Now it's GoPro (GPRO) taking a dive.

Now it's GoPro (GPRO) taking a dive.

As I noted yesterday, there are a lot of over-hyped, over-valued stocks out there and the more of them that go down in flames, the more people will begin to reflect on the true value of the stocks they are holding and, eventually, the market begins to reprice to a normalized price to earnings ratio which is, sadly, 20% below where we are now.

Now, I know a lot of guys would make that point their whole article and write 3 or 4 pages on it but I prefer to just put up a simple chart and move on. You are just one google away from checking the facts – I suggest you do so with me or anyone you read – I'm just assuming you are a smart person who routinely does that, so I try not to belabor my points if I can make them quickly. That does not mean, however, that they aren't important!

And keep in mind that's the average p/e ratio – at PSW, we like to buy companies that are better than average, the ones I'm worried about (see yesterday's post) are above the average – especially ones that have p/e's above 50, which means it will take 50 years for the company to make back the money you are paying for a share or 2% per year – WORSE than even the pathetic rate of return on a 30-year note. Logically, that should be your benchmark for avoiding a company, right?

And keep in mind that's the average p/e ratio – at PSW, we like to buy companies that are better than average, the ones I'm worried about (see yesterday's post) are above the average – especially ones that have p/e's above 50, which means it will take 50 years for the company to make back the money you are paying for a share or 2% per year – WORSE than even the pathetic rate of return on a 30-year note. Logically, that should be your benchmark for avoiding a company, right?

Now, the mitigating factor there is growth. If the company is growing, then you might think it's OK that, at the moment, it may be making 2% but maybe, in the futures, business will double and it will make 4% back on your money and then double again and make 8%. That's the logic behind investing in Amazon (AMZN), Tesla (TSLA), NetFlix (NFLX), etc but the problem is – companies don't tend to double up very quickly and, if you need 3 doubles just to get to where we like to start (p/e below 15) – you're going to be years and years behind us in value.

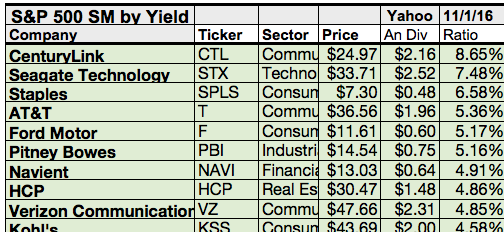

Dividends are nice too, nothing wrong with nice, steady dividend payers and, as we discussed in Wednesday's Live Trading Webinar, the secret to our success isn't in finding stocks that grow to beat the market – the key to our success, like Buffett, is buying solid stocks at a discount and using stock options for hedging and leverage, selling premium to BE THE HOUSE – a system that outperforms flat or down markets all the time and outperforms up markets most of the time.

Dividends are nice too, nothing wrong with nice, steady dividend payers and, as we discussed in Wednesday's Live Trading Webinar, the secret to our success isn't in finding stocks that grow to beat the market – the key to our success, like Buffett, is buying solid stocks at a discount and using stock options for hedging and leverage, selling premium to BE THE HOUSE – a system that outperforms flat or down markets all the time and outperforms up markets most of the time.

Yes, we miss out on part of big rallies but we make money when the market is down and when it's flat and when it's up slightly, so what do you think our system usually does? Don't forget, we don't lose money in a big rally (over 20%), we just tend not to outperform the market under those conditions. Of course, that's why we have our Short-Term Portfolio – that's where we have our fun during rallies but our much bigger (5x) Long-Term Portfolio, that's for serious investing and wealth-building.

Speaking of serious investing, RICK in the chart above, is a the strip club Rick's Cabaret and life is a cabaret for that company that ironically doesn't get a lot of lovin' from Wall Street, despite the fact that actual Wall Street bankers stuff cash into g-strings at their club every day. This is a great stock to play if Trump wins because who loves strippers more than President Trump?

8:30 Update: Non-Farm Payrolls just came in at 161,000, a bit light of 180,000 expected but last month has been revised up 22%, from 156,000 to 191,000, so take any jobs number with a grain of salt. Unemployment is down again, just 4.9% and maybe this good news is bad news as it's one of the Fed's key data-points – adding support to a December Rate Hike. Also bad news for our Corporate Masters – hourly earnings are up 0.4%, 25% ahead of expectations and last month was revised up 50%, from 0.2% to 0.3% – those wages are creeping up!

8:30 Update: Non-Farm Payrolls just came in at 161,000, a bit light of 180,000 expected but last month has been revised up 22%, from 156,000 to 191,000, so take any jobs number with a grain of salt. Unemployment is down again, just 4.9% and maybe this good news is bad news as it's one of the Fed's key data-points – adding support to a December Rate Hike. Also bad news for our Corporate Masters – hourly earnings are up 0.4%, 25% ahead of expectations and last month was revised up 50%, from 0.2% to 0.3% – those wages are creeping up!

So more people working making more money (wow, we MUST put a stop to this on Tuesday!) means more driving yet Gasoline Futures (/RB) have plunged to $1.39 this morning because that pipeline fire that caused prices to spike (which we shorted) earlier in the week, is already fixed but now we like /RB long because more workers = more drivers and we have the Thanksgiving Holiday coming up and that's a big demand holiday. We made a quick $500 yesterday on a pop off the $1.45 line so this, of course, is a much better entry but it's a scary, volatile contract that makes or loses $420 per penny move!

We're expecting some weak bounces in low-volume trading today as we head into the weekend but then down Monday and Tuesday if it looks like Trump has a chance, followed by a huge relief rally on Wednesday to ring in the Clinton Presidency (if it's not contested, if it is – DOOM!!!). Long gold (orange) if Trump wins and short gold if Hillary wins because gold hates stability and prosperity and loves uncertainty, jingoism and chaos.

We're expecting some weak bounces in low-volume trading today as we head into the weekend but then down Monday and Tuesday if it looks like Trump has a chance, followed by a huge relief rally on Wednesday to ring in the Clinton Presidency (if it's not contested, if it is – DOOM!!!). Long gold (orange) if Trump wins and short gold if Hillary wins because gold hates stability and prosperity and loves uncertainty, jingoism and chaos.

We went over the bounce lines and our 5% Rule™ in yesterday's Live Member Chat Room and the short summaries for the Futures are:

- Dow (/YM) weak bounce is 17,860, strong bounce is 17,905

- S&P (/ES) weak bounce is 2,089, strong bounce is 2,097

- Nasdaq (/NQ) weak bounce is 4,720, strong bounce is 4,740

- Russell (/TF) weak bounce is 1,182, strong bouce is 1,194

We're expecting to see the weak bounce lines tested and REALLY bad if we can't make those stick. At the strong bounce lines, we're likely to be shorting the indexes again and, of course, the move up is a great opportunity to add some more hedges if you have not been satisfied with your portfolio performance in the past two weeks. We certainly are – but, then again, we expected this drop.

Have a great weekend,

– Phil