Wheeeee – we love a good sell-off.

Especially when we're expecting it, right? Last week, in our September Portfolio Review, we suggested a new hedge to prepare for the coming sell-off. It was a more aggressive hedge than we usually take because our sense of doom was growing stronger and we didn't feel we had enough protection for our Long-Term Portfolio. The hedging play was:

- Buy 50 (more) TZA Jan $30 calls for $3.15 ($15,750)

- Sell 50 (more) TZA Jan $40 calls for $1.70 ($8,500)

- Sell 5 TSLA Jan $250 calls for $4.70 ($2,350)

- Sell 5 AMZN Jan $900 calls for $8 ($4,000)

It says 50 more because we already have the spread. The net cost of our addition was just $900 in cash plus the margin on the short calls and the position pays back, if the ultra-short Russell ETF (TZA) is over $40 in January, $50,000 back for a $49,100 profit.

It says 50 more because we already have the spread. The net cost of our addition was just $900 in cash plus the margin on the short calls and the position pays back, if the ultra-short Russell ETF (TZA) is over $40 in January, $50,000 back for a $49,100 profit.

Of course, you don't have to wait until January to make some good money on hedges. After just a single day's sell-off, already the Amazon (AMZN) Jan $900 short calls have fallen to $6.40 ($3,200) and the Tesla (TSAL) Jan $250 short calls are down to $2.60 ($1,300) while the TZA Jan $30 long calls have jumped to $3.85 ($19,250) and the TZA Jan $40 long calls are now $2.15 ($10,750) for a current net of $4,000, which is already up $3,100 (344% on cash) in just one week.

That's how hedges are supposed to work. How it works and why it works would be the subject of a whole book but it's the core strategy that we teach our Members at Philstockworld, which we call: "Being the House – NOT the Gambler." Keep in mind that's "only" $3,100 gained out of a $49,100 potential so it's still a good hedge for the next $46,000 to be gained – you only missed the first 344%!

That's how hedges are supposed to work. How it works and why it works would be the subject of a whole book but it's the core strategy that we teach our Members at Philstockworld, which we call: "Being the House – NOT the Gambler." Keep in mind that's "only" $3,100 gained out of a $49,100 potential so it's still a good hedge for the next $46,000 to be gained – you only missed the first 344%!

The key to a good hedge is protecting yourself against the thing you fear most and offsetting it with the thing you fear least. In the above example, we fear a 10% market correction which would punch TZA (a 3x ultra-short) up 30% and we offset the cost of that hedge by selling calls against two stocks (AMZN and TSLA) that we're inclined to short anyway – so we're not too worried they'll jump 20% and hurt our positions.

Still, that's aggressive and we only do that when we're highly confident that we're making a market top. Usually, we offset our hedges with a bullish play, so we can't get hit too hard if we're wrong. For example, as a fresh hedge, we like:

- Buy 50 S&P Ultra-Short (SDS) Jan $16 calls for $1.75 ($8,750)

- Sell 50 SDS Jan $19 calls for 0.85 ($4,250)

- Sell 5 Gilead (GILD) 2018 $60 puts for $4.10 ($2,050)

- Sell 5 Apple (AAPL) 2018 80 puts for $4.40 ($2,100)

That set comes out to net $350 and the upside, if SDS hits $19, would be $14,650 and SDS was almost at $20 on the June (Brexit) sell-off. Notice you can JUST take the SDS bull call spread and that would give you $15,000 worth of protection for $4,500 and the nice thing about this spread is it's already $5,000 in the money so the only way you can lose is if SDS goes lower which means the S&P would be higher and your portfolio is safe, so it's a great spread to slap on to stop the bleeding if you are inadequately covered.

As to Apple and Gilead – those are both stocks we'd LOVE to own if they got cheaper and AAPL is currently at $103 so it would have to fall 22% before it hits our buy price – otherwise we just keep the money we sold the puts for. Gilead is now $78 and that makes $60 23% away and, frankly, if you are worried the whole market is going down 23%, then you can just buy the SDS calls as they would be at $23 and paying $7 back on $1.75 (+300%) if the S&P is down 20% in January. But then it's a bet and not a hedge and we don't KNOW the markets will go down and stay down – so we'd rather have the safer hedge.

