Wheeeeee – what a ride!

Looking at the Euro Stoxx 50 index, you can understand why the UK got off this sinking ship. 2,800 WAS the -20% line from 3,500 and that just failed so we're way past a bear market in EU stocks and it has little to do with the aftermath of Brexit and everything to do with what led up to Brexit in the first place.

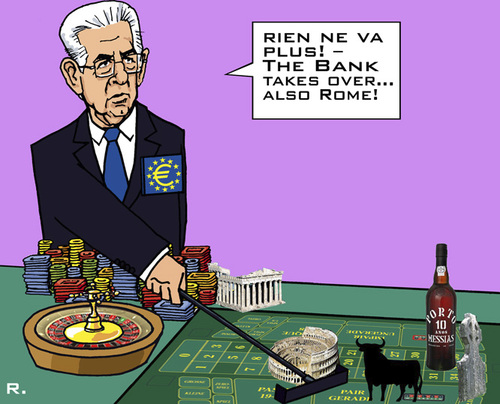

The EU destroyed Greece and now (as I predicted 2 years ago), Italy is next in the crosshairs and though Portugal and Spain are way ahead of the UK in line, what can you do to stop the ECB and their nightmarish policies if you remain tied to them through the EU?

The EU is killing Italy – it's killing all of them. While Italy is a taker state and benefits from the relationship, they have now hit the cut-off point (like Greece) and suddenly Big Daddy EU starts slapping them around and taking disciplinary actions and it's no fun anymore.

The EU is killing Italy – it's killing all of them. While Italy is a taker state and benefits from the relationship, they have now hit the cut-off point (like Greece) and suddenly Big Daddy EU starts slapping them around and taking disciplinary actions and it's no fun anymore.

- ECB asks Italy's Monte dei Paschi to slash bad loans

- Italian banks under pressure as political crisis looms

BMPS (Monte Paschi) is down 75% to 0.37 and it's the 3rd largest bank in Italy. Rather than realize the systemic importance of the bank (it is to Italy but to the ECBs board, it's competition), they are demanding BMPS cut $11Bn in bad loans which is another way to say – book the losses. Obviously, that will crush the bank and the ECB has generously given them until Friday. UCG (UniCredit) is the largest bank and they are down 63% and 2nd largest, ISP (Intesa Sanpaolo) are testing the -50% line.

Italian banks have $400Bn in non-performing loans, which is 20% of their GDP, that would be like our banks having $4Tn worth of bad debt that needs to be bailed out (been there, done that). Negative rates (set by the ECB) means they have no way of generating money so it won't be surprising if one or more of these banks goes under BECAUSE of the ECB's actions. I very much doubt that Italy has $400Bn to pay back BMPS depositors if they fail – I wonder how happy that will make Italians with their EU relationship?

Speaking of 20%, 2,400 is 20% of 12,000 and if we subtract 2,400 from 12,000 we get 9,600 and that's the line that just failed on Germany's DAX – and they are supposed to be the "good" economy in Europe!

There's nothing "strong" about this weekly chart – it's a bouncing ball that's running out of kinetic energy and likely to flat-line at 9,000 – or perhaps we're consolidating for another move down? In the bigger (monthly) picture, we can see that the DAX was jacked up from 4,000 to 12,000 on all sorts of artificial stimulus since 2009 but how much of that is a real economic recovery and how much of that is only as good as their next fix of easy money?

Over that same time period the Euro has lost over 25% of it's value and the DAX is priced in Euros so they are actually much worse off than they were – as are the retirement dreams of the EU citizenry – is it really any wonder why the UK abandoned ship?

8,000 was the top in 2000 and 8,000 was the top in 2008 and now it's 2016 and we have some delusion that these companies deserved 50% higher valuations than they had 8 years ago? Based on what? That's why the "buy the dip" crowd is wrong – it's not a dip, it's a correction – as in "We are now heading back to the CORRECT pricing for stocks."

People are overpaying for stocks because the return on bonds has been so dreadful but rates are only part of the story. If you invested in the bond ETF (TLT), for example, you gained about 16% this year, plus your crappy 2.4% interest (paid as a monthly 0.25 dividend in the ETF). That's still a hell of a lot better than market returns have been this year, right?

Not only did the value of your long bonds go up 16% this year but the Dollars they are priced in are starting to rise and that can add an additional boost to the bond value – especially for overseas investors in Europe, whose currencies are slipping by the day. The same goes for Japanese bonds, which pay -1% but the Yen they are priced in have gained 10% in the past 30 days – that's an annualized 120% return on Japanese bonds!

We're short TLT at the moment as we think it's too far, too fast and the Yen will almost certainly be rejected at 100, but over it this morning so we'll see. In fact, in anticipation of BOJ action, we like /NKD long at 15,250 (tight stops below) and we'll be making an options play on the Japan ETF (EWJ) which is hopefully bottoming at $11.40.

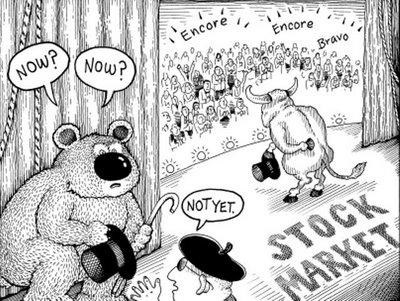

Meanwhile, this is a great test to answer the weekend question "Are we too bullish" from our July Portfolio Review. We THINK we are leaning bearish but it's tricky to balance our positions in such a crazy market so we'll be keeping count to see if we're hedged enough.

- Our Short-Term Portfolio (STP) finished Friday at $506,007 and yesterday at $511,262 so up $5,255 as the S&P dropped 1%.

- Our Long-Term Portfolio (LTP) finished Friday at $1,015,101 and yesterday at $1,007,649, down $7,452.

That's not quite perfectly balanced in our paired portfolios but we have to take into account that our hedges don't kick in right away – certainly not for a 1% dip but certainly, if 2,035 fails on the S&P, we'll want to get a bit more bearish. I already sent out a Top Trade Alert to our Members yesterday for a new SDS hedge – if you are not bearish enough, this can save your summer!

That's not quite perfectly balanced in our paired portfolios but we have to take into account that our hedges don't kick in right away – certainly not for a 1% dip but certainly, if 2,035 fails on the S&P, we'll want to get a bit more bearish. I already sent out a Top Trade Alert to our Members yesterday for a new SDS hedge – if you are not bearish enough, this can save your summer!

- Our Options Opportunity Portfolio (OOP) finished Friday at $167,677 and yesterday at $162,517, down $5,160. That one needs another hedge if the weakness continues though it's mostly our TLT short and WSM got hit hard yesterday as well (big one for us).

- Our Butterfly Portfolio finished Friday at $268,662 and yesterday at $263,865, which is also down $5,000(ish) but this portfolio doesn't use hedges, per se, and relies on bets on both sides over time so we're used to these fluctuations and we'll make our normal adjustments next week at expiration.

We'd be more bearish but, so far, the Central Banksters have saved the markets every time they tried to have an honest correction. Maybe this time will be different but let's not bet on that! We're happy to be in a fairly neutral position while we wait and see where the action takes us.

Our 3 small portfolios each began with $100,000 so up over 150% is really not a place to start panicking while our LTP is more than a double from it's $500,000 start and we want to lock that double down, but we're not going to over-hedge out of fear – we need evidence!

Speaking of evidence, like trickle-down economics, the EU is clearly a failed experiment – why do we begin these experiments and, when the results come back negative, instead of chalking it up to experience and moving on, our leaders tend to double down – using OUR MONEY to take the risks! When are we going to wise up and stop the madness?