Wheeeeeee – that was fun!

Wheeeeeee – that was fun!

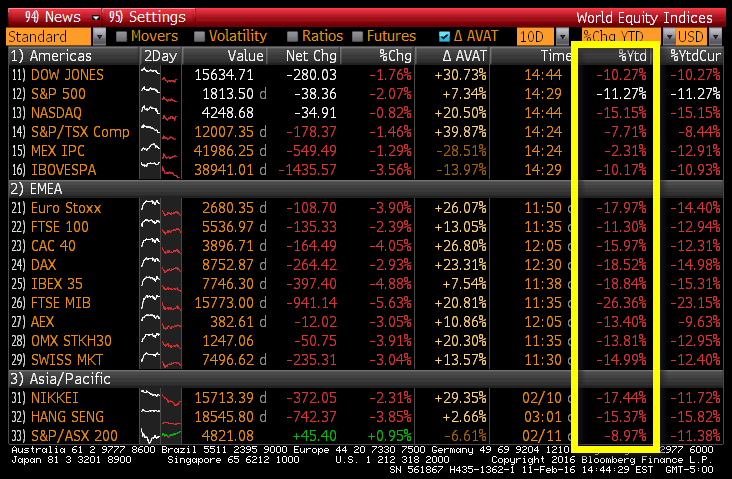

As the groundhog (who's name is Phil) predicted, we had 6 long weeks of selling to start off 2016 and, as of yesterday's close, we were teetering on the brink of a Global Bear Market after a 20% correction – as you can see from the Bloomberg chart on the right.

Things are so desperate out there that we find ourselves BEGGING for OPEC to cut production and raise oil prices – how crazy is that? It's crazy because it's idiotic an it's idiotic because we have become a nation… a planet of impatient idiots who can't bear to endure even a bit of discomfort – even if it's for our own good – if that good is delayed and the discomfort is immediate.

Sectors rotate, that's a fact. You can't have every part of an economy winning all of the time. It's OK for the banks to have a period of low earnings when the rates are low and they can't get a good spread lending to consumers. It's OK for oil companies to break-even selling $30 oil because the money the consumers would have spent on oil instead goes to the movies or the toy manufacturer or the hotel they can afford on their vacation.

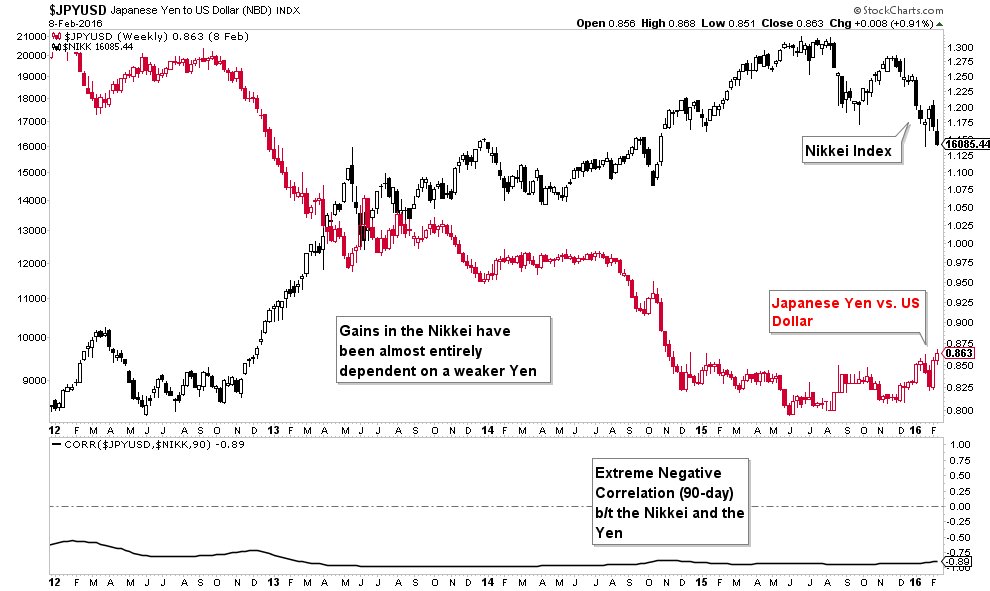

Avoiding economic pain leads to economic stagnation and THAT is the lesson we should be taking away from Japan's 20-year failed experiment in economic tinkering. They propped up their economy by making their currency worthless and that may help the Zaibatsu (the Corporate Conglomerate the runs the country) but it's been a complete disaster for the people, who have seen the buying power of their life savings drop by 35% in the last 3 years!

