What a difference a day makes.

What a difference a day makes.

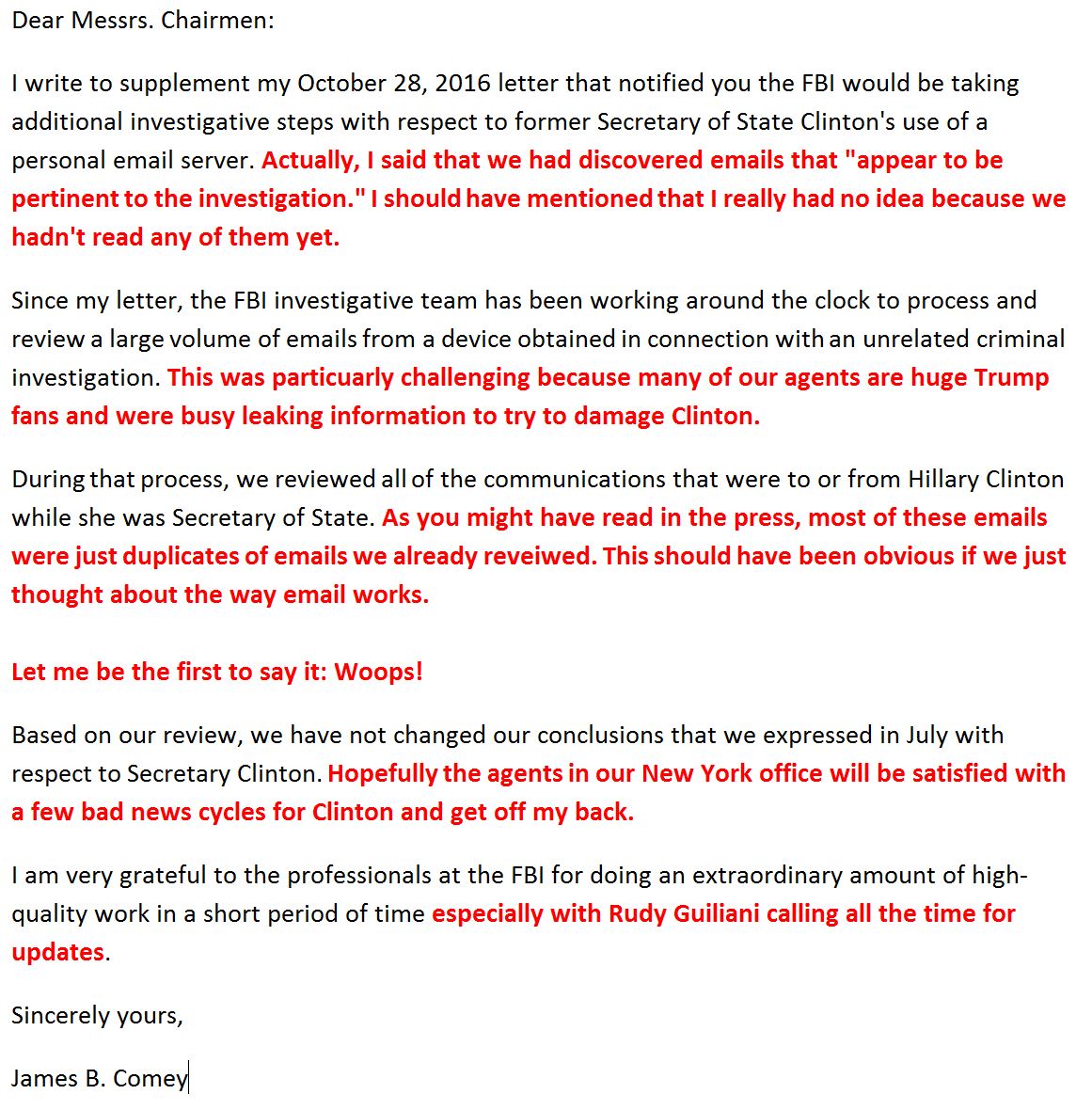

Or a weekend, in ths case as Donald Trump and the GOP went into the weekend thinking they had a chance of winning the White House until, last night, FBI director Comey (the hero of the GOP, the stand-up guy who speaks the truth and isn't afraid to take on the Clintons…) sent ANOTHER letter to Congress but this one was not as helpful as the last (as annotated by @JuddLegum).

Obviously, this morning's post will not be published on Seeking Alpha or many other sites that syndicate my content because it's "political" but, in my defense, to look at the Futures, which are rocketing up 1.5% at 8am, and not think it has something to do with politics is ASININE – it's a complete and utter disservice to your investing readers NOT to discuss politics and it's an even worse disservice to do so while pretending to be objective – which is the editorial policy of most sites.

