One again the BOJ does nothing over the weekend.

That's put many, many traders on the wrong side of the strong Dollar/weak Yen bet and it's also pushed the Nikkei back to our long line at 16,000, which is where we expect support from the BOJ – whether overt or covert. As I said in a Bloomberg interview last week:

I think 105 is a line that will be defended by the BOJ in whatever way they can, for as long as they can and the 16,000 line is also being defended at the moment so it's great fun to play in the Futures but as soon as we get to around 18,000 or 116 on the Yen, we flip to shorting the Nikkei and long on the Yen (short USD/JPY) because both those levels are unrealistic, no matter how hard the BOJ tries to push us over those lines.

The BOJ's problem is they can't fight the constant flow of money coming into Japan from Asian investors looking for safe-havens to park their cash. What are the alternatives? As bad as Japan is, it's less scary than their home countries so investors tend to buy Euros (Francs, etc.), Dollars and Yen but, as a reserve currency, the Yen is just 2.5% of the Global Float (Dollar 63%, Euro 24%) yes, when people are allocating cash – they tend to put a disproportionately high percentage into Yen (vis a vis allocating by reserve status) and that is what causes the Yen to be too strong, no matter how much the BOJ tries to weaken it.

Now Japan has been placed on on official US Government watch list for currency manipulation and that's forcing the BOJ to tread cautiously before making any additional currency moves and, as I said in another interview last week (hasn't aired yet), we're not expecting any real action from the BOJ until after the upcoming G7 meeting.

Now Japan has been placed on on official US Government watch list for currency manipulation and that's forcing the BOJ to tread cautiously before making any additional currency moves and, as I said in another interview last week (hasn't aired yet), we're not expecting any real action from the BOJ until after the upcoming G7 meeting.

Without specific action to weaken the Yen, we can expect it to gather strength as money flows into Japan from other Asian markets, where their problems are even worse than Japan's 250% debt to GDP ratio. The Yen is 106.65 to the Dollar at the moment and most of Asia (and Europe) are closed for May Day holidays and Japan will be closed tomorrow through Thursday so don't expect big action until Friday when anything can happen.

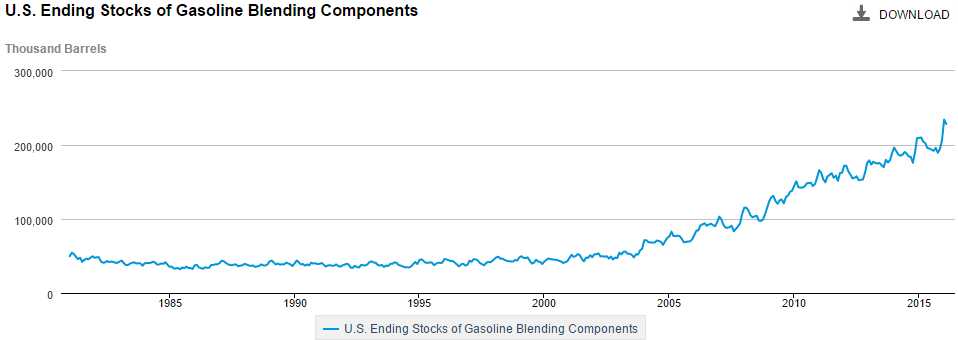

With our Fed staying cautious, our Government doesn't want Japan circumventing the Fed and strengthening the Dollar, which puts downward pressure on our stocks and commodities just when the oil lobby is getting gas back over $2 a gallon – the BOJ should know better than to go against the wishes of the US oil cartel, who have driven gasoline prices up 25% since February – despite the FACT that gasoline stockpiles are at new record highs – 10% higher than they were in February:

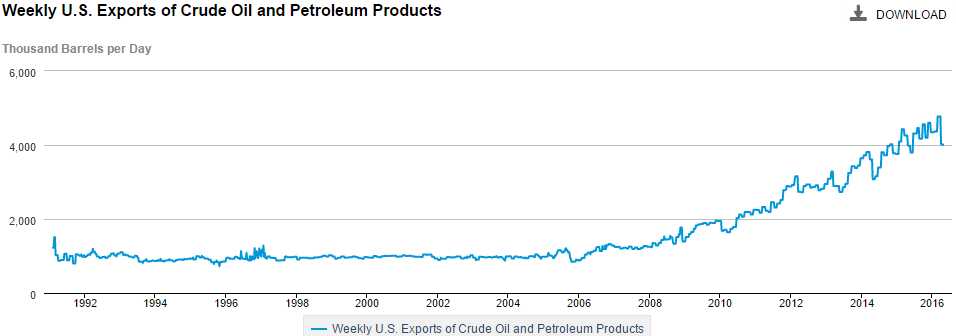

The less we use, the more we pay – IT'S AMAZING!!! A total scam is what it is with prices totally disconnected from supply and demand. Not only has our demand fallen off a cliff but 4M barrels a week of our demand (over 500,000 barrels a day) is also FAKE!!! because we are EXPORTING petroleum products to other countries (in addition to natural gas):

YOU pay more money at the pump, 0.50/gallon more than you did 3 months ago because YOU don't care enough to write to your Congressman and DEMAND action be taken to rein in the BLATANT manipulation of prices by the US Energy Cartel. Who is the US energy cartel? It's the same "7 Sisters" who have always dominated the oil industry, they just don't hold semi-annual meetings (well, not in public, anyway). The average car uses 750 gallons of gas per year so 0.50 per gallon is costing you $375 per car that's as much money as our entire Education Budget and a $120Bn boost in revenues to our beloved 7 Sisters Cartel (and their OPEC brothers).

