It's always something.

It's always something.

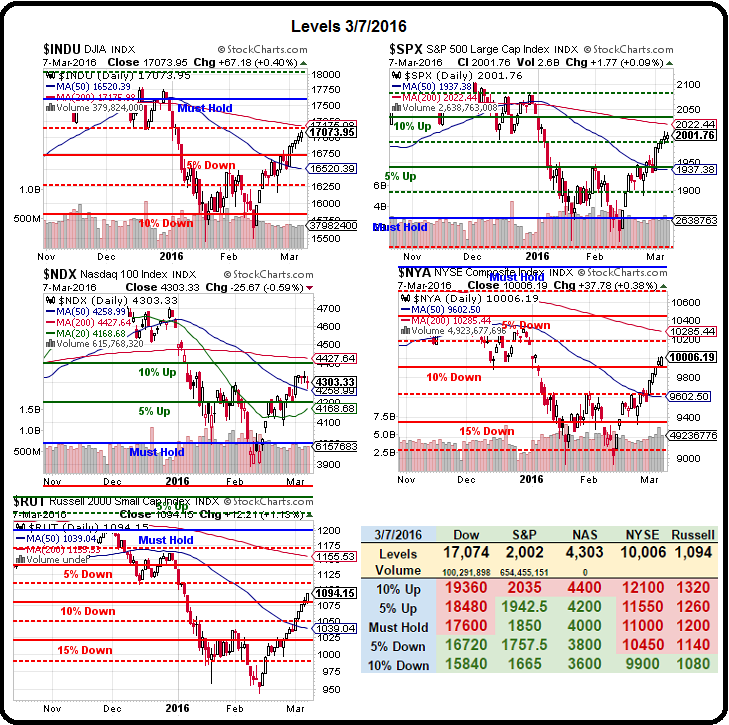

I told you yesterday in "S&P 2,000 and Bust" that we would get rejected at the 2,000 line on the S&P 500 (/ES Futures) and, because we were not greedy and were just looking for quick profits – we had two chances to make $500 per contract in yesterday's trading. Our non-headline trade ideas (all delivered to you, pre-market, in the morning post) did well as well including:

- S&P Futures (/ES) short at 2,000, out at 1,990 – up $500 per contract (twice)

- Dow Futures (/YM) short at 17,000, out at 16,950 – up $250 per contract

- Nasdaq Futures (/NQ) short at 4,350, out at 4,775 – up $1,500 per contract

- Russell Futures (/TF) short at 1,080, out at 1,085 – down $500 per contract

- Nikkei Futures (/NKD) short at 17,200, out at 16,700 – up $2,500 per contract

- Natural Gas Futures (/NQ) long at $1.62, out at $1.72 – up $1,000 per contract

The Russell was just weird and certainly you can't win them all but hopefully our Trade of the Year on Natural Gas (detailed yesterday as well) is finally getting back on track after yesterday's big move. As I said, I've been banging the table on that one for some time but it's possible that UNG moved simply because we were talking about it and not just because we had perfect timing – that's why it's good to pick up side money on the Futures while you wait for your longer-term plays to develop.

Anyway, it's not that we went bearish, per se, it's just that the markets went up too far, too fast – so we called an audible and hedged our longs. Our Long-Term Portfolio has gained 24% already this year as that one (our biggest) is all bullish and even our Options Opportunity Portfolio, which had been suffering from a mistake we made last quarter going bullish too early, has now nicely recovered and is up 19% since it's 8/8/15 start date – not bad for 7 months but still 15% behind schedule, though we have lots of good trades there that can make up the gap if all goes well.

Our Short-Term Portfolio has made way too much money and even our ultra-conservative Butterfly Portfolio is now up over 100% as we flipped that bullish with much better timing than the OOP. We reviewed the portfolios briefly in last week's live Webinar, that replay is available HERE. We also reviewed all the free trade ideas we recently shared on Friday – also makes for good reading!

Why do we constantly look back before we look ahead? To make ourselves better traders. As we were discussing in Member Chat last night, the whole reason I started blogging was to keep track of what I was thinking when I made a trade, so I could go back and learn what I was right or wrong about at the time. Over the past 10 years, it's made me much better at predicting the future BECAUSE I am mindful of past mistakes and always willing to learn from them.

We do a lot of reading at PSW because we're FUNDAMENTAL traders who happen to use Options and Futures for leverage, not "option technicians", which is what most people use them for. When you are right about a play, options let you take a position using much less cash (and much less margin) to get the same results and, if you construct it correctly, it has more (though limited) upside AND less downside risk than owning the stock. That helps us get a better winning percentage.

