This rally is unstoppable!

This rally is unstoppable!

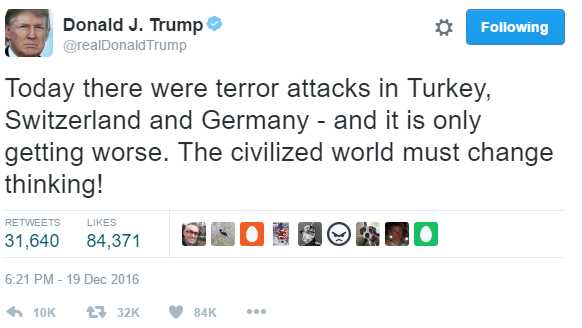

