You missed the news.

You missed the news.

That's OK, I posted not one but two news reviews to our Twitter account, so you can get an idea of what goes on in our Live Member Chat Room during market hours (and before and after). This morning there was so much to talk about we had to make two posts with big news from China and an examination of the Oil Market (contracts roll over tomorrow), Corporate Profits, a Chart Review and even some election news – it's all there for you on Twitter (6:30 am) – I'm not repeating myself.

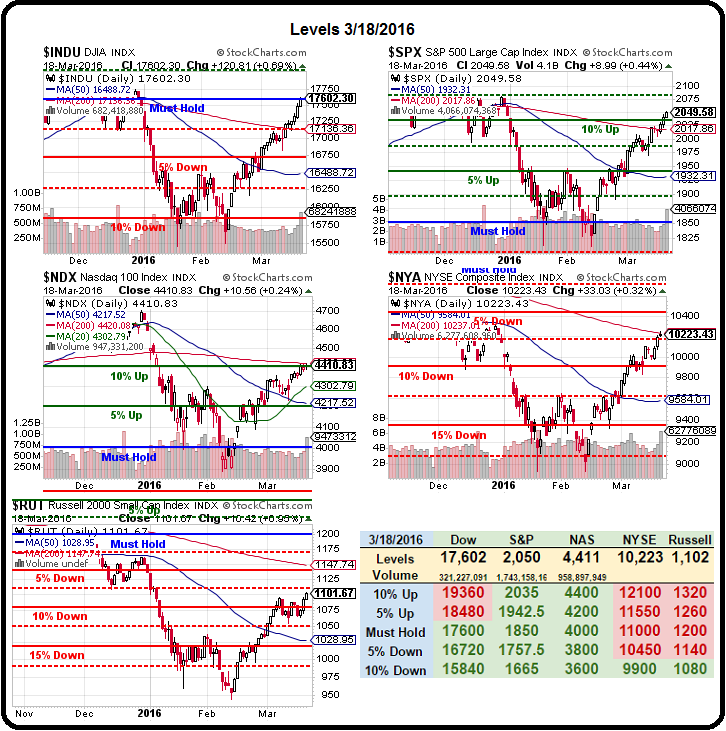

As you can see from the above chart, a month of Central Bank actions (12 of them) has bought our beloved S&P up from 1,850 all the way to 2,040, which is 190 points and just over the 10% line of 2,035, which is where we predicted we'd be on our Big Chart (see dozens of other posts). As noted this morning, we expect to be rejected at 2,040 (/ES Futures), which lines up with 17,550 on the Dow (/YM Futures), 4,415 on the Nasdaq (/NQ Futures) and 1,100 on the Russell (/TF Futures) – so those are our shorting lines with very tight stops above – in case we're wrong and the rally has more legs.

There's not much data this week but we do have the Chicago Fed this morning, PMI and the Richmond Fed tomorrow, Durable Goods on Thursday along with Consumer Comfort and then the 3rd adjustment to GDP on Friday along with an 8:30 peak at Corporate Profits which, by all accounts are shrinking rapidly!

There's not much data this week but we do have the Chicago Fed this morning, PMI and the Richmond Fed tomorrow, Durable Goods on Thursday along with Consumer Comfort and then the 3rd adjustment to GDP on Friday along with an 8:30 peak at Corporate Profits which, by all accounts are shrinking rapidly!

Are 12 rounds of stimulus/easing enough to ignore the 2.5% drop in earnings expectations in a $100Tn Global equity market? Well, it wasn't $2.5Tn worth of stimulus so, no, it's not… See, investing isn't hard – it's just math! We do math all the time when we are evaluating companies so why not do it when we evaluate indexes as well?

We did the math on the Dow back on Jan 14th, when the Dow was at 16,159 and we valued each component and that led us to make a bottom call, which is why we went bullish at 16,000 (the actual closing low was 15,766 a week later, on the 20th). We had plenty of time to pick up more bullish positions and we were able to do it with confidence because we KNEW what a fair value was and that's the same way we KNOW that 10% above (17,600) is a bit too high without new FACTS to change our valuation.

