Incredible!

Incredible!

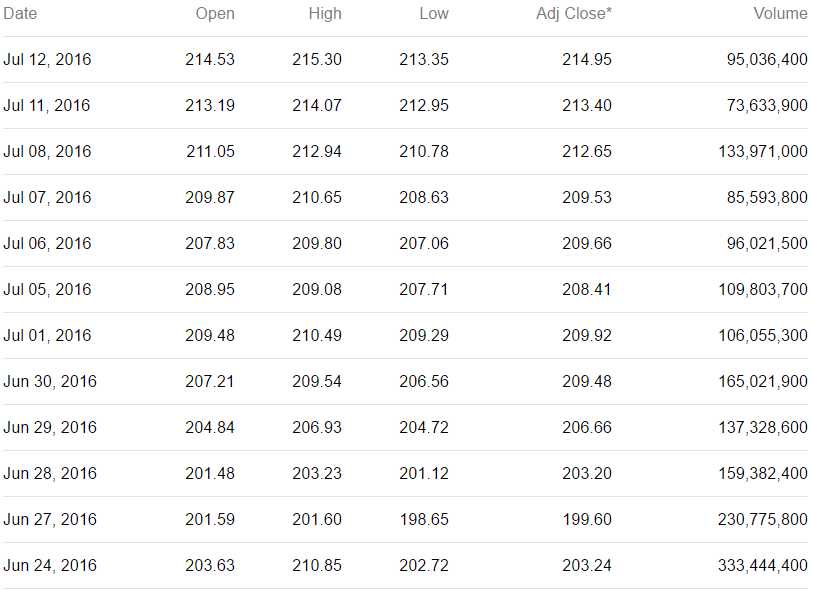

As in, not credible, especially when you take into account the not very credible volume counts on SPY this week, with just 73M shares on Monday and 95M shares yesterday compared to 333M shares traded on the way down 2 weeks earlier. Come on people, where's your enthusiasm?

That's the problem, of course, PEOPLE are not buying stocks, Fund Managers (arguably, not people) are not buying stocks, even HFT trading programs are sitting this one out. No, it turns out the only idiots buying stocks at these record-high levels while ignoring all that is wrong in the global economy is, you guessed it – Central Banksters!

While Investors are bailing out of equity funds at a pace not seen since 2008, the retail suckers are being herded in to hold the bags by the Central Banksters, who, along with the MSM are, of course, owned by the Top 1% – the people who are selling their equities at record highs.

While Investors are bailing out of equity funds at a pace not seen since 2008, the retail suckers are being herded in to hold the bags by the Central Banksters, who, along with the MSM are, of course, owned by the Top 1% – the people who are selling their equities at record highs.

Investors have pulled the equivalent of $133 billion from global equity funds so far this year, according to a weekly fund flows report from Bank of America Merrill Lynch released Friday. Of that nearly $80 billion has been pulled from U.S. equity funds.

None of that matters, of course as our beloved Central Banksters have purchased (on our behalf because we're on the hook for any losses) $600Bn in assets, at least 20% of which is, you guessed it – equities! That's why we get these wild end of day rallies – the Fed doesn't buy like a human, they don't care what the price is – they decide to buy $2Bn worth of stocks at the end of the day and then they barrel into the markets, spending like drunken sailors with one day of shore leave. Only they do it every day!

In 2016 alone, the ECB and BOJ, alone, have bought $500Bn of assets. China is not even on this chart so figure another $200Bn for them and now we're hearing the BOJ wants to do more along with the BOE and maybe even the Fed and China, for their part, are now going to allow $300Bn in pension funds to play the markets – what could possibly go wrong?

Well, plenty, of course. This isn't the first time the S&P has been up this high – only last time we were at 2,134 we had spent most of a year building a base while this run, from 1,850 to 2,150 (16%) is just 5 months old with the last 120 points taking just 2 weeks.

Using a standard Fibonacci series in conjunction with our 5% Rule™, we can see a similar move in October of 2014 ran into resistance that was not futile right about the 62% line (2,150 on the current index) and very quickly gave back about 1/3 of the gains before testing the 50 dma, which was 1,980 then and is now 2,040 – 60 points higher. Now, look at where we topped out last time – 2,090 and look where we are now – 2,150 – that's 60 points higher too.

We did a good job calling the bottom on 10/14/14 with "Testy Tuesday – 10% and/or Bust!" and, just a week before, I had warned on the 6th "Market Mayhem – 12 Fed Speeches in 5 Days Causes Chaos" and this week we have 13! Draghi promised more free money, Yellen spoke about "the durability of the US economic expansion", Jim Bullard flipped doveish, and, by the end of October, the BOJ and Sweden had both added more free money into the mix.

That's how we set up for a run to 2,150 last time and here we are again on more rumors of more free money oh, and by the way, we ended up back at 1,850 the following August – not really the market for long-term investing. Maybe this time is different but it will take more than a couple of low-volume moves up to convince us of that.

That's how we set up for a run to 2,150 last time and here we are again on more rumors of more free money oh, and by the way, we ended up back at 1,850 the following August – not really the market for long-term investing. Maybe this time is different but it will take more than a couple of low-volume moves up to convince us of that.

As you can see from the chart on the right, aside from the Fed buying stocks like they are rare Pokemon cards, you have companies spending $161Bn just last quarter buying their own stocks back. If we figure the average has been just 130M per quarter since October, 2014, we're talking about 7 quarters and $910Bn worth of stock taken out of the S&P, which has a total market cap of about $20Tn, so 5% of the index has been bought back since last time we visited 2,150 and that means the top is now 2,257.50, a bit past our 20% line.

This stock buyback nonsense isn't stopping. Companies have authorized $357Bn in buybacks for 2016 and more could be announced this month as they report their earnings (which will all SEEM better as they are being divided by less shares). In addition to the buybacks, an uptick in M&A activity is another way to reduce the overall available share count as one company absorbing another is pretty much a huge buyback for the acquired company.

So take it with a huge grain of salt when people try to tell you that the p/e of the S&P is under control – it's not at all. When looking at those earnings reports, make sure your company is earning more actual dollars than it did last year, not just that the dollars they did earn are now being divided by a smaller number of shares.

Gilead (GILD), for example, bought $8Bn of their own stock back last quarter, that's 7% of their $115Bn market cap. We are long GILD and I do think they are way undervalued but let's be careful about their report as their net income in Q1 '15 was $4.333Bn and in Q1 '16 it was $3.567Bn (down 17.7%). However, on an EPS basis, because they bought back so many shares, they only dipped from $2.76 to $2.64 per share (4.3%) – how's that for a magic trick?

So earnings were down 17.7% when measured in actual Dollars earned but the "good" news is, facing declining profits, the company bought back $28,000,000 (24%) of their own stock in the intervening period so that they can flash a near-miss on EPS. This is a scam folks – the company now has less in the bank ($3Bn less cash and $11.5Bn more debt) than they had before and they are earning less money on flat revenues.

As I said, we went long on GILD around $80 because they do make $2.64 per share and we think there's an upside and, after buying back 24% of their stock, they're practically a private company now! We can play the game and complain about it at the same time, so expect a lot of that as we dive into more and more earnings reports.

This is the kind of BS that is driving the S&P and the rest of the markets – just a gigantic game of financial engineering fueled by an endless supply of cheap money pumped out by the Central Banks, who don't ask any questions when they line up to buy these stocks for themselves (on your behalf).

Caveat Emptor!