We love to find bargain stocks and then give ourselves additional 15-20% discounts by selling puts for our initial entry (see: "How to Buy a Stock for a 15-20% Discount"). Any stock you've had your eye on, that you'd REALLY like to buy if it gets cheaper, is a good candidate for a hedge offset position. We have a long list of stocks we are dying to buy if they get a bit cheaper from here.

Today, of course we are going to bounce off the 2,125 line in the S&P, 2,125 is the -2.5% drop from 2,180 and should offer some support but below that is 2,070, which would be the 5% pullback we're expecting. From 2,180 to 2,125 is 55 points so call them 10-point bounces to 2,135 (weak) and 2,145 (strong) and I think a weak bounce, at best, is what we're looking for this morning. Dow 18,000 also better be bouncy and the fall from 18,600 was 600 points so 120-point bounces so let's say 18,120 is weak and 18,250 would be the strong bounce line – that's the goal for any kind of "recovery" – otherwise, still bearish.

.png)

Russell (IWM) 1,200 is the Must Hold line on our Big Chart and 10,450 is the -5% line for the NYSE and failing that would be a very bad sign as well – so we'll keep an eye on those if those weak bounce lines fail. 1,200 was down 61.5 points from our call to short it on Thursday morning and those contracts paid our Members $6,150 per contract at 1,200 – not bad for two day's work so no need to be greedy and today will be more of a "watch and wait" kind of day. Our oil shorts (/CL) went from $47.50 to $45 for gains of "only" $2,500 per contract – comparatively tame.

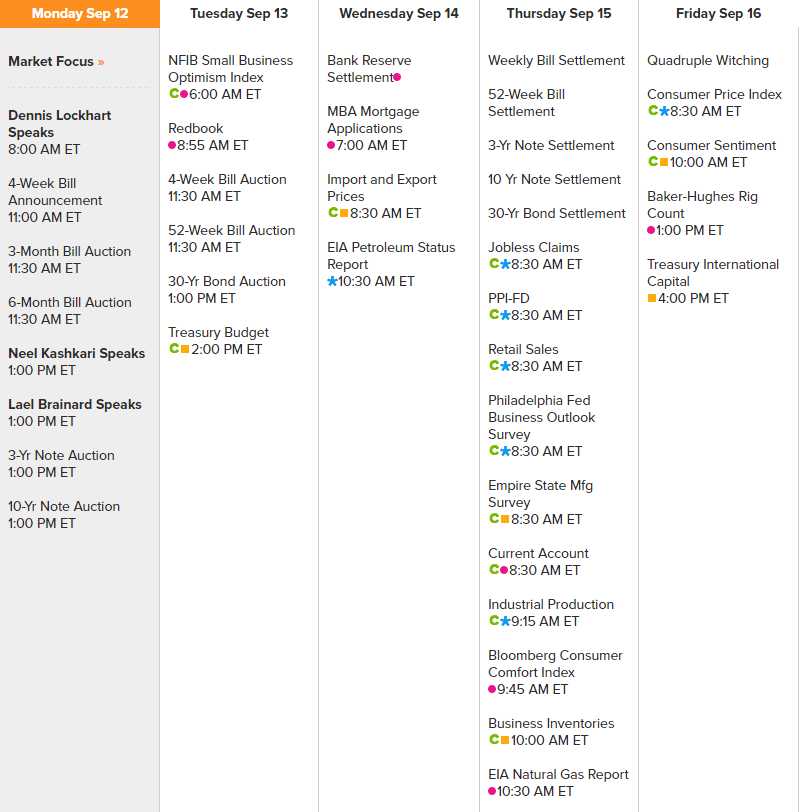

Only 3 Fed speakers this week and all today ahead of next week's FOMC Meeting, where a raise is seeming much more likely. Options expire on Friday and we get the NY and Philly Fed reports on Thursday along with Industrial Production – all of which have been awful recently.

China has a holiday Thursday and Friday this week so, if our markets don't recover quickly, we may get a fresh round of panic-selling in China as they are not likely to want to risk a 4-day weekend if the US and Europe still seem uncertain. So the clock is ticking and we need to see those bounces and any failure of key supports at Dow 18,000, S&P 2,125, Nasdaq 4,700, NYSE 10,500 and Russell 1,215 will be strong indications of more pain to come.

Let's be careful out there,

– Phil