We talked about our hedges last week, so I'm not going to get into it here but clearly we had a huge pop last week from the Energy sector and the Financials, who thought they were all going to default on their loans and the REITs, who love the ever-low rate policy reiterated by the Fed so all is well and the Dow jumped 450 of those 1,500 points since Wednesday's Fed meeting.

Unfortunately, a good market rule of thumb is "what can easily be done can just as easily be undone," so we went into the weekend a bit bearish and we're shorting the Futures this morning – looking for at least a small pullback off those +10% lines (about 2.5% at least). That would give us the following watch levels (and we are using our 5% Rule™ to plot non-spike consolidation points):

Unfortunately, a good market rule of thumb is "what can easily be done can just as easily be undone," so we went into the weekend a bit bearish and we're shorting the Futures this morning – looking for at least a small pullback off those +10% lines (about 2.5% at least). That would give us the following watch levels (and we are using our 5% Rule™ to plot non-spike consolidation points):

- Dow 16,000 to 17,600 is a 10% move up (1,600) and that means a weak pullback would be -320 to 17,280 and another -320 would take us to 16,960 – below that is just bearish again.

- S&P 1,850 to 2,035 is a 10% move up (185) so we'll call it 35-point retraces to 2,000 (weak) and 1,965 (strong).

- Nasdaq has been very strong and 4,200 is already the +5% line on our Big Chart. There's an Apple event today and we'll see if they can hit $110 but Valeant is killing the entire Pharma sector and that's holding the Nasdaq down a bit. Still, they are at 4,400, which is a healthy 5% bump and puts them in-line with the S&P at the +10% line on our Big Chart. Still, with the broader NYSE and the Russell dragging – there's not much hope the two sub-indexes will punch higher. Anyway, so 200 point move up means 40-point retraces to 4,360 (weak) and 4,320 (strong).

- NYSE is, essentially, all stocks and all stocks are not doing well at 10,220, which is well below the -5% line at 10,450. The NYSE bottomed out right at the 9,000 line and that's near 20% off the Must Hold line at 11,000, which it hasn't really held – ever. So how can we be bullish if our broadest index isn't? I'm going to ignore 9,000 and focus on the 10,175 line (-7.5%) and say that "must hold" for us to stay less than bearish.

-

The Russell is specifically small caps and specifically, unlike the S&P, who do 60% of their business overseas, the Russell companies do 80% of their business in the US. Why then, are they underperforming if our economy is supposed to be the engine driving World growth? Something is rotten but that's a different article and for now we'll concentrate on that 1,100 line and let's say that's up from 1,000 and that means 20-point retraces to 1,080 (weak) and 1,060 (strong) but, as you can see from Dave Fry's chart – technical resistance is more like 1,115, so any failing at 1,100 is not a good sign.

The Russell is specifically small caps and specifically, unlike the S&P, who do 60% of their business overseas, the Russell companies do 80% of their business in the US. Why then, are they underperforming if our economy is supposed to be the engine driving World growth? Something is rotten but that's a different article and for now we'll concentrate on that 1,100 line and let's say that's up from 1,000 and that means 20-point retraces to 1,080 (weak) and 1,060 (strong) but, as you can see from Dave Fry's chart – technical resistance is more like 1,115, so any failing at 1,100 is not a good sign.

That's more or less where we are but bear in mind there were three driving factors in this amazing 10% market run. One was, of course, the Fed, along with ALL the other Central Banks, throwing another Trillion onto the fire to keep us warm for another month. Two has been the Dollar, which fell 5%, from 100 to 95, where it now sits. A 10% market rally is much less impressive when it's priced in Dollars that have dropped 5%. Three is the price of oil, which is up 10% from it's bottom too and now, as we discussed in Member Chat, likely drifting into a new range:

There is NOTHING fundamental supporting the move in oil – just rumors that there will be supply cuts or, in the very least, production freezes at the upcoming OPEC/Russia meeting (4/17). A LOT of eggs are going into that basket (see morning chat post) and, though we're generally bullish on oil into July, we may end up shorting it into the April meeting if we're still in the $40s.

So, it's a meaningless Monday and this whole week promises to be meaningless as there's little data, little Fed speak and little earnings so it's all about spin and sentiment as we wait for the quarter to close a week from Thursday – THEN the fun can begin!