What a nice day yesterday was!

What a nice day yesterday was!

As I noted in the morning post (giving you PLENTY of time to catch the run if you subscribe to our PSW Pre-Market Report), we had a note out to our Members to short oil at the $54.50 mark and, as you can see, we hit it on the nose and, during yesterdays' session, we had a lovely melt-down that gave us $2,000 per contract gains on the day.

As a bonus, we had a little pullback that made us think maybe we are not crazy to be so well-hedged and we'll be cashing out more longs during the day, ahead of tomorrow's Fed announcement (2pm) and Yellen press conference (2:30) and I'll be doing my Live Trading Webinar starting at 1pm (Members only), so get ready for a very exciting session. Don't worry, if you can't afford to subscribe to our service and get these great tips live, you'll be able to see the Webinar replay a few days later!

Of course, it's not too likely the Fed will be doing anything to derail the rally. In fact, just this morning, since Financials led us lower yesterday, the Fed announced they would be allowing banks 5 MORE YEAR (they've already given them 3) to unwind high-risk investments they take with their clients' money.

Of course, it's not too likely the Fed will be doing anything to derail the rally. In fact, just this morning, since Financials led us lower yesterday, the Fed announced they would be allowing banks 5 MORE YEAR (they've already given them 3) to unwind high-risk investments they take with their clients' money.

That's the so-called Volcker Ruler in the Dodd-Frank act and the Financials are coming back strong on expectations that Trump and his team of Banksters will dismantle Dodd-Frank before they ever have to comply. "Oh frabjous day, callooh callay," he chortled in his joy…

