The Donald needs do-over. He took his passion for defaulting on debt a bit too far when he suggested that he could negotiate such a deal for the US.

[T]he United States is not a struggling casino. It's a sovereign nation with sovereign debt…

But the fact that Trump is proposing it shows that when it comes to macro-economics and global economics, Trump is a huge ignoramus who shouldn't be allowed anywhere near the Treasury. It's amazing suggestion. Not just stupid but someone who simply knows nothing about how the economy works. ~ Josh Marshall, TPM

Hearing Trump talk about economics gives one an instant understanding of why he has declared so many bankruptcies. ~ Andy Borowitz, Borowitz Report

Here is the GOP’s Presumptive Nominee on Negotiating Treasury Payments

Courtesy of Joshua Brown, The Reformed Broker

I’m not a Hillary fan and I voted for Romney last time, so don’t even think about pigeonholing me into a partisan / bias debate.

I’m not a Hillary fan and I voted for Romney last time, so don’t even think about pigeonholing me into a partisan / bias debate.

But I have to just point out, this is the mentality of the GOP’s presumptive nominee for the Presidency, on how he thinks about Treasury bonds, which are the bedrock of global capitalism and geopolitical stability in the Milky Way galaxy:

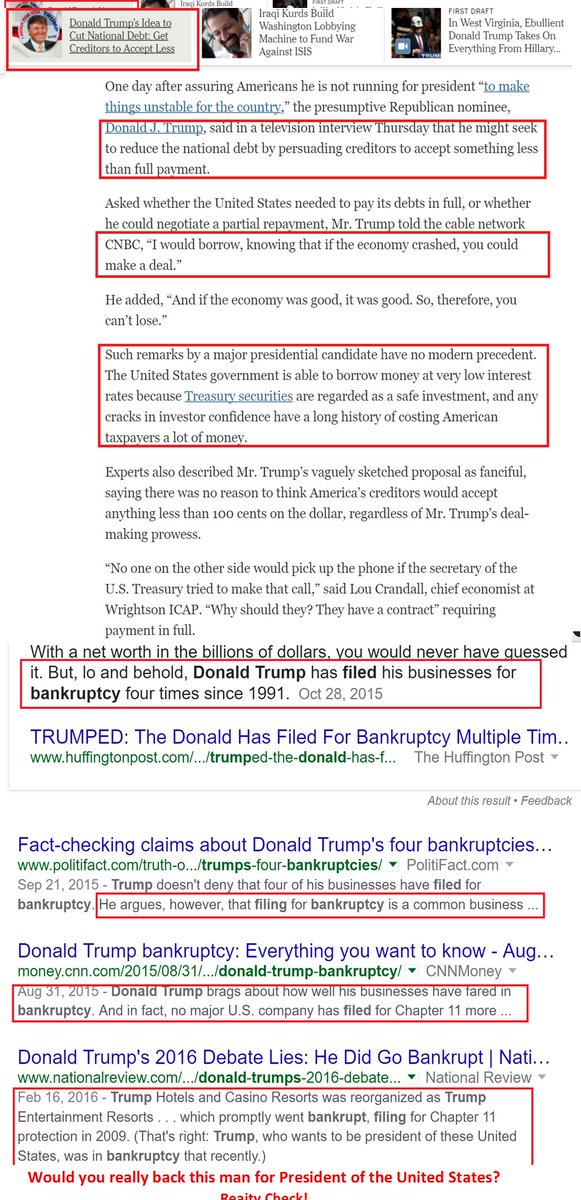

Asked whether the United States needed to pay its debts in full, or whether he could negotiate a partial repayment, Mr. Trump told the cable network CNBC, “I would borrow, knowing that if the economy crashed, you could make a deal.”

He added, “And if the economy was good, it was good. So, therefore, you can’t lose.”

If this doesn’t frighten you or bother you – regardless of your party affiliation – then you’re either an anarchist or an idiot.

The whole world runs on the premise that US debt is risk-free in terms of return of principal, backed up by our status as the world’s reserve currency and the enforcement of the US Navy, Army, Air Force and Marine Corps. You can mess with just about anything else you want, but you can’t mess with that. Ted Cruz tried in 2011 and we should have deported him on the spot. This is a no-go zone for dilettantes and ideologues.

Sorry, I just had to say it. Others will say much the same thing in a thousand articles that will be written today.

He thinks this is like an Atlantic City shakedown against Lehman Brothers or something. Or maybe he doesn’t. Maybe Jared and Ivanka will read the reactions and talk him off this ledge.

Fortunately, like almost everything Trump says about finance and economics, he probably doesn’t mean it and may say the opposite within 24 hours, depending on how he’s feeling or whom he’s speaking to.

Source:

Donald Trump’s Idea to Cut National Debt: Get Creditors to Accept Less (New York Times)

***

Donald Trump just threatened to cause an unprecedented global financial crisis

Excerpt:

In an interview Thursday on CNBC, Donald Trump broke with tired clichés about the evils of federal debt accumulation. "I am the king of debt," he said. "I love debt. I love playing with it."

But he replaced fearmongering about debt with an even more alarming notion — a bankruptcy of the United States federal government that would incinerate the world economy.

"I would borrow, knowing that if the economy crashed, you could make a deal," Trump said. "And if the economy was good, it was good. So therefore, you can't lose."

With his statement, Trump not only revealed a dangerous ignorance about the operation of the national monetary system and the global economic order, but also offered a brilliant case study in the profound risks of attempting to apply the logic of a private business enterprise to the task of running the United States of America.

[…]

What's especially troubling about Trump's proposal is that there is genuinely no conceivable circumstance under which this kind of default would be necessary. The debt of the federal government consists entirely of obligations to pay US dollars to various individuals and institutions. US dollars are, conveniently, something the US government can create instantly and in infinite quantities at any time.

Of course, it might be undesirable to finance debts by printing money rather than raising taxes or cutting spending. In particular, that kind of money printing could lead to inflation, and even though inflation is very low right now there's no guarantee that it will always be low.

***

Trump's Election Should Cause US CDS Spreads to Spike, and for Good Reason

By Reggie Middleton (originally posted at Zero Hedge)

Exceprted from the NY Times and a Google search.