This week, worries about China and other Asian economies sent investors flying back to the relative stability of the Yen, which seems to have bottomed at 120 to the Dollar or 80 on $XJY. The problem is (and this is likely to surprise you) that the Yen, though a reserve currency, is less than 4% of the money in the World while Dollars are 63% and Euros are 22%. That means that when investors diversify more than 4% of their cash into Yen, they disproportionately strengthen the currency.

That's been a long-standing problem for Japan as they try to weaken their currency as a wealthy US investor or one of our fine Corporate Citizens may choose to keep 60 or 70% of their money in Dollars but they'll often split the rest between Euros and Yen. That portion works out correctly for the Euro, but not for the Yen. European investors do the same, splitting between Dollars and too many Yen and Asian investors tend to keep half their money in Yen – even the ones that are not Japanese.

That creates a constant demand for Yen no matter how hard the Bank of Japan tries to destroy it's value. That's why Japan has been able to get away with 0% interest for so long and that's why Japan is able to sustain a Debt to GDP Ratio that is now over 250%. Unfortunately, other countries are beginning to think it's a good idea to follow that path and that is going to lead to BIG TROUBLE – as Japan's monetary madness is only sustained by this quirk of monetary misallocations.

That creates a constant demand for Yen no matter how hard the Bank of Japan tries to destroy it's value. That's why Japan has been able to get away with 0% interest for so long and that's why Japan is able to sustain a Debt to GDP Ratio that is now over 250%. Unfortunately, other countries are beginning to think it's a good idea to follow that path and that is going to lead to BIG TROUBLE – as Japan's monetary madness is only sustained by this quirk of monetary misallocations.

Japan's debt is over one Quadrillion Yen, which is one Thousand Trillion or a Million Billion Yen and it begins to sound like numbers a little kid is just making up but this is a dead serious problem and, if people were able to wrap their heads around a number like that, they probably wouldn't be buying any Yen at all and certainly not lending Japan money at 0.1%! Even at the current low rates, Japan's debt service is over 24% of their National Budget at $230Bn this year and that's at 1.9% average interest on over $11Tn in debt. Japan's whole Government Budget is about $1Tn so interest rates rising just 1% could cause a major crisis in that country.

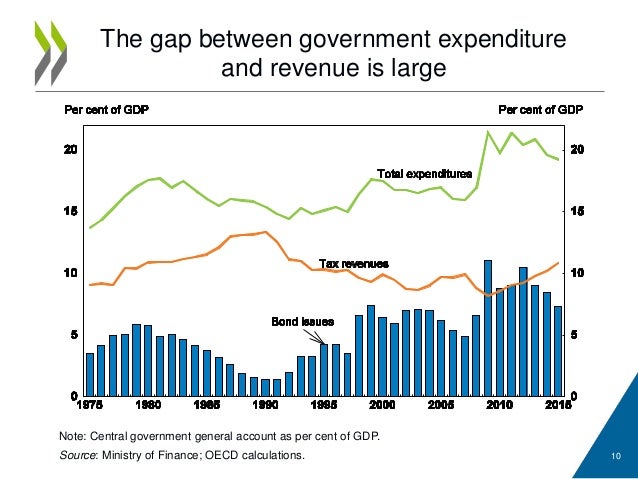

Unlike most countries, there's actually no realistic way to "fix" Japan's problem. While 24% of the budget for interest payments may not sound so awful (the US is about 10%), you have to also consider the fact that Japan runs a near 100% annual deficit, spending twice as much as it generates in revenues. This is what happens when you let Corporations (Zaibatsu) control government policy folks!

Unlike most countries, there's actually no realistic way to "fix" Japan's problem. While 24% of the budget for interest payments may not sound so awful (the US is about 10%), you have to also consider the fact that Japan runs a near 100% annual deficit, spending twice as much as it generates in revenues. This is what happens when you let Corporations (Zaibatsu) control government policy folks!

