By Ilene

Infinera Corporation (INFN) — an optical transport networking equipment, software and services company — experienced one of those brutal selloffs last week, with the stock falling from over $15 down to $12. For perspective, that's a 20% decline in market capitalization in response to a weak outlook for this quarter's revenue, which was reduced from expectations of $272 million to $250 – $260 million — a drop of around 6% at the midpoint.

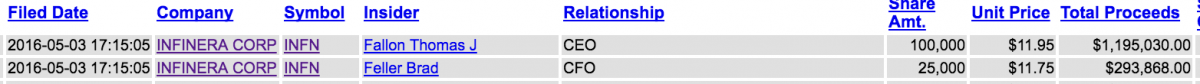

Yesterday, both the CEO and the CFO of the company bought significant numbers of shares (May 3). Their buys were filed after hours, and the stock gapped higher this morning from its close on Tuesday of $11.52 back to $12.02 today.

[From Insider Cow – type INFN in Insider Cow's search bar.]

The reason for the reduced revenue guidance: CEO Tom Fallon reported that a customer of Transmode (acquired last year) was holding off on purchases. Fallon noted,

“We picked up several new smaller customers but we have one significant Metro customer who has historically been part of the Transmode customer base, who hasn't bought for about two quarters and there's nothing, I don't believe, that's structural there around the relationship. We believe that there is a big opportunity for us in the next quarter or so. There is an opportunity that's been driven to them by one of their customers and I think they get back on track soon. Having said that, it's a big enough customer that it's a really tough to backfill that in the short term.”

Rick Neaton at Rivershore Investment Research (RIR), who covers this company, shared his analysis with me:

Excerpt from Rick:

Although INFN reported revenue at the midpoint of its guidance and EPS above analyst expectations, it spooked the after-hours markets with its guidance for 2Q-16 coupled with its reluctance to say that this issue is limited only to the current quarter.

“Net-net, while we are experiencing a convergence of local and macro issues, though we do not see as indicative of any longer-term trends, it is challenging to predict the timing of customer spending in our industry and to determine whether this is a one quarter dynamic or one that might persist further into 2016.” – Brad Feller, CFO, April 27, 2016

Most of the lower than expected revenue results from one customer of Transmode, the Swedish based metro equipment vendor that was acquired by INFN last fall.

[…]

Bottom Line: I still think that INFN will earn $0.82-0.85 non-GAAP EPS in 2016 even if the specific Transmode customer never returns. In that case, the company’s growth rate will be in high teens instead of mid-20% range. That still merits a 20X PE ratio or a $16.40 to 17.00 share price. Thus, I would be adding to my position on this weakness because I think the market has overreacted.

In PSW's comment sections, Phil writes:

INFN's an interesting one. Good price, too. They beat but had a weak outlook – if you don't buy stocks to make money EVERY quarter – it's a good time to buy.

A few analysts issued calls on Infinera after the earnings report:

- Citigroup downgraded to it Neutral from Buy and lowered its price target to $17 from $20.

- Goldman Sachs has a Neutral rating and lowered its price target to $15 from $16.

- Jefferies has a Buy rating and lowered its price target to $18 from $22.50.

- MKM downgraded to it to Neutral from Buy and lowered its price target from $21 to $15.

- Needham has a Buy rating and lowered its price target to $20 from $25.

- Northland Capital has an Outperform rating and lowered its target to $20 from $30.

- Stifel lowered its price target to $19 from $23.

Last year the stock was $18 and this year they are making more money on more revenues and it's $12 – investors are basically idiots.

The insider buying is significant — almost $1.2 million by the CEO and almost $300k by the CFO. Given how much the stock has fallen, even with today's move, I think INFN is a good value/speculation.

Infinera provides Intelligent Transport Networks, enabling carriers, cloud operators, governments and enterprises to scale network bandwidth, accelerate service innovation and simplify optical network operations. Infinera's end-to-end packet-optical portfolio is designed for long-haul, subsea, data center interconnect and metro applications. Infinera's unique large scale photonic integrated circuits enable innovative optical networking solutions for the most demanding networks (Infinera).

Rivershore Investment Research

RIR is an investing newsletter service that focuses on technology (mostly), equities markets, stocks, and the underlying macro and micro trends that affect companies' decisions and results. In technology, RIR currently focuses on the disruptive potential of Software Defined Networking and Network Function Virtualization. Rick began RIR in 2008.

Disclosure: Long INFN.

****

Note: Rivershore Investment Research is not a registered investment advisor, broker-dealer, or a research analyst/organization. Readers are advised that the commentary and reports on the rivershorecapital.com website and in its newsletters are issued solely for information purposes and should not to be construed as an offer to sell or the solicitation of an offer to buy any security. The opinions and analyses included herein are based from sources believed to be reliable and written in good faith, but no representation or warranty, expressed or implied is made as to their accuracy, completeness or correctness.