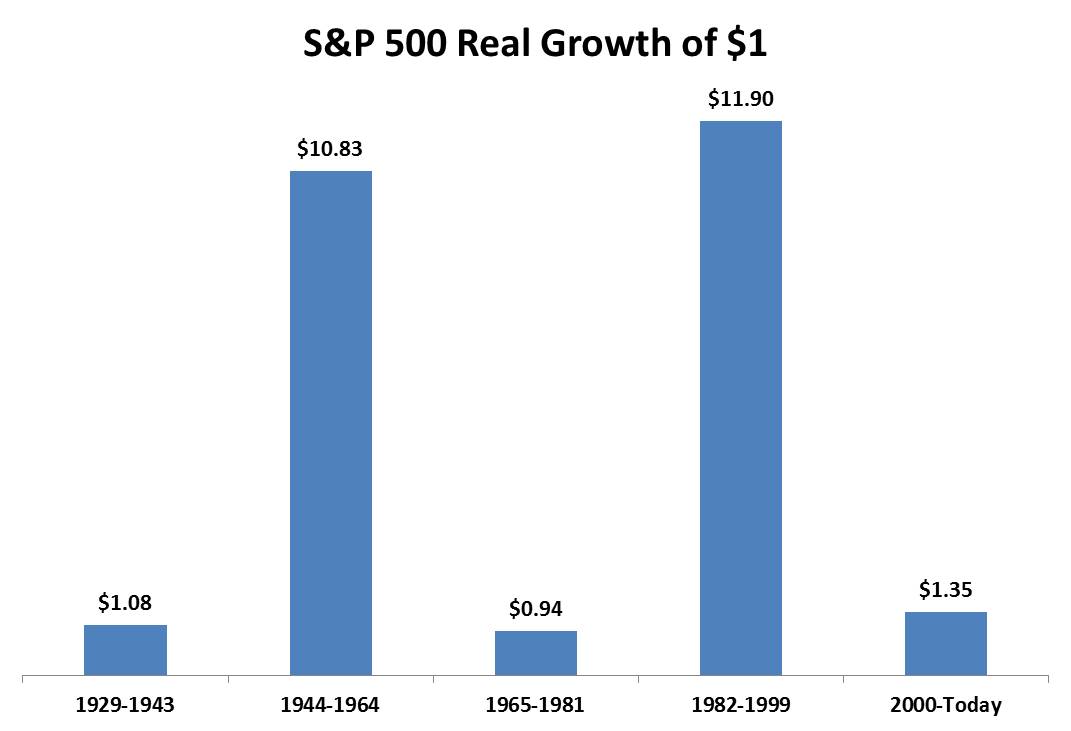

Look at the bar chart at the end of the post and ask: Do markets move in cycles? What are my long term objectives? And, is this time different?

You Are Owed Nothing

Courtesy of Michael Batnick, The Irrelevant Investor

People invest their hard earned dollars to earn a return above and beyond inflation. At a three percent inflation rate, your purchasing power would get cut in half over twenty years. As the value of your dollar diminishes over time, the goal when investing is to maintain and even grow the value of your money.

