I think we should at least get to our strong bounce lines (more on that later) but, for the moment, our 5% Rule™ warns us that, after a 5% drop, we EXPECT a 1% bounce (weak) and we're not impressed until we spend a full day above a 2% bounce (strong). In Europe, where they dropped 10% in two days, +2% is a weak bounce and +4% would be strong – we're only at our weak bounces folks – don't get excited…

Friday is the last trading day of the quarter so we can expect a lot of window-dressing and I would be much more concerned about a quick return to our highs – especially on low-volume, pre-market BS like we have today (see morning tweet) than if we grind along at the -5% line and form a serious base we can build off. On the whole, this wasn't much of a correction – it didn't even trigger our long-term hedges — yet.

Wednesday's Russell Ultra-Short ETF (TZA) hedge was only $1 yesterday morning but finished the day at $2.05 – up 105% for the day on the 3.3% drop in the Russell and THAT is how we hedge! 30 contracts purchased for $2,550 (0.85/option, $85 per contract) ended the day at $6,300 for a $3,750 (147%) gain but it will be easy come, easy go this morning as much of that is given back and we didn't take them off the table yet.

A hedge is there to prevent us from losing money on our long positions – it's insurance, not a bet – don't confuse the two! If the market went lower, the hedge could pay up to $12,450 to offset our losses but, as it was, we haven't really needed the offset so far and our portfolios have weathered the storm with hardly a scratch.

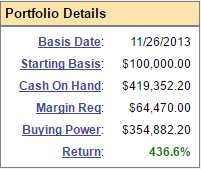

While our 100% bullish Long-Term Portfolio dropped back to $959,805 (up 92%) yesterday, our Short-Term Portfolio (where the hedges are) blasted up to $536,627 (up 436%) for $1.496M, up almost $900,000 (150%) from our $600,000 start for our paired portfolios.

While our 100% bullish Long-Term Portfolio dropped back to $959,805 (up 92%) yesterday, our Short-Term Portfolio (where the hedges are) blasted up to $536,627 (up 436%) for $1.496M, up almost $900,000 (150%) from our $600,000 start for our paired portfolios.

The reason the STP has done so well is because we often change our hedges into bets when we feel the market is done correcting to the downside. We do this buy buying back some or all of our short calls in the bull call spreads we like to take on the ultra-short index ETFs and, of course, we also place the occasional directional bet on the market. This is NOT one of those times.

As you can see from the summary, we are 78% in CASH and, if it were up to me, we'd be 100% in cash and, frankly, cash would have been a great position as the Dollar has popped 3% since we mostly cashed out June 8th. When I say it's not up to me, I mean because it's my job to run a trading education site and sitting around in cash isn't very educational so, at times like these, we teach the very valuable tool of learning how to BALANCE your portfolio – so you can ride out these uncertain times with ease.

We did play for a bounce today – because we hit our bounce lines yesterday – and our primary play (as noted yesterday morning) was Oil (/CL Futures) and Gasoline (/RB Futures) based on the very simple logic that the UK voting to leave the EU over the next two years wasn't likely to affect the demand for gasoline in the US over the July 4th weekend in 5 days. Again, Fundamental trading is not a hard thing to do – we read the news, think and trade – just 3 steps!

Our long line in yesterday's post (and, if you don't want to miss them, just subscribe here) for Gasoline Futures (/RB) was $1.51 and $46.50 for Oil (/CL). As you can see from the chart below, it was a rough ride in the morning (which is why we use tight stops when our line fails) but very, very rewarding by the afternoon with gains (so far) of $1,100 per contract.

As I often remind our Members: I can only tell you what the market is going to do and how to make money trading it – the rest is up to you!

As I often remind our Members: I can only tell you what the market is going to do and how to make money trading it – the rest is up to you!

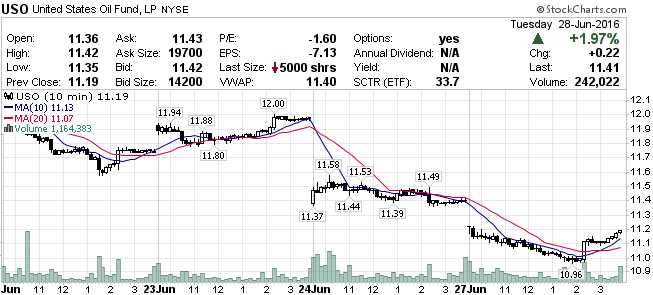

Futures trading is not complicated and you shouldn't be afraid of it, the hardest thing to master is overcoming your fear and developing a solid discipline of taking those quick losses and waiting for the next good opportunity to enter at a support line. By the way, you can also play the longs with index ETFs like USO or UCO and you can use options on those ETFs for leverage that gets you similar returns to the Futures but the Futures are very liquid and cheaper to trade – so they have less friction as we jump in and out of positions.

If you were in USO, for example, you wouldn't take a loss because oil moved down 0.10 below your entry (0.2%) but, on the Futures, that's a $100 loss per contract so we take it off the table and wait to play the next time we cross over the $46.50 line and that would put us at $350 – $100 + $250 + $1,100 (so far) for a net $1,600 gain on the 4 trades. There's no reason to ride out losses in the Futures – there's always something else to trade – something I demonstrate live in our Weekly Webinars (tomorrow, 1pm, EST).

If you were in USO, for example, you wouldn't take a loss because oil moved down 0.10 below your entry (0.2%) but, on the Futures, that's a $100 loss per contract so we take it off the table and wait to play the next time we cross over the $46.50 line and that would put us at $350 – $100 + $250 + $1,100 (so far) for a net $1,600 gain on the 4 trades. There's no reason to ride out losses in the Futures – there's always something else to trade – something I demonstrate live in our Weekly Webinars (tomorrow, 1pm, EST).

Tempting though today may be – we're just going to review our Watch List and begin to roll it into a Buy List – the first one we've had in quite a while. After the End of Qtr/Holiday Weekend we have Q2 earnings so I'm not in the least bit worried that we won't be able to find lots of bargains to put our cash into if we sit out the rest of the week.

Beware the dead cat!