I'm not objective – I think a Trump Presidency would be a disaster as did – obviously – the stock market. I think the Democratic takeover of this country after the Great Depression not only saved the United States at the time but led to an unprecedented are of relative peace and expansion that was later squandered by more Republicans. You are free to disagree with me – I'm just letting you know where I stand so you can better understand my point of view on things.

I'm not objective – I think a Trump Presidency would be a disaster as did – obviously – the stock market. I think the Democratic takeover of this country after the Great Depression not only saved the United States at the time but led to an unprecedented are of relative peace and expansion that was later squandered by more Republicans. You are free to disagree with me – I'm just letting you know where I stand so you can better understand my point of view on things.

In that spirit, I shared my take on Hillary's Emails with our Members:

Submitted on 2016/07/07 at 1:30 pm

Email/Rexx – I took it that they were only first initiating those policies and Clinton, of course, has a lot going on with the Foundation and all so it makes sense she wanted to have something other than just her state Department Emails. I don't think there's anything she did that a reasonable person wouldn't have done – she took plenty of precautions and, as noted by the FBI, only 3 PARAGRAPHS out of 30,000 Emails accidentally were on her phone and, frankly, she can't control what some dumb-ass sends her on her personal Email – it wasn't like she sent the classified paragraph to someone else. If that's the new standard, we can all EMaill GOP Congresspeople something classified and then demand they be removed from office for mishandling the mail.

Submitted on 2016/10/28 at 3:15 pm

Hillary speaks and says nothing about the FBI – interesting way to go. I would think that means it's nothing and they want to let the Republicans act like idiots all day tomorrow and then go clear it up on Sunday and make a huge point about how you can't let people who jump to conclusions and stir hatred based on half-assed assumptions remain in Government. Hmmm, maybe Hillary's people released those Emails….

So the GOP got played and made the Email scandal the focus of their entire last week in power and forgot to talk about Obamacare rate hikes – SUCKERS!!! Oh sorry, was that partisan? I try so hard not to be…

Not only has the GOP now blown any chance of Trump becoming President but now they've been tricked into circling the wagons around Donald Trump in the final week of the campaign, completely reversing their previous plan to distance themselves to save Congress and the Senate and now that's out the Window and all the voters will remember is a week of screaming about Hillary's Emails (again) that led up to a big nothing – a huge waste of everyone's time.

Not only has the GOP now blown any chance of Trump becoming President but now they've been tricked into circling the wagons around Donald Trump in the final week of the campaign, completely reversing their previous plan to distance themselves to save Congress and the Senate and now that's out the Window and all the voters will remember is a week of screaming about Hillary's Emails (again) that led up to a big nothing – a huge waste of everyone's time.

If only the GOP had listened to Bernie's advice when he said he was sick of hearing about Hillary's Emails. He said that in a debate, when he could have tried to use it to his advantage but he knew there was no substance there and was smart enough not to link himself to such idiocy. Not the Republicans though – idiots one and all!

If only the GOP had listened to Bernie's advice when he said he was sick of hearing about Hillary's Emails. He said that in a debate, when he could have tried to use it to his advantage but he knew there was no substance there and was smart enough not to link himself to such idiocy. Not the Republicans though – idiots one and all!

So, what does this have to do with the markets? EVERYTHING! We went long on Health Care and Infrastructure betting Hillary would end up as President, we went long on Gasoline Futures (/RB) over the weekend at $1.375 (still playable) and, most importantly, we pressed our long-term positions last week because we felt the Trump sell-off would be temporaly and THAT is how politics drives our investments.

As noted by Time Magazine (yes, they still print it) last week:

In the U.S., Republican presidential candidate Donald Trump has even tried to make a virtue of his tax avoidance. No wonder surveys show that the trust gap between the 1% and the 99% has never been greater… Cases like this foster the message that institutions and rich individuals can float above the system–and that has serious ramifications…

In this sense, Trump may be a canary in the coal mine for the U.S. This election cycle has brought the public-approval rating of government to new lows. The GOP nominee has gone from obscuring how little he pays in tax to arguing that it qualifies him to fix the system. (When you look at the way in which Trump avoided paying taxes, you see a business model similar to Deutsche’s: loads of tax-code-incentivized debt, which can be written off in ways that favor the investor while leaving others on the hook.) If his argument works, it is likely to make things worse, not better.

People will never love paying taxes. But when they stop trusting the system altogether, the foundations of a country begin to crumble.