The fact of the matter is that almost 40% of all taxes collected in Japan go just towards paying the Government's current debt but this year they will borrow another $400Bn just to keep the lights on and their debt will top $11.4Tn in a $4.5Tn economy. For perspective, US debt is $19Tn in an $18Tn economy and we're borrowing $300Bn this year. This is why Japan, as well as the US and Europe and most debtor nations are DESPERATE to have inflation. Inflation helps grow your GDP and, if your GDP gets bigger and your debt is stable – it becomes easier to pay off.

However, they are ALL going about it the wrong way because the way to get HEALTHY inflation is to give money to the people, who will spend it on goods and services and create demand strains that pushes prices higher while creating more jobs and driving more corporate investment and even using commodities again. If all goes well, those prosperous people can afford housing and, before you know it, you have to raise rates just to stop them from spending too much (sound familiar?).

I wrote "Inflation Nation" back in 2008 warning that policy was on the wrong path in attempting to fight the inflation we should be embracing. The Banksters did such a good job of fighting inflation that they destroyed the economy and now they can't get it going again, no matter how much money they give to rich people (about $26Tn Globally, so far). These wrong-headed polices led me to write "Screwflation Nation" in 2010 and, sadly, nothing has changed since.

I wrote "Inflation Nation" back in 2008 warning that policy was on the wrong path in attempting to fight the inflation we should be embracing. The Banksters did such a good job of fighting inflation that they destroyed the economy and now they can't get it going again, no matter how much money they give to rich people (about $26Tn Globally, so far). These wrong-headed polices led me to write "Screwflation Nation" in 2010 and, sadly, nothing has changed since.

Things have been great for our Zaibatsu Masters, of course, they have been able to buy back their own stock at record levels and refinance their debts to LOOK more profitable but the people, the ones that are turning to Bernie Sanders and Donald Trump for answers, are NOT yet feeling the economic gains.

For one thing, very little of these low rates have "trickled" down to the working man. In January of 2007, the Fed Funds Rate was 5.25% and Mortgage Rates were 6%, a 0.75% spread for the Banksters. Until the last Fed meeting and since early 2011, the Fed Funds rate has been effectively 0.1%, yet Mortgage rates are 4%. This is fantastic for the Banksters but terrible for the 99.9999% of the citizens in this country who do not happen to be Banksters.

For one thing, very little of these low rates have "trickled" down to the working man. In January of 2007, the Fed Funds Rate was 5.25% and Mortgage Rates were 6%, a 0.75% spread for the Banksters. Until the last Fed meeting and since early 2011, the Fed Funds rate has been effectively 0.1%, yet Mortgage rates are 4%. This is fantastic for the Banksters but terrible for the 99.9999% of the citizens in this country who do not happen to be Banksters.

Likewise, you have not been able to refinance your credit cards at 0.1% or, keeping the Bankster's spread steady at 0.75%, at 0.85%. No, instead you still pay as much as 22% on past due balances or 220 TIMES what the bank pays for the money they are lending you.

No wonder the economy can't get moving. Don't worry though, the cost of artificially reducing rates for the Top 0.00001% Banksters which they don't pass on to you is borne by our Treasury and ultimately by you and your children in the form of increasing National Debt and Taxes.

America's Corporate Kleptocracy is no different than Japan's Zaibatsu culture and 20 years of these policies have put Japan's Corporate Return on Equity down around 7%, less than half of what it is in the US and Europe yet THAT is the model we are following down the deep, dark spiral of endless low interest rates and austerity spending that ONLY benefits the Corporations and their owners:

Japanese corporations average 25% of their market cap in CASH!!! – why would they spend it? US firms average less than 10% while European firms are moving towards Japan at 15%, up 50% since the crisis. Charging negative rates for deposits is an attempt to get our Top 1% Corporate Citizens, as well as their human counterparts, to do SOMETHING with their money but 20 years of this policy in Japan has already proven it simply DOES NOT WORK.

What does work is good old Keynesian stimulus but there has been a smear campaign against Keynes run by those very same corporations and their pet media, who have muddied the waters by calling QE Keynesian. That's not Keynesian at all! Keynes wants money to be spent BUILDING THINGS, EMPLOYING PEOPLE – not handed out to rich folks who use it to buy back their own stock and take over other companies so they can cut half the staff and boost profits – where is the economic benefit in that?

Have a great weekend!

– Phil