Are we there yet?

Are we there yet?

Barron's doesn't think so but, this morning, the Chinese markets fell 12.5% in seconds, erasing 3 months of gains but immediately (same minute) recovered and finished the day up 2.5%, for a 15% intra-day swing. Overall, China's CSI 300 is down 16% for the year so, technically, not a bear market – yet.

Of course, we started the year 30% off the highs so, technically, it's totally STILL in a bear market. Interestingly, short interest on China's ETF (FXI) climbed to record highs last week – just ahead of this morning's test crash. Yes, I said test crash because that's what these "flash-crashes" tend to be – some program spiking the bottom to see where the real buyers are so they can set up their cascading sell orders for the month ahead.

I know – yawn! – China's a mess, Japan's a mess, Europe is toxic and perhaps about to fall apart, oil is barely holding $49.50 after the busiest driving week of the year… so what? We've had the same concerns for ages and we're STILL at 2,100 – testing the record high for the S&P 500. While that's true, couldn't you say the same thing about a car that's about to fall apart but making "record" mileage? You KNOW it will die one day – just maybe not today.

Check out the also record-high price to sales ratio on the S&P 500. Never before has so much money been paid for so little actual sales. We are now paying 20% more for Corporate Revenues than we did before the last collapse and about 130% over the historic average. That seems like a lot, doesn't it? Of course, never before have the books been manipulated to the extent they are today, with a record 58% of the S&P companies reporting non-GAAP numbers this year.

If you listen to analysts, Q2 earnings are the trough and Q3 and Q4 should be much better, which is good – because they can hardly get any worse, can they? Of course, now that we're done with Q1 earnings reports, we'll begin to get those crappy Q2 reports and that might sour investors moods – especially if we have more downward revisions as we close in on June's early reporters.

If you listen to analysts, Q2 earnings are the trough and Q3 and Q4 should be much better, which is good – because they can hardly get any worse, can they? Of course, now that we're done with Q1 earnings reports, we'll begin to get those crappy Q2 reports and that might sour investors moods – especially if we have more downward revisions as we close in on June's early reporters.

We'll be paying close attention to the data in the next couple of weeks but Abe/Koroda made a big move in Japan over the weekend – adding more stimulus and pushing back sales tax increases and, as we expected, it barely moved the Nikkei higher (17,250). We'd short the Nikkei but the Dollar is weak (95.60) and a stronger Dollar is good for /NKD – so we'll wait and see how the day goes.

More so than our local data, we have our eye on the Global Calendar this month as there is a lot of major action though we're not expecting any big change from the ECB, Fed or BOJ in their official announcements – especially as the BOJ just fired their other guns this weekend. Everyone is on pins and needles ahead of the Brexit vote on June 24th and we'll have to wait for the July meetings to clean up the aftermath of that disaster (either a disaster for the UK if they stay or a disaster for the EU if they leave).

More so than our local data, we have our eye on the Global Calendar this month as there is a lot of major action though we're not expecting any big change from the ECB, Fed or BOJ in their official announcements – especially as the BOJ just fired their other guns this weekend. Everyone is on pins and needles ahead of the Brexit vote on June 24th and we'll have to wait for the July meetings to clean up the aftermath of that disaster (either a disaster for the UK if they stay or a disaster for the EU if they leave).

Speaking of the Brexit, Project Fear took the weekend off and that was a mistake as the Brexit crowd (as we predicted) came roaring back in the polls and is now ahead as half of the undecideds have moved off the sidelines. This is always the tricky thing about running fear campaigns into an election – after a while, the people become bored with all your doom and gloom prognostications and you begin to sound downright silly as you try to up your game. This weekend there was an uproar as the Government sent out voting instructions that indicated that "Remain" was the correct box to check (no, not kidding).

I know we're talking about the Brexit a lot, but there's only 23 days left and, 20 years from now, when your children ask you what caused the Great Depression of 2016 – you'll need to know all about the Brexit and how how it led to the collapse of the European Union, the devaluation of the Euro, the meteoric rise of the Dollar and Gold at the same time and Global Financial Chaos – so pay attention!!!

With all that being said, of course, I still think the UK should leave as all that stuff will happen anyway (and HSBC's Michael Geoghegan agrees with me) – it's just a question of when. Someone has to be brave and rip the band-aid off so let the UK take the hit and, if they don't get an infection – then the next wounded country can pull away before it's too late and perhaps we can save some before the whole thing unravels – you never know.

Speaking of stuff happening anyway, poor Greece is begging for mercy as they simply cannot impement additional austerity measures demanded by the IMF in exchange for more bailout money. That money is needed to pay off loans that come due this month or we face yet another Greek default.

Speaking of stuff happening anyway, poor Greece is begging for mercy as they simply cannot impement additional austerity measures demanded by the IMF in exchange for more bailout money. That money is needed to pay off loans that come due this month or we face yet another Greek default.

To qualify for the rescue funds, Greece has so far approved pension reforms, tax hikes, the establishment of a privatization fund and a contingency mechanism for spending cuts to be activated if it seems set to miss fiscal targets. One lawmaker has resigned from Tsipras's Syriza party in protest over the measures, leaving Tsipras' party with a very narrow 153 of 300 parliamentary votes. Essentially, if 2 more votes cross over – the whole referendum blows up along with the Greek Government – that's what Tsiparas means when he says they can't go any farther but will the IMF and Brussels care? That's the $10Bn question…

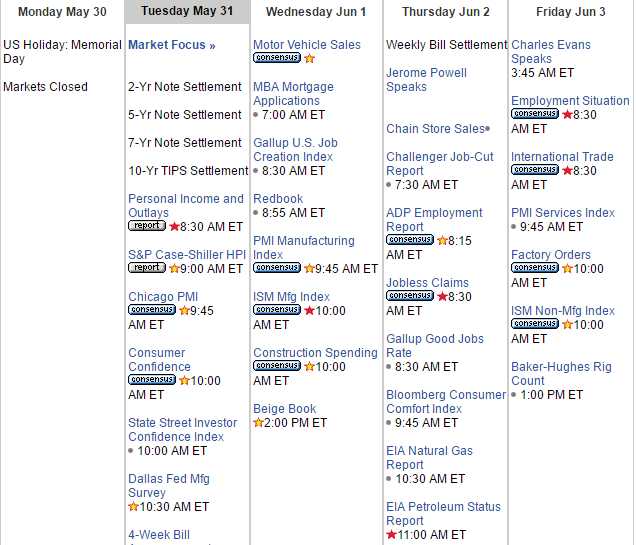

It's a very busy data week with very little Fed speak (3) but we have the Beige Book tomorrow afternoon (and we'll be doing our Live Trading Webinar at 1pm, EST – so tune in for the fun!) and a lot of good consumer reports. Already this morning we got a weaker than expected GDP Report from Canada (0.6%) but US Personal Income is up 0.4% and Consumer Spending is up 1% so yay more debt!

As long as interest rates remain cheap and consumers are willing to lever up their debt loads to support the economy – all shall be well but the Fed has said over and over again that party is coming to an end – it's just that no one believes them. They won't raise rates in the June meeting so we can keep up near the top all the way into July before the Fed pulls the plug but make sure you are well-hedged (see last week's posts) and have plenty of cash on the sidelines – just in case Barrons is wrong!