This is why I'm a Demorcat – I support Democracy and the formation of a Government that DOES demand sacrifice to support the greater good. As our founding fathers said: "Governments are instituted among men, deriving their just powers from the consent of the governed" and yes, President Clinton 2.0 will demand a lot more sacrifice (especially from the Top 1%) than President Trump would have but Trump is the road to anarchy – he still hasn't even released his tax returns, for God's sake!

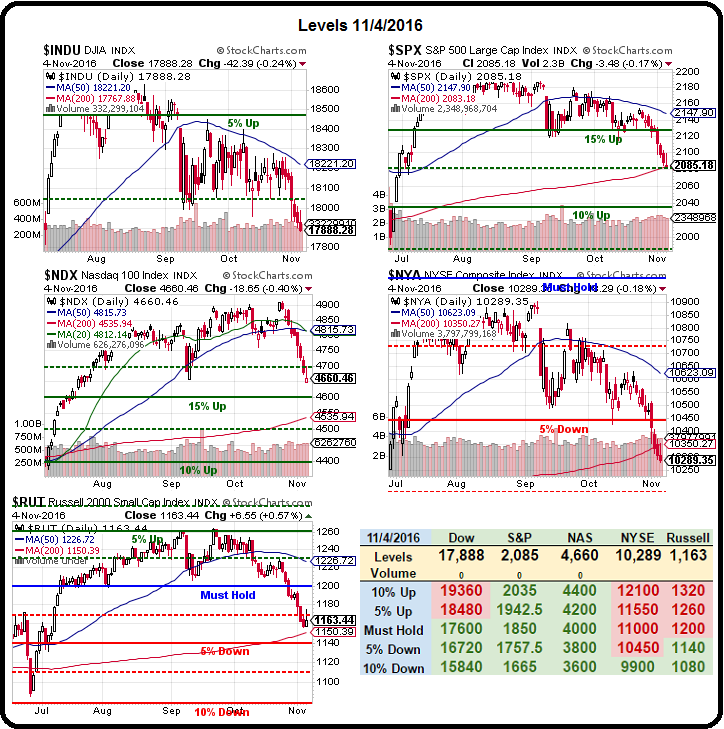

We will see how much of a bounce we get in our indexes pre and post election. We went over the bounce lines in Friday's post, and we should already be over 2,100 on the S&P Futures (/ES) at the open – the trick is whether or not we hold it.

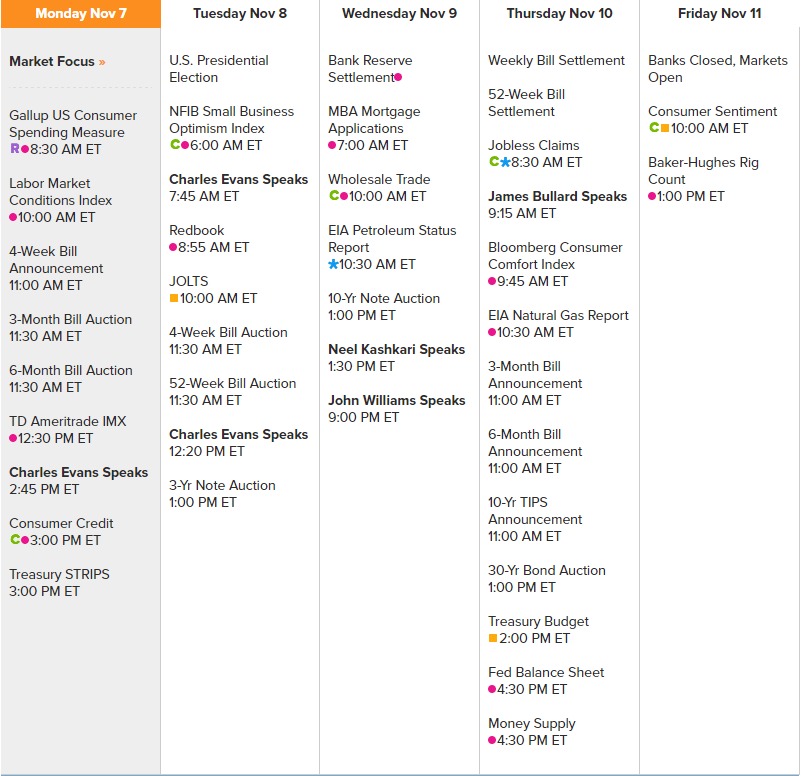

We have a lot of Fed speak this week but 3 out of them are Evans (dove) saying the same thing 3 tmes by lunch tomorrow. As you can see below, we have some data, mostly on the consumer front but the biggest poll of all is tomorrow's elections and we'll know on Wednesday which direction the country has decided to go for the next 4-8 years – THAT is a macro we can use to our advantage!