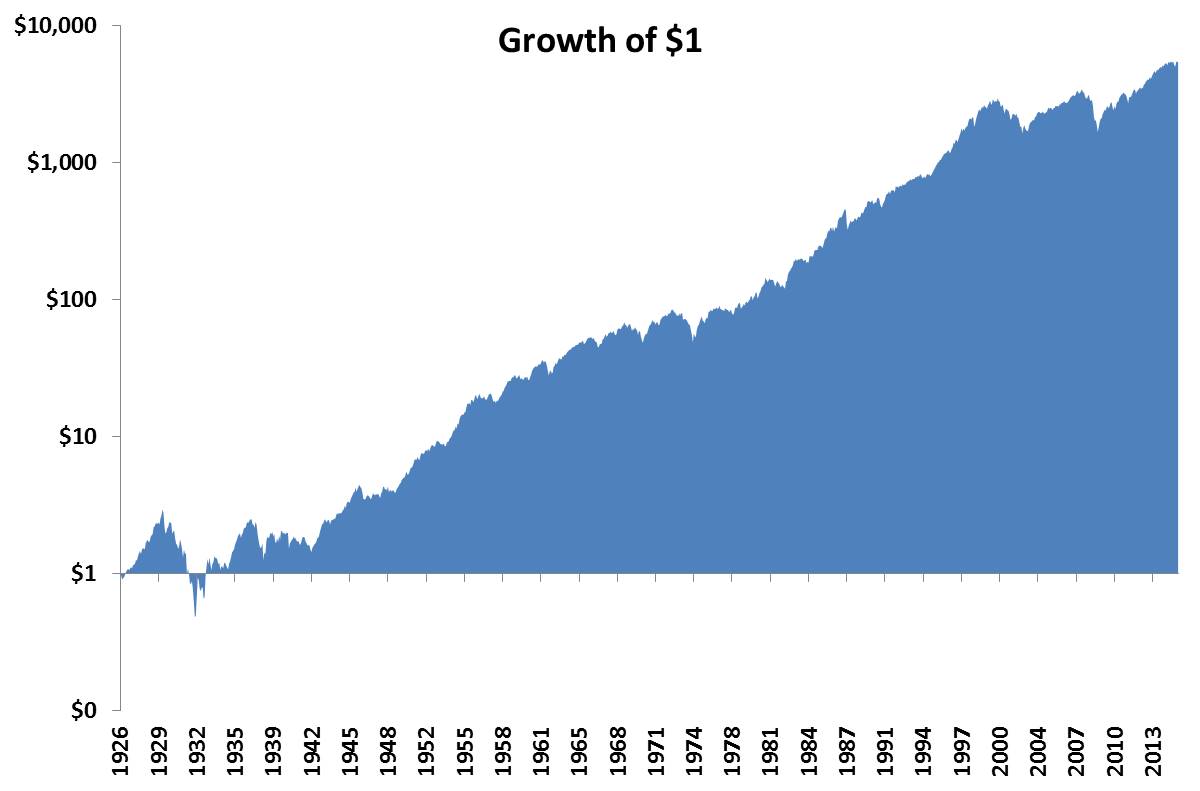

You’ve seen this chart before, it shows that $1 invested in 1926 would have grown to $5,386 today, a whopping return of 538,547%, or 10% a year.

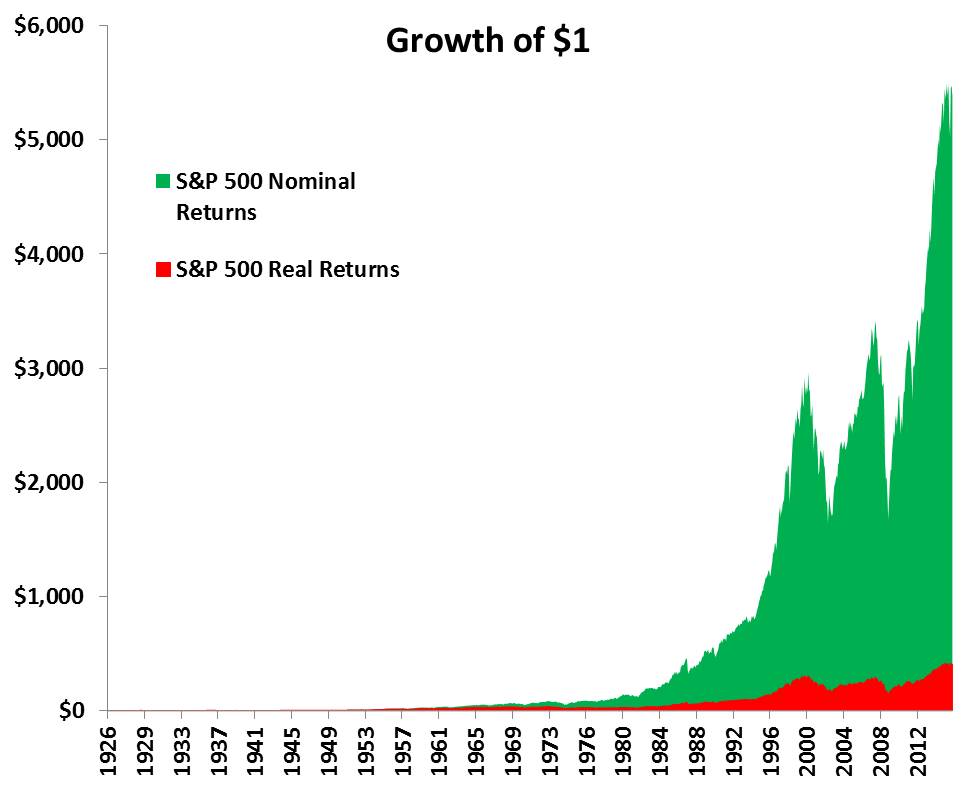

What you don’t always see is the real growth of $1, or what the returns would be after you factor in inflation. Once this is accounted for, stocks have returned 40,670% over the last ninety years, or 6.9% a year (I used an arithmetic scale here for affect, the chart above uses a log scale).

The chart above clearly demonstrates how much inflation eats into returns. Still, an 8.5% average real return, or 6.9% compounded is pretty darn good. If an investor earned 6.9% for twenty years, their total return would be 280%. Sounds good right? Here’s the kicker. Real returns aren’t owed to anybody, they’re earned the hard way.

Over all ten-year periods, the real rate of return for stocks has been positive 85% of the time. While these are pretty good odds, you probably wouldn’t feel invincible if somebody told you there was a 15% chance that you could lose money investing over the next decade. The image below illustrates that investing is not for the faint of heart.

As you’re probably painfully aware, the S&P 500 hasn’t made any progress over the last two years. If you’re feeling a little frustrated, I have some bad news for you, this is how stocks works. The stock market doesn’t owe you anything. It doesn’t care that you’re about to retire. It doesn’t care that you’re funding your child’s education. It doesn’t care about your wants and needs or your hopes and dreams.

I absolutely believe that stocks are the best game in town. I don’t think there is a better way for the average investor to grow their wealth. However, this is called investing and the price of admission is gut wrenching drawdowns and sometimes years and years with nothing to show for it. If you can accept that this is the way things work, you can be an enormously successful investor.