Positioning vs Construction

Courtesy of Joshua M Brown, The Reformed Broker

Were you “positioned” for Brexit?

Other than a handful of hedge funds and some wildly contrarian prop traders, who boldly fought the trend into Thursday’s close, the answer is probably not. Ironically, there are many global macro, long-short and event driven hedge funds, whose investors are counting on them to have gotten something like this right, that will be shown to have gravely miscalculated.

This is what happens when an event stuns the consensus – including stock markets, bond markets, economists, Wall Street banks, the IMF, governments around the world and even the betting markets. By Thursday evening EST, one outcome looked extremely probable – and then the exact opposite happened.

Who was positioned correctly? We’ll find out.

But the bigger question is whether or not it was terribly important to have been positioned correctly, outside of a sleeve within the hedge fund complex.

For most investors, portfolio construction is more important than portfolio positioning. This is because a retirement portfolio positioned for outrageous unexpected events will likely not be able to do its job over the long term, even if it gets an outlier right here or there.

A well constructed portfolio, on the other hand, is durable and ready for anything.

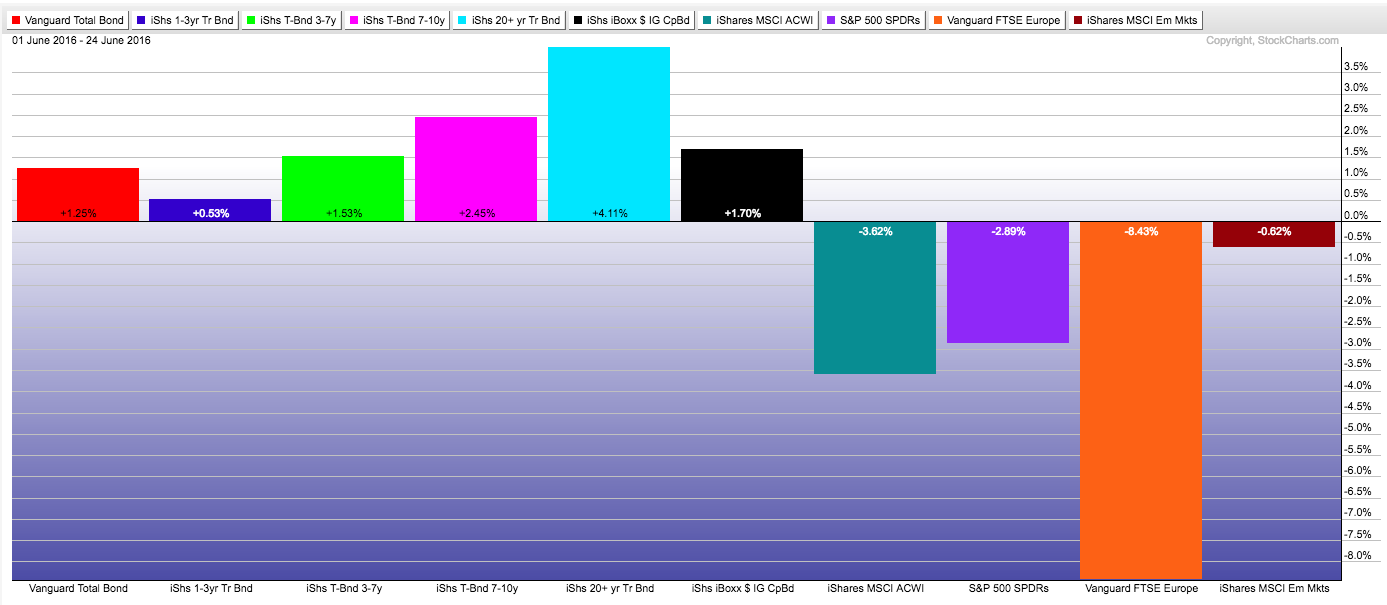

June has been a difficult month for those trying to position for Friday’s unlikely event. For those who focus on construction, however, it’s business as usual. Below, a glance as the types of asset classes (in ETF form) that make up a strategic asset allocation. You can see that, in the midst of recent volatility, everything is going more or less according to plan:

(click to embiggen!)

On the left side, fixed income ETFs, doing their job in offsetting the more volatile stock index products to the right. From the SHY (1-3 short-term Treasury bonds) to the LQD (investment-grade corporates) to the BND (total bond market), returns are positive over the course of the month. This is why traditional fixed income ought not to be abandoned at low rates, even though it seems that there is limited upside. The answer to that is always “in comparison to what?”

Even within the stock asset classes, you see quite a bit of dispersion between US large caps, global developed markets and emerging equities. This is as it should be. Friday was traumatic for all stocks around the world, but to varying degrees. The action this week will possibly prove to be every bit as varied and wild, but for the investor who is still building up their savings, adding to retirement accounts and generally in a position to accumulate assets, it’s a bonanza. The younger one is, the more one should be rooting for more of the same. Expected returns rise when values fall.

The question of positioning vs construction largely centers around what one does for a living.

The 2-and-20 set better have gotten this right (or at least, have gotten somewhat out of the way). The regular saver and investor, who builds software programs or runs a medical practice or teaches criminal justice at a University or has one of a million other occupations in America, ought not worry much about positioning at all. Construction is a more practical thing to be concerned about.

How’s yours?