16,400!

16,400!

That's where we finally stopped out on our Nikkei (/NKD) shorts from Friday's morning post. The short at 16,830 made $2,150 PER CONTRACT for those of you smart enough to subscribe to the PSW Report or one of our higher-level memberships. We initiated that trade on Wednesday, during our weekly Live Trading Webinar (replay available here) where we first laid out our logic as to why the Nikkei would plunge over the weekend no matter what the Doha outcome was. As I said in Friday's post (and on Benzinga's Morning Show):

That's right, yesterday we told you that the Nikkei was facing the Kobayashi Maru and we picked a short on the Futures (/NKD) at 16,830 and m-m-m-my Kuroda literally went to war with us, calling the Yen's recent strength "excessive" and warning speculators(us) not to get on the wrong side (our side) of his trade.

…If we're right about the Nikkei dropping 700 points (4%) that would drop EWJ ($11.89) to $11.41 so 0.59 on the puts and let's say we look for 0.50 and a 0.15 (42%) profit by Tuesday – that's almost as much fun as playing the Futures!

We shorted oil futures (/CL) at the bell yesterday as it tested $42 based on the ridiculous amount of fake, Fake, FAKE!!! open front-month orders at the NYMEX and the FACT that the storage facilities at Cushing, OK (where the NYMEX oil is delivered), as well as everywhere else in the country are full, Full, FULL!!! It's a simple investing premise and one we make money on on a regular basis at PSW – simply because we pay attention to basic fundamentals like these.

Yes, there's a big OPEC meeting this Sunday (again, see yesterday's post) but they are talking about a production FREEZE, not cuts and a freeze won't do anything to burn of the massive global glut of oil that is sloshing around out there and oil had already run up from $32.50 to $42 (29%) in anticipation of this and we considered 30% a bridge too far and $42.25 is right about where we spiked to a halt, which was also $45 on Brent Crude (/BZ) – so a perfect spot to go short.

Remember, I can only tell you what is going to happen and how to profit from it – the rest is up to you! In this case, our example trade from the Webinar left us with 5 contracts short on Friday morning but we stopped out 3 of the 5 to lock in a $6,000 gain and reduce our risk over the weekend. The two remaining contracts made another $2,300 for an $8,300 total since our Wednesday webinar – now extending our 2016 winning streak into the middle of April.

We also did a Top Trade Review over the weekend and those too, have been on a very hot roll, with 15 of 16 trades working out so far (and the 16th is our Trade of the Year – so we still have hope). As you can see, our oil trade idea went very well too. Natural Gas (/NG) came down to test the $1.85 line in the front month and the July contracts (/NGN6) fell briefly below $2.10, where we do like them long (now $2.13) so we can keep an eye on those for an entry opportunity.

We also did a Top Trade Review over the weekend and those too, have been on a very hot roll, with 15 of 16 trades working out so far (and the 16th is our Trade of the Year – so we still have hope). As you can see, our oil trade idea went very well too. Natural Gas (/NG) came down to test the $1.85 line in the front month and the July contracts (/NGN6) fell briefly below $2.10, where we do like them long (now $2.13) so we can keep an eye on those for an entry opportunity.

At the moment (8am), the Futures are at Dow (/YM) 17,762, S&P (/ES) 2,068, Nasdaq (/NQ) 4,523, Russell (/TF) 1,223 and Nikkei (/NKD) 16,500 on the button. We'll see how things look at the open but I think we should head lower – it's really just a dip in the Dollar that's been supporting us this morning.

As to the oil situation, with no deal on the table, Iran and Saudi Arabia may be racing to ramp UP production ahead of a possible future agreement – especially in light of an oil strike in Kuwait that is taking 1-1.5Mb/day off-line. Most interesting in the oil patch is the fact that the NYMEX contracts roll over on Wednesday and they are still stuffed with 99M barrels of fake, Fake, FAKE orders and, given the failure at Doha – it's going to be very hard to find buyers for May delivery – despite the start of summer driving season. pit Session Quotes

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| May'16 | 38.75 | 38.75 | 37.61 | 38.16 |

19:56 Apr 17 |

– |

-2.20 | 30715 | 40.36 | 99549 | Call Put |

| Jun'16 | 39.90 | 40.00 | 39.00 | 39.49 |

19:56 Apr 17 |

– |

-2.22 | 37674 | 41.71 | 480122 | Call Put |

| Jul'16 | 41.03 | 41.03 | 39.80 | 40.33 |

19:56 Apr 17 |

– |

-2.21 | 4987 | 42.54 | 240983 | Call Put |

| Aug'16 | 41.54 | 41.55 | 40.29 | 40.76 |

19:56 Apr 17 |

– |

-2.27 | 2341 | 43.03 | 94247 | Call Put |

| Sep'16 | 41.60 | 41.64 | 40.58 | 41.25 |

19:56 Apr 17 |

– |

-2.13 | 2492 | 43.38 | 136755 | Call Put |

| Oct'16 | 42.11 | 42.11 | 41.04 | 41.46 |

19:56 Apr 17 |

– |

-2.20 | 1150 | 43.66 | 59114 | Call Put |

| Nov'16 | 42.25 | 42.25 | 41.29 | 41.82 |

19:56 Apr 17 |

– |

-2.12 | 692 | 43.94 | 49043 | Call Put |

| Dec'16 | 42.76 | 42.76 | 41.43 | 42.05 |

19:56 Apr 17 |

– |

-2.14 | 6683 | 44.19 | 201887 | Call Put |

| Jan'17 |

– |

– |

– |

42.31 |

19:56 Apr 17 |

– |

-2.10 | 485 | 44.41 | 36576 | Call Put |

That means that at least 80M, probably 90M of those barrels have to be rolled to June, which is already stuffed with 480M FAKE!!! orders or July or Aug and then we're talking 900,000 contracts in the front 3 months representing 900M barrels scheduled for FAKE delivery by August for a country that only imports 5Mbd so about 100 days until the end of July means these 900M FAKE orders would cover the US's ENTIRE import needs for 100 days and still have 400M barrels to spare and that's just one already overflowing hub (we have a dozen) in the middle of Oklahoma.