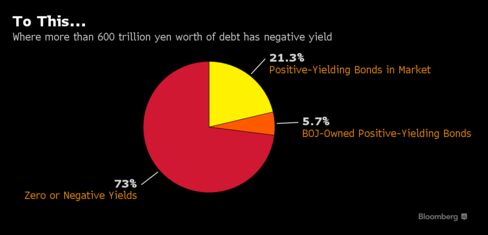

Anyway, today we were "right" about the Futures because Asia did not get the stimulus they expected from the BOJ or the PBOC so they were already in a pouty mood and now we have a report that, aside from Japan's revised Q4 GDP showing 1.1% contraction, they've gone gung-ho into negative interest rates just to keep it from being worse.

Anyway, today we were "right" about the Futures because Asia did not get the stimulus they expected from the BOJ or the PBOC so they were already in a pouty mood and now we have a report that, aside from Japan's revised Q4 GDP showing 1.1% contraction, they've gone gung-ho into negative interest rates just to keep it from being worse.

BOJ Governor Haruhiko Kuroda said Monday he can’t deny the adverse effect on bank earnings of his stimulus, even as he reiterated it can help spur inflation to the 2 percent target. With maturities extending to 10 years offering negative yields, investors need to take ever greater risks in longer-maturity bonds. More than two-thirds of respondents in a quarterly BOJ survey last month said market functioning had deteriorated, as a gauge of volatility spiked to the highest since June 2013.

“Yields will continue to fall and the curve will continue to flatten under pressure from negative rates and quantitative easing,” said Shuichi Ohsaki, the chief rates strategist at Bank of America Merrill Lynch in Tokyo. “Trading volumes will become even thinner. A typical bond investor probably wouldn’t want to touch this market.”

To put icing on this very scary cake, in order to make sure you know China's 6.5% growth target is total BS, Exports fell 25.4% last month, the biggest decline since May of 2009. Even worse for their Asian trading partners, Imports were down 13.8%. "Exports got pummeled again in February, highlighting the downturn in global demand," said Frederic Neumann, co-head of Asian economic research at HSBC Holdings Plc in Hong Kong. "Hopes for a global rebound need to be tempered with numbers like these. It’s easy to blame Chinese New Year distortions, but there is a much deeper malaise that is becoming apparent in the numbers."

There's a growing concern that Abenomics is not working and, in fact, the PM may end up with a no-confidence vote this year and this entire, painful, economic experiment will come to and end and the next PM will have to clean up the mess (if such a thing can be accomplished). “I have a 25-year-old son and he’s lived with deflation his entire life,” HajimeTakata (57), chief Economist at the Mizuho Research Institute said. “I don’t think three years can change the mindset of people."

"Japan’s economy really doesn’t have any leading power with primarily consumer spending dragging growth,” said Takashi Shiono, an economist at Credit Suisse Group AG, who had correctly predicted the annualized GDP number. “I expect some rebound this quarter but it’s not going to be an impressive one.” Other economists aren’t so positive, with HSBC’s Izumi Devalier saying that a contraction in the three months ending March 31st is “probable.” “There’s no real sign that economic momentum is picking up in the first quarter,” she said on Bloomberg Television after revised report was released.

The slowdown in China — Japan’s largest trading partner — and the appreciation in the currency are concerns for companies and may erode their record profits. Panasonic Corp. cut its profit forecast for the year ending in March as sales of products including air conditioners fell in China. Hitachi Ltd. reduced its full-year profit forecast on slower sales of construction machinery in China and reduced demand from oil-producing nations hurt by falling energy prices.

None of this is good for Asian economies and that then spills over to Europe and the US, though comparatively little impact on the US since most of what we buy from Asia is stuff we have them making for us anyway and our balance of trade exports has always been so low, a little lower doesn't matter. In fact, our trade balance with China and Japan has been improving, as a small cut in our consumption overrides a medium cut in theirs!

Sorry I don't have a more updated chart but that's a really good one for illustration purposes. So, mathematically, if China's imports from the US were to drop off 10%, that's $530M which would balance out if we were to import just 1.6% less from them. That's the problem both Japan and China are facing with both the US and Europe – those trade surpluses can really sting you when they start to unwind.

None of this changes our overall view of US equities – these are all known factors which led us to come up with these lines on our Big Chart, which hasn't changed since November of 2013 for our 2015 targets and, into the close of last year, we saw no reason to change them for 2016 either.

In short, the overall markets are, essentially, correctly priced taking into accounts the geopolitical risks of the moment. That doesn't mean there aren't bargains to be bought long (BHI) or overextended stocks to be sold short (SHAK). All in all, it's a stock picker's market and that is what we do best – so bring it on!