In November of 1863, Lincoln said that:

In November of 1863, Lincoln said that:

"The government of the people, by the people, for the people… Oh, not you. Or you, or you, or you, or you, maybe that guy with the nice hat, no, not you, or you, not you either, maybe you…"

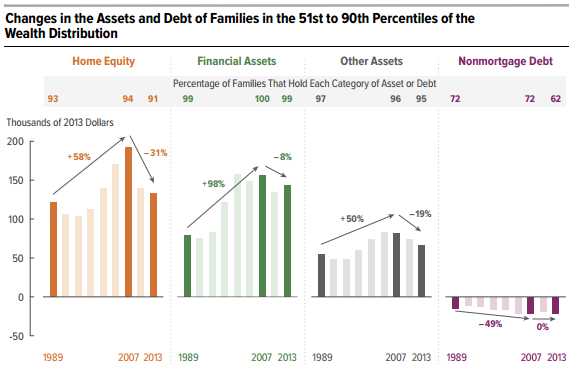

They edited some of that out but clearly our first Republican President's (back when Republican meant a rejection of the aristocricy, not the worship of it) selectivity was taken to heart as the wealth of the top 10% has more than doubled in the last 30 years while the rest are, of course, flat or down (because where do you think they took the wealth from?). The above chart is from the CBO's Report to Congress and, of course, our Republican Congress will take it as a sign of success, not failure.

Here's a lovely chart that highlights what's been happening to the Middle Class since the Reagan Years – the only thing shocking about this is the fact that people aren't rioting:

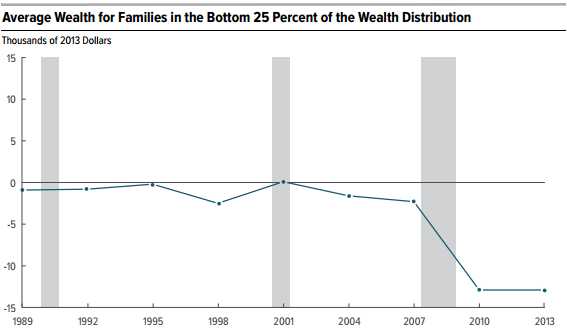

And how have things been going for our nation's 75M poorest citizens?