That's why oil trading is nothing more than a scam – it's a perpetual game of 3-Card Monty where they keep moving the oil around quickly and then encourage the suckers to bet on it by planting this and that story and having their paid media barkers turn a blind eye and act like the whole thing is somehow legitimate. It's not – it's a huge scam! Fortunately, it's a scam we understand and can make money off of – is that wrong?

That's why oil trading is nothing more than a scam – it's a perpetual game of 3-Card Monty where they keep moving the oil around quickly and then encourage the suckers to bet on it by planting this and that story and having their paid media barkers turn a blind eye and act like the whole thing is somehow legitimate. It's not – it's a huge scam! Fortunately, it's a scam we understand and can make money off of – is that wrong?

That's why OPEC has lost control of the game. They were happy to let the con artists take over while they ran the price up from Clinton's $20 to Bush's $140 per barrel but, at that price ($5 gallon at the pump), it was simply unaffordable so the same Banksters and other thieves who manipulated the prices up began manipulating the prices down because they (and we) can make money playing oil in either direction while poor OPEC needs oil to go higher – not lower.

Now it's a joke to talk about supply and demand when US petroleum storage is over 2Bn barrels and globally over 8Bn barrels of oil are now in commercial and government storage and that represents a 100-day supply – even if all of the oil in the World were to shut off at once. That's what drives the price of commodities, scarcity and supply shortages. Neither are possible at the moment – even if OPEC had cut drastically back and what we now fact is is a potential glut and that's not good for the energy sector, which has driven the recovery of the S&P recently.

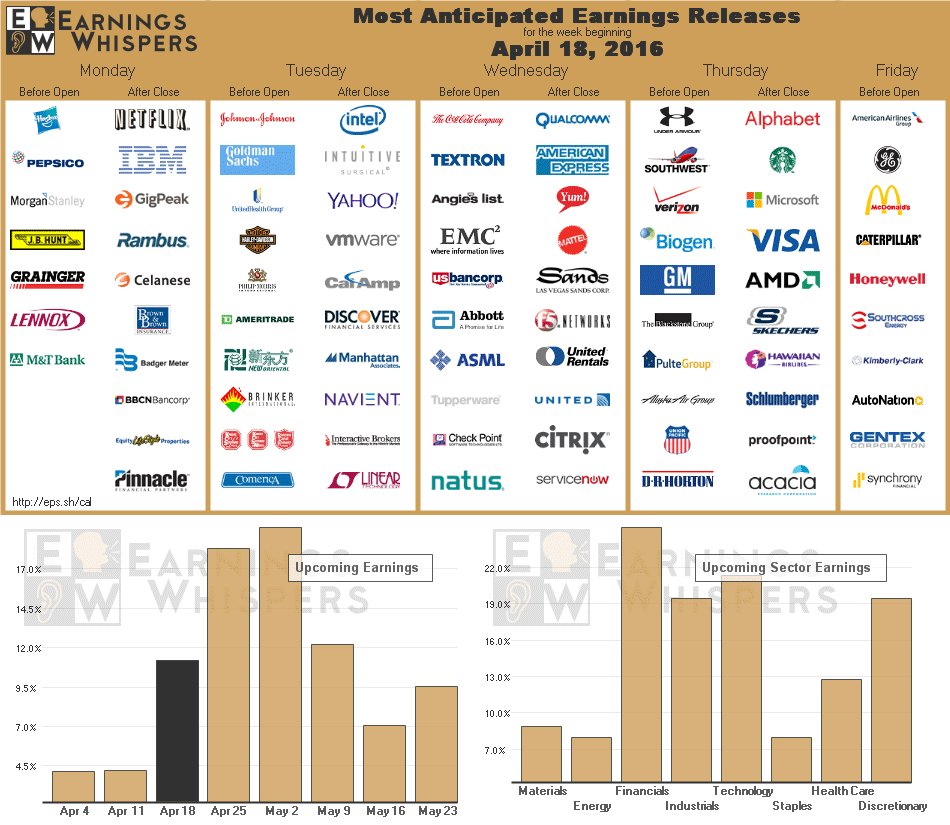

As usual, Monday's are meaningless and it's a low-data week but 103 S&P companies will report earnings, so we'll turn our attention to that. Dudly (8:30), Kashkari (12:30) and Rosengren (7:00) speak today to help get us through what's probably going to be bad housing data at 10 am. More home stuff through Wednesday and the Philly Fed with Chicago Activity and Consumer Comfort Thursday and, amazingly, no Fed speakers!

On the International front, we have Germany's always exciting ZEW Sentiment Survey and, for some reason, Economorons believe it will jump from 4.3 to 9.8 (because everything is so great in Germany?) and Wednesday we get the Japanese Trade Balance, Thursday is UK Retail Sales, EU Consumer Confidence and the ECB Rate Decision – where Draghi needs to put up or shut up (he'll do neither) or he stands to lose more credibility and push sentiment back to a Brexit in June.

Friday we get PMIs across Europe so this week won't be over until the fat lady sings.