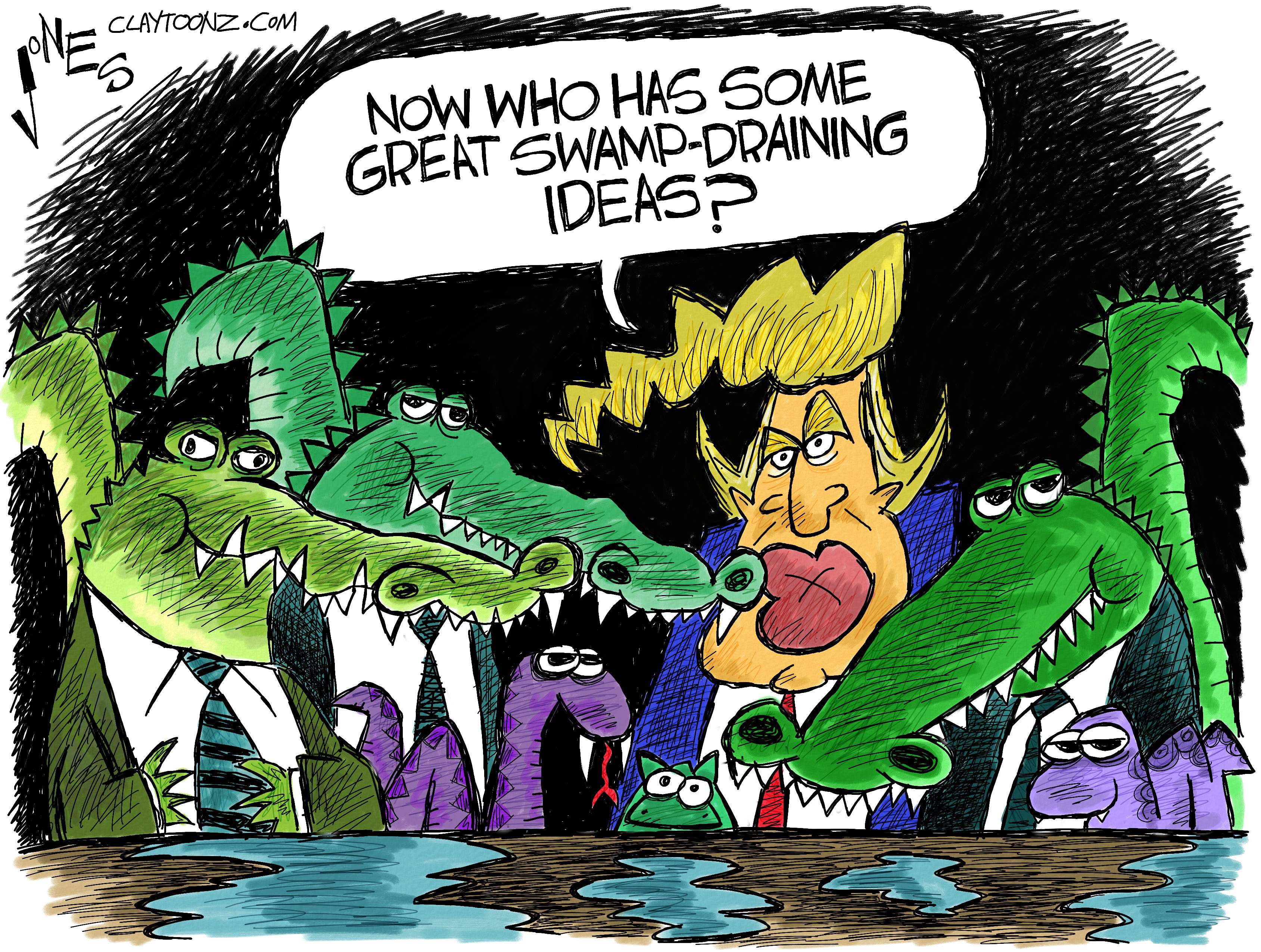

Well, we all know how this movie ends and, just like the poem, the last verse is the same as the first and here we are again, so it's little wonder that our friends at Government Sachs (GS) have seen their stock rise 50% in 3 months with 33% coming after Russia elected Donald Trump to be our President. Of course, Trump isn't actually President yet, the Electoral College meets on Dec 19th and, for the first time in over 200 years – may actually have to do their job!

Is the 50% rise in GS (and GS alone is responsible for 1/3 of the Dow's post-election gains with JP Morgan (JPM) adding another 25%) justified. After all, they've been in charge of Government before, right before the last crash in fact – so who better to steer us into the next economic melt-down than the guys who didn't quite finish the job last time?

In 2005, Goldman had $25Bn in revenues and $8Bn in earnings (not including the $12Bn of salaries and bonuses for the partners and associates) but by 2007, thanks to putting their clients into "shitty deals", revenues had flown up to $45Bn and they took $20Bn in salary & bonuses and still dropped $17Bn to the bottom line. Revenues fell to $22.5Bn in 2008 and salary and bonuses were just $10.5Bn that year – hard times indeed but they were back to $35Bn with $20Bn in salary and bonus a year later but, since then, it's been pretty flat due to all these pesky regulations.

Imagine how much more money GS can make if we let them go back to the glory days! Hillary Clinton was a terrible person because she gave a speech to them but Donald Trump has so many Banksters in his bed at this point, there's no room for Malania.

Imagine how much more money GS can make if we let them go back to the glory days! Hillary Clinton was a terrible person because she gave a speech to them but Donald Trump has so many Banksters in his bed at this point, there's no room for Malania.

Now, before we get too excited about GS breaking $250 and the Dow breaking 20,000, we first have to get over the humps at 19,800, which is the +12.5% line on our Big Chart and, for the Dow, that's a significant point of resistance. For Goldman, 50% is a big run but consider they were down on the assumption that Elizabeth Warren would be watching them under a Clinton Administration – this is the complete opposite.

So, ignoring the peril to humanity, Goldman Sachs deserves their 50% bump because the glory days are coming back and they will make Billions more Dollars and pay Billion LESS taxes on that money with almost no regulation (and their own people in charge of the regulators) – what could possibly go wrong? I mean, hey, they just paid $5.1Bn in fines and penalties for defrauding investors this Spring – that won't happen again (the penalties, I mean).

As I noted over at the Nasdaq yesterday, the momentum to get the Dow to 20,000 is certainly there but it's against an unrealistic backdrop that is not likely to be sustained when skyrocketing earnings expectations are not met.

Meanwhile, money continues to pour out of bonds and that money has nowhere else to go except into Equities. After all, what are the alternatives? Cash? Real Estate? Bank Accounts? We have a 30-year note auction today and the bidding on yesterday's auctions was anemic. Natural Gas (/NG) Futures, which I talked about in yesterday's interview and tweeted out as a buy this morning (follow us here) are on a tear this morning with the change in weather. Maybe it's just our guys buying but I think it was the right call…

As I also noted in yesterday's interview, we're getting bearish here with Dow 20,000 in site. If we go over that line, we'll have to go back to being bullish until it fails. A lot of that is up to the Fed and we'll see what they have to say to us tomorrow afternoon.

Until then, be careful out there.