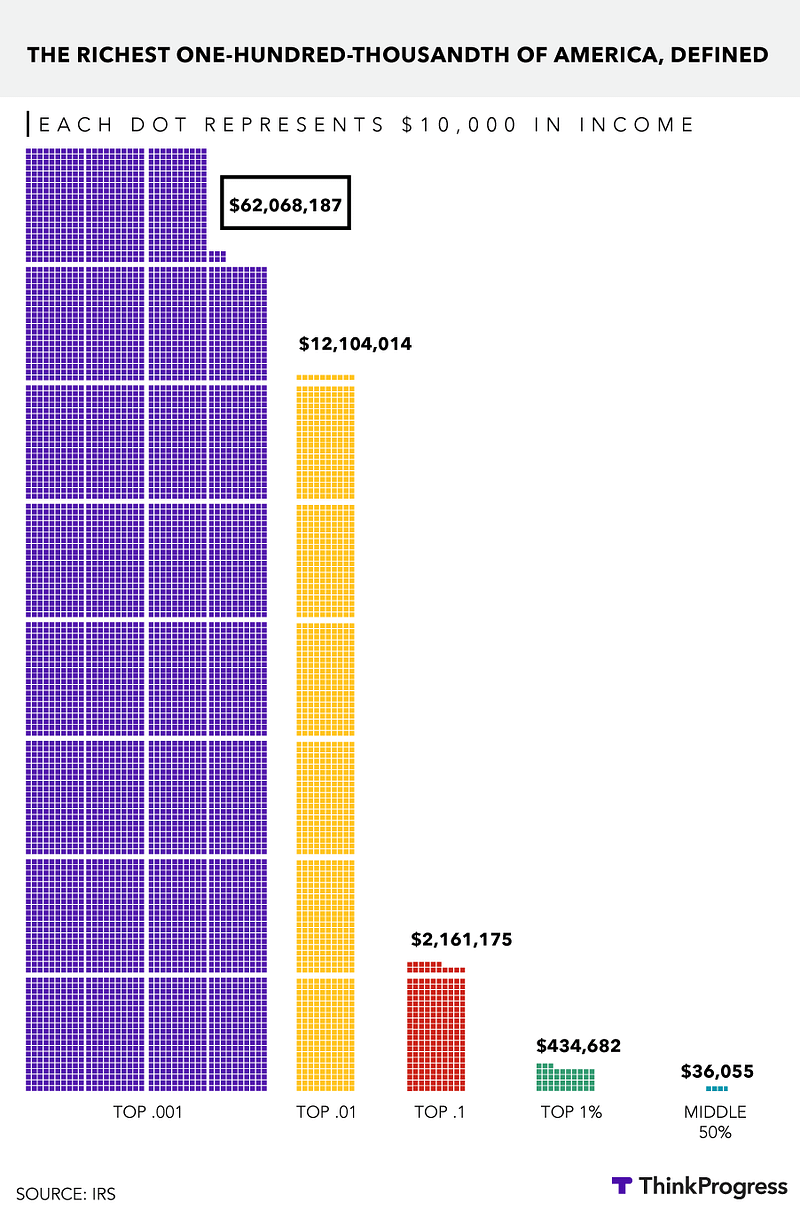

They went from ZERO to -$13,000 as we cut back on aid. That's $390Bn we took from 30M families to transfer up to the Top 1% (and the CBO, ordered by Congress, is not allowed to break down groups smaller than 10% or these charts would seem really outrageous). Fortunately, Think Progress was able to break things down a bit further on the income side and made this chart to illustrate how much money the Top 1% (30M Americans) and the Top 0.001% (30,000):

And yes, of course their net effective tax rate is higher so they contribute more. The average person who makes over $62M per year paid 17% of their income in taxes while those welfare queens making $36,000 paid just 14% – it is indeed an outrage because 17% of $62M is $10.5M leaving them with only $51.5M to spend for the year while 14% of $36,000 is just $5,000 – why even bother collecting it?

And yes, of course their net effective tax rate is higher so they contribute more. The average person who makes over $62M per year paid 17% of their income in taxes while those welfare queens making $36,000 paid just 14% – it is indeed an outrage because 17% of $62M is $10.5M leaving them with only $51.5M to spend for the year while 14% of $36,000 is just $5,000 – why even bother collecting it?

Why indeed? $62M is $170,000 per day so, in an 8-hour day that's about $20,000 per hour so $5,000 is 15 minutes work for a Top 0.001%'er. Still, if they didn't put the screws to the people who make in a year less than they make in a day, then they'd have less than $50M a year to live on and THAT would be an outrage because clearly they are worth at least 365 times more than an ordinary person and luck or birth had nothing to do with it at all.

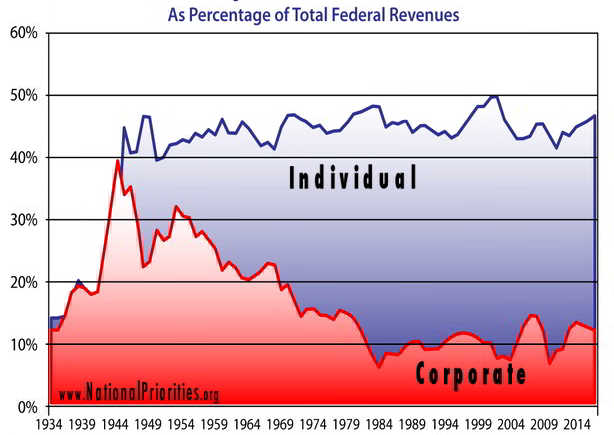

And all of this – all of it, is just a distraction because CORPORATIONS pay far, far less taxes than the wealthy people who own them. As you can see from the chart on the left, individuals and corporations once paid the same amount of taxes but corporations had much better lobbyists and now they pay 1/4 of what individuals pay and THAT is why we have to take $5,000 from people who certainly can't afford it.