Exxon (XOM) made $1.8Bn last quarter selling oil at an average price of $33.50 per barrel and gasoline averaged $1.15 at the retail level. As of Friday's close, we were over $1.60 – a 40% jump in prices in less than 3 months. Are we using 40% more gas? No, we're not using any more gas at all but we are exporting more to make it LOOK like there's been an increase in demand in the US.

The reason there's no demand increase is because new cars get an average of 35 miles per gallon and our current fleet has an average of 20 miles per gallon so, every day someone trades in a gas-guzzling clunker for a new car, their personal demand for gasoline drops 43% or, if they get an electric car, their personal consumption drops 100%!

The reason there's no demand increase is because new cars get an average of 35 miles per gallon and our current fleet has an average of 20 miles per gallon so, every day someone trades in a gas-guzzling clunker for a new car, their personal demand for gasoline drops 43% or, if they get an electric car, their personal consumption drops 100%!

Every month, 1M cars are sold and our population isn't growing so we don't have more drivers – just newer cars. It's a slow but steady effect that is grinding down gasoline usage and will continue to do so for another 15 years as we fully roll the fleet over until we're using half as much gasoline in the US (and other developed nations) as we did in 2005.

Next year, another 15M cars will be sold in the US that average 15 mpg more than the cars that are being traded in and that will take an average of 320 gallons per car less gas to drive, per car or about 7.6 barrels which, multiplied by 15M cars, is a very healthy 114M less barrels (2M/week) needed in the US next year than this year.

This is, of course, great for our environment and great for US consumers (who have more discretionary money to spend) but bad for the US energy cartel and there's a reason that Saudi Arabia is setting up a $2Tn fund to find other avenues for income besides oil – that party is almost over so don't get sucked into the energy sector just because oil is back over $45 – it may last the summer (we expect $50ish in July and bet accordingly when it was $30) but we'll be shorting again by August, looking for a spectacular fall!

OPEC can talk about production freezes all they want but that 2Mb week reduction in US usage flows over to almost 1Mb/d each year World-wide and that will more than offset any growth in demand from increasing population (1.1%) though a pickup in the economy will give us a temporary boost – that's the one the oil bulls are counting on into the summer – so we'll be keeping a close eye on that as well.

For now, we're not too enthusiastic in the middle of our range but we did use $46.50 for a shorting line on Friday. Speaking of oil, the Baker Huges (BHI)/Haliburton (HAL) deal is OFF and we have a lot of BHI but we are THRILLED to own the company as they collect their $3.5 BILLION break-up fee. Would anyone else like to make an offer? BHI is using $1.5Bn of that money to buy back 10% of their shares at this discounted price ($48.50) and our 2018 spreads are targeting $50 or more for some spectacular payouts (see Top Trade Alerts).

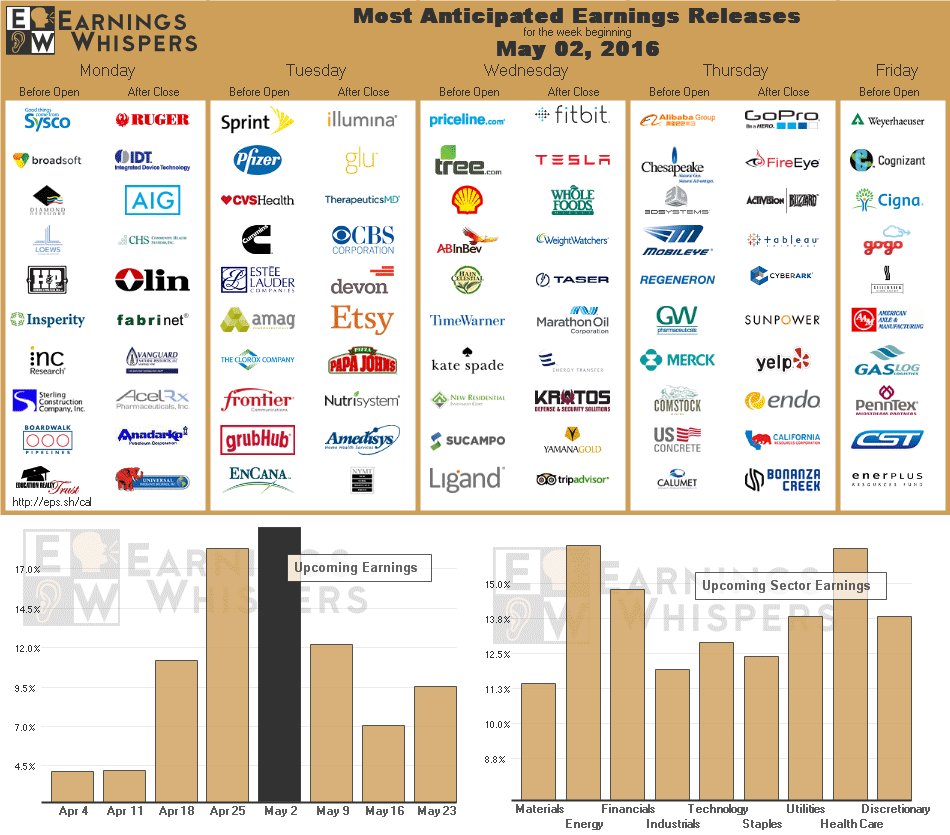

It's a very busy data week and we have 4 Fed Speakers and hundreds of earnings reports to wade through and then fireworks on Friday when Japan re-opens so get ready for a wild one!