Trump's cabinet is shaping up!

Trump's cabinet is shaping up!

As Democratic Senator, Claire McCaskill noted over the weekend, "Donald Trump has a three 'G' Cabinet,” filled with Goldman, generals and gazillionaires.” While I'm not sure how much a gazillion actually is, estimates are the net worth of Trump's cabinet has passed the $15Bn mark and that's before appointing Exxon (XOM) CEO, Rex Tillerson to be Secretary of State. Boy, if you think the rest of the World was concerned about our strong-arm oil policies before!

Proving once again that politics do matter to the markets, oil shot up to $54.50 this morning (where I put a note out to our Members to short Oil Futures (/CL)). OPEC also sealed a deal with non-OPEC nations like Russia, who have also agreed to cut 558,000 barrels a day of production (one-half of 1%) but, of course, that's not very much out of 93Mb/d of current production, which is still about 1.5Mb/d more than the World is consuming – so the glut continues.

Meanwhile, we can't throw around terms like Gazillionaires because the Republican Senate has now passed the Republican House's "Countering Disinformation And Propaganda Act" which defines media manipulation as follows:

Meanwhile, we can't throw around terms like Gazillionaires because the Republican Senate has now passed the Republican House's "Countering Disinformation And Propaganda Act" which defines media manipulation as follows:

The section lists the following definitions of media manipulation:

- Establishment or funding of a front group.

- Covert broadcasting.

- Media manipulation.

- Disinformation and forgeries.

- Funding agents of influence.

- Incitement and offensive counterintelligence.

- Assassinations.

- Terrorist acts.

As noted by Zero Hedge, who are henceforth considered an outlaw web site: "It is easy to see how this law, if signed by the president, could be used to target, threaten, or eliminate so-called “fake news” websites, a list which has been used to arbitrarily define any website, or blog, that does not share the mainstream media's proclivity to serve as the Public Relations arm of a given administration."

The bill (and I am not making this up) tasks the Secretary of State with coordinating the Secretary of Defense, the Director of National Intelligence, and the Broadcasting Board of Governors to “establish a Center for Information Analysis and Response,” which will pinpoint sources of disinformation, analyze data, and — in true dystopic manner — ‘develop and disseminate’ “fact-based narratives” to counter effrontery propaganda.

That's right boys and girls, the United States Government establishing the Ministry of Truth, as described in Orwell's 1984:

That's right boys and girls, the United States Government establishing the Ministry of Truth, as described in Orwell's 1984:

The Ministry of Truth is involved with news media, entertainment, the fine arts and educational books. Its purpose is to rewrite history to change the facts to fit Party doctrine for propaganda effect. For example, if Big Brother makes a prediction that turns out to be wrong, the employees of the Ministry of Truth revise the record to make it accurate. This is the "how" of the Ministry of Truth's existence. Within the novel, Orwell elaborates that the deeper reason for its existence, the "why", is to maintain the illusion that the Party is absolute. It cannot ever seem to change its mind (if, for instance, they perform one of their constant changes regarding enemies during war) or make a mistake (firing an official or making a grossly misjudged supply prediction), for that would imply weakness and to maintain power the Party must seem eternally right and strong.

Minitrue plays a role as the news media by changing history, and changing the words in articles about events current and past, so that Big Brother and his government are always seen in a good light and can never do any wrong. The content is more propaganda than actual news.

I think now might be a good time to check on that amendment before the 2nd amendment (the one that is defended) before "THEY" change it:

Amendment 1:Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.

Well, it seemed pretty clear at the time, I suppose. I am against "fake" news as the next guy but how about educating the population so they can tell the difference instead of creating Government agencies to tell us what speech is allowed and what is not? I would support a ministry of fact-checking that would rate web sites and writers for accuracy and that ministry would, in turn, be checked by the independent press. There are such a things as a verifiable facts – we seem to have lost sight of that.

Well, it seemed pretty clear at the time, I suppose. I am against "fake" news as the next guy but how about educating the population so they can tell the difference instead of creating Government agencies to tell us what speech is allowed and what is not? I would support a ministry of fact-checking that would rate web sites and writers for accuracy and that ministry would, in turn, be checked by the independent press. There are such a things as a verifiable facts – we seem to have lost sight of that.

Fake news, unsubstantiated predictions and propaganda are what the markets are all about, especially this runaway insanity we find ourselves in the middle of. As you can see from the chart below, Non-Financial Corporate debt is back to pre-crash levels but junk bond yields have never been lower. To paraphrase Churchill, "Never before have so many, borrowed so much, for so little."

We have a so far, so wrong bet on JNK, using the March $35 puts, now 0.40, to bet junk bonds start rising in our Options Opportunity Portfolio. While corporate yields are "irrationally" low, government bond yields have risen sharply since the middle of the year. The benchmark 10-year U.S. Treasury yield has jumped 100 basis points since July's multi-decade low, with a growing number of investors saying the 35-year bull run in bonds is now over. Worse, it has led to nearly $2 trillion in global fixed income losses, which surprisingly, has not led to a major shake up across markets.

Why is this? The BIS provides one explanation – the bulk of the losses are concentrated in the hands of central banks who – luckily – do not have to mark to market.

For instance, around 40% of US Treasuries are owned by the Federal Reserve and the foreign official sector. Pension funds (the third largest holders of Treasuries) and insurance companies may even benefit from rising rates in the medium term, as a normalized yield environment would allow them to more easily meet promised returns.