And all of this – all of it, is just a distraction because CORPORATIONS pay far, far less taxes than the wealthy people who own them. As you can see from the chart on the left, individuals and corporations once paid the same amount of taxes but corporations had much better lobbyists and now they pay 1/4 of what individuals pay and THAT is why we have to take $5,000 from people who certainly can't afford it.

40 years of corporate tax avoidance are ENTIRELY responsible for our national debt. Just $500Bn (10%) more per year for 40 years would have been $20 TRILLION DOLLARS – not even including the interest gained and not even including the fact that we would never have had to pay Trillions of Dollars of interest on our debt because we wouldn't have had any debts in the first place!

Today the European Union is rightfully demanding that Apple (AAPL) pay them $14Bn in back taxes, going over Ireland's head and imperiling many favorable tax strategies employed by US Corporations to avoid paying both foreign and US taxes.

Today the European Union is rightfully demanding that Apple (AAPL) pay them $14Bn in back taxes, going over Ireland's head and imperiling many favorable tax strategies employed by US Corporations to avoid paying both foreign and US taxes.

When they don't pay these taxes, they are sticking YOU with the bill because, somehow, some way, the Government needs to collect revenues and if they can't get it from Corporations – they'll get if from you.

While this will barely effect Apple's stock as their total cash pile is well over $200Bn, it's surprising that the S&P isn't moving down as this is the beginning of a turning tide because the Governments realize that the people have nothing more to give (well, the bottom 90%, anyway) but the Corporations are giving far too little – not even the very little they are required to by law.

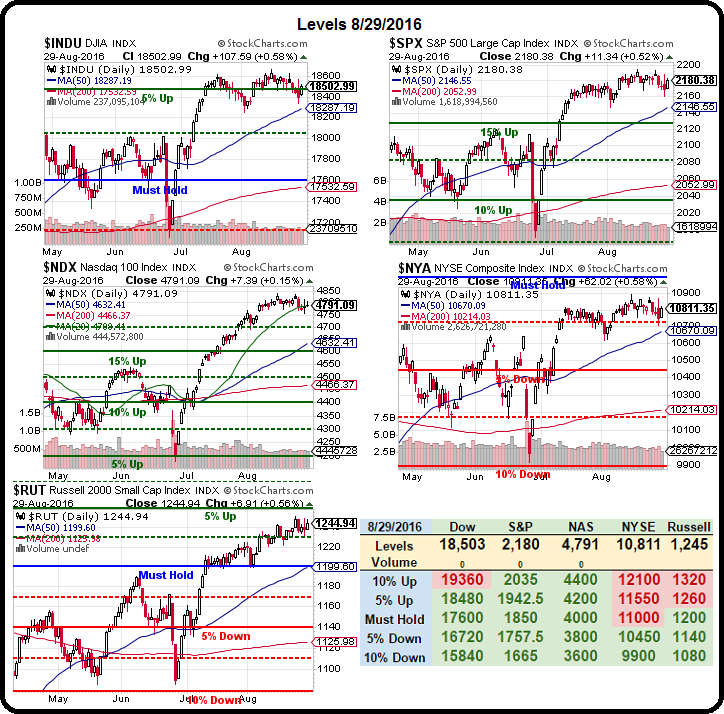

Yet another reason we feel the market is overvalued as we're in a time of peak tax avoidance and that's just another market cycle that will likely correct over time. We're back at the same shorting spots we liked last week: Dow (/YM) 18,500, S&P (/ES) 2,180, Nasdaq (/NQ) 4,800, Russell (/TF) 1,245 and Nikkei (/NKD) 16,850. Our system is to wait for 3 of 5 to go under and then short the next one to cross, stopping out if ANY of them cross back over the lines – that limits our losses but allows our gains to run.