1,250 per contract

- S&P Futures (/YM) long at 1,850, now 1,870 – up $1,000 per contract

- Nasdaq Futures (/NQ) long at 3,900, now 4,000 – up $2,000 per contract

- Russell Futures (/TF) long at 950, now 972 – up $2,200 per contract

- Nikkei Futures (/NKD) long at 15,900, now 16,050 – up $750 per contract

We took the money and ran early this morning in our Live Member Chat Room as I was worried Europe was topping on a 2.5% move up at their open and now we're watching 16,100, 1,870, 4,000, 970 and 16,000 for signs to go back long (just grab the slowest mover when 3 break higher) and we will be keeping very tight stops if any of them fall below.

While we fully expected an up day today we're not going to be impressed if all we do is manage our weak bounce targets at 16,150, 1,887, 4,050, 1,000 and all the way to 16,640 on /NKD. Of course that means /NKD is our highest beta mover – risky but fun!

As you can see, we're re-testing our January lows here and we had a lovely run back to 18,000 into the end of last month that was good for $10,000 per contract off the bottom, so we figure it's worth risking a loss of a few hundred taking pokes down here near the 16,000 line again. Though we usually only provide these trade ideas to our Members, we did make a very similar public call to go long on /NKD and other Index Futures back on 1/25 and here we are again where,. as I said at the time:

Tomorrow or Friday, I'll tell you how much money we made and you'll say "why do I never catch these great trade ideas?" and I'll say it's because you're not patient enough to wait for the pattern to reset itself and just make the obvious play.

We've been waiting for Natural Gas (/NG) to reset itself so we could go back into our long positions on the May contracts (/NGK6), which are right back at our $2.17 entry point this morning. That means we can also reiterate our Trade of the Year, where we use UNG and that trade is:

- Buy 100 UNG Jan $5 calls for $2.65 ($26,500)

- Sell 100 UNG Jan $10 calls for 0.65 ($6,500)

- Sell 50 UNG 2018 $8 puts for $2.10 ($10,500)

That works out to a net cost of $9,500 and pays $50,000 if UNG is above $10 in January and stays above $8 into Jan 2018. Worst case is you end up owning 5,000 shares of UNG at net $8.95 ($44,750), which is about $2.40 on /NG contracts. Best case is you make a $40,500 profit on a $9,500 cash bet, which is 426% back on your cash! I went over the logic of this trade way back on Dec 15th and it ended up beating out IBM to become our Trade of the Year for 2016.

I'll be discussing this trade and others in our Live Trading Webinar today at 1pm and again this evening on Money Talk (Business News Network), so tune in for that and more fun, as I seem to be on for the whole show today, so we'll have plenty of things to talk about.

8:30 update: There is nothing in Yellen's prepared remarks that's any different from what the Fed has been saying all year – they are cautiously moving towards higher rates and their decisions will be data-dependent and they will error on the side of caution. This is somewhat disappointing to the bulls, who were hoping they would signal a possible reversal but the era of infinite free money is over and people need to accept that.

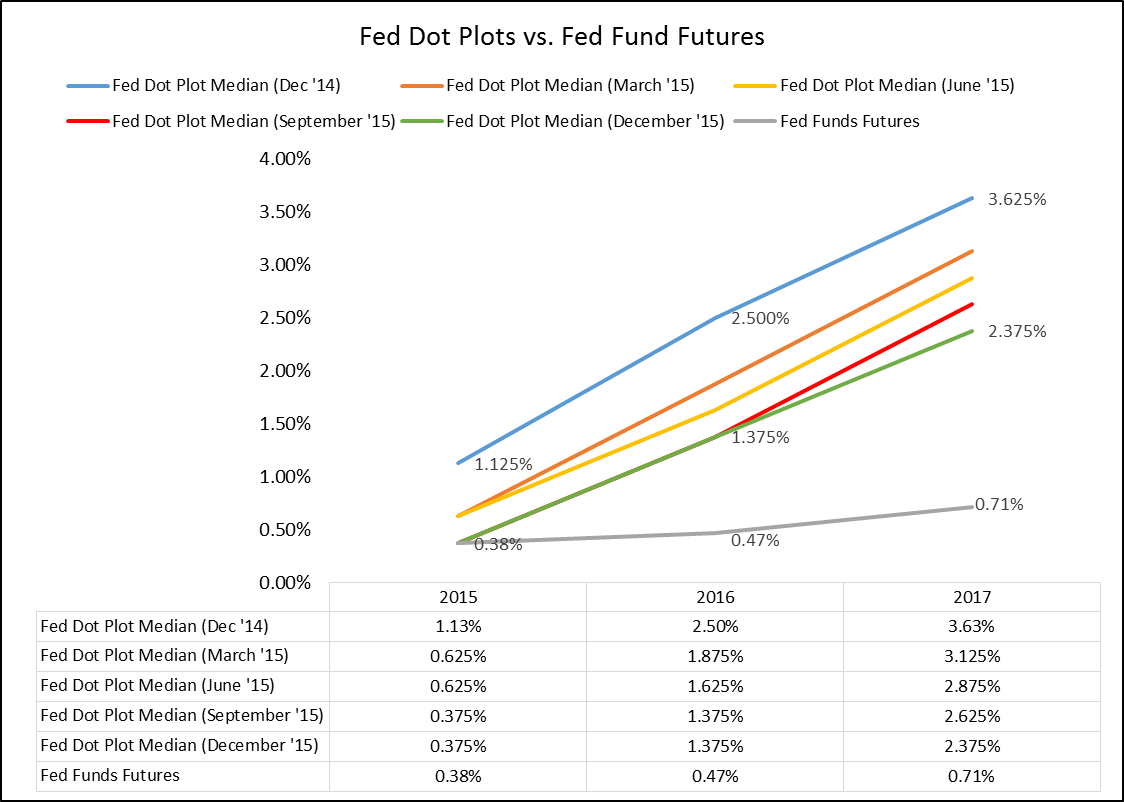

During her testimony, we expect there to be discussion of the path of rate hikes this year and I have said no more than two and most people expect 4 0.25% hikes and if Yellen clarifies things for the economorons and lowers their expectations for hikes (and the Fed Funds Futures already know), she will have accomplished her doveish goals and we can get back to the 1,900 line on the S&P but, we're not expecting much more than that as what we've experienced here is a CORRECTION – meaning we are now at the CORRECT price levels for most stocks.

During her testimony, we expect there to be discussion of the path of rate hikes this year and I have said no more than two and most people expect 4 0.25% hikes and if Yellen clarifies things for the economorons and lowers their expectations for hikes (and the Fed Funds Futures already know), she will have accomplished her doveish goals and we can get back to the 1,900 line on the S&P but, we're not expecting much more than that as what we've experienced here is a CORRECTION – meaning we are now at the CORRECT price levels for most stocks.

Getting our head into the macro view for a moment, you may barely hear it in the Corporate Media but Bernie Sanders just took 60% of the vote in New Hampshire (and his fantastic speech is here) with less than 9 months until election day. This is a strong indication that the American underclass is not going to take it anymore and is ready for radical change. Even on the political right, Trump is also an agent of radical change – also tapping in, oddly enough, to the anti Wall Street, anti 1% sentiment that is brewing in the underclass.

That's going to keep margin pressure on Corporate America throughout 2016, as will the new-found freedom of US workers to no longer take the BS low wages they've been offered as 3.1M Americans QUIT their jobs in December, the most since December of 2006 – a strong indications that our downtrodden labor force is finally feeling a bit more confident and are willing and able to find better-paying jobs elsewhere.

It's been a long time in this country since labor has had the upper hand!