However, valuation losses in the short run may affect profits and capital depending on accounting standards. In addition, the hedging activities of the US government-sponsored enterprises (GSEs), which contributed to the bond market turbulence of 1994, are much lower now.

This is because, as part of quantitative easing policies, GSEs sold a large share of their portfolios to the Federal Reserve, which does not hedge its securities.

There is no reality here so there's no way to know when the market bubble will burst. We are down the rabbit hole and wondering around in Wonderland and there's no sense in expecting the next animal you meet not to talk to you, or the next overpriced stock you look at not to go higher – that's just the way things are until you wake up when, very suddenly, none of those things will happen.

I think shorting JNK is a good hedge against reality but, as you can see from the chart, reality has been fighting back since the very unreal (or all-too-real) election. As noted above, bond rates have jumped 20% since their summer lows and, on Wednesday, the Fed will almost certainly raise rates (2pm), so there's not much chance they turn back down for now.

Of course, it doesn't matter if the Fed raises rates as long as they keep buying Junk Bonds from our Corporate Masters at record-low prices. After all, the Fed is spending YOUR MONEY, which becomes YOUR DEBT if the bonds end up defaulting so everybody wins (who counts).

As you can see from this S&P 500 chart, we can remain overbought (red boxes) for a couple of months before a correction and, so far, it's only been one month and it's almost Christmas and Sandta Clause is coming to town and we're so close to Dow 20,000 it would be a real shame not to get these but, as I noted last week – we are more inclined to short at these levels and we're pulling some winners off the table – just in case EVERYONE is wrong…

- Dow 20,000 And Beyond – Mark DeCambre

- 3-Reasons The Trump Rally Will Continue – Stephen Gandel

- Reasons Why Stocks Are In “Melt-Up” Mode – Adam Shell

- Rising Rates Good For Stocks – Lee Jackson

- Rising Yields Signal Economic Growth – Peter Ireland

- Rising Yields A Bullish Signal – James Picerno

So let's enjoy the party while we can – it's kind of like one of those college parties that are so good, you just know the police are going to come pretty soon and shut it down but, meanwhile, LET'S PARTY!!!

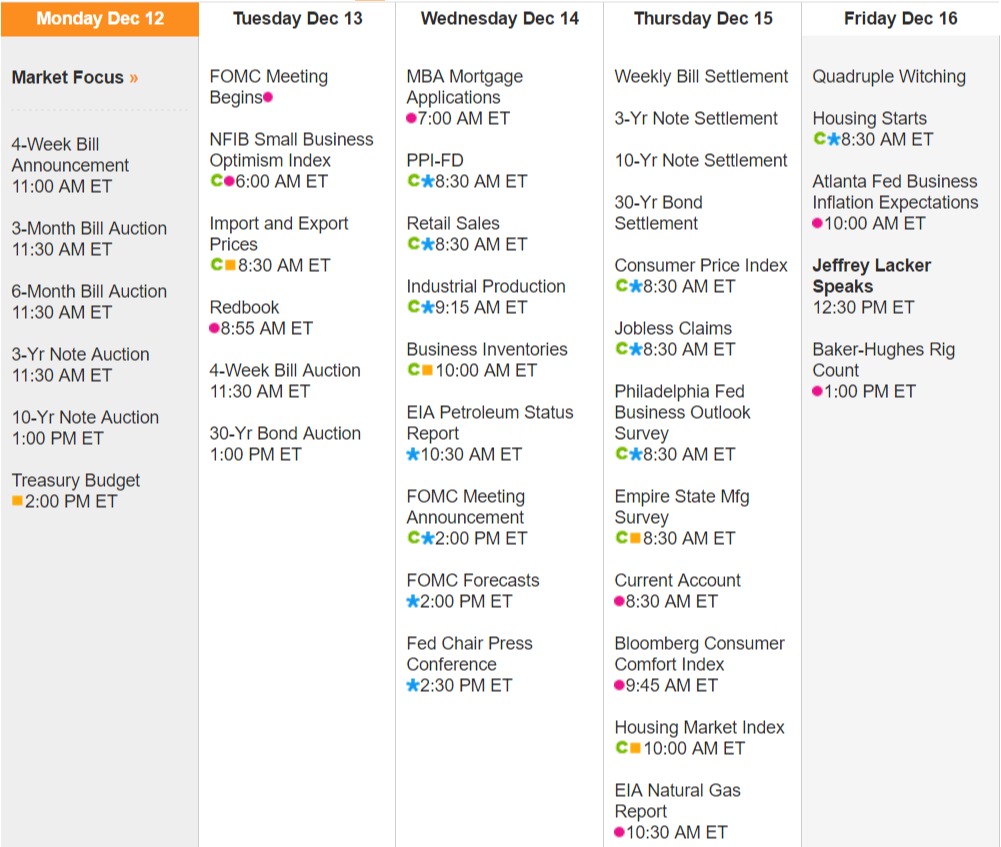

Lot's of notes to sell today, it will be interested to see if anyone other than our own Fed is still buying bonds. It would be stunning if small businesses are not optimistic tomorrow after the Russell Small Cap Index has jumped 20% since the election. Retail Sales will give us a pre-holiday hint on Wednesday and then the Fed, with Yellen speaking at 2:30. If we survive that, it's CPI and the New York and Philly Fed reports on Thursday and we'll see how comfortable the consumers are feeling as well. Friday is everything expiration day – capping off what's likely to be a wild week.

Have fun out there but, as with any good college party, stay near the exits so you can escape when the police come to shut it down. My brother had to bail his whole floor out of jail once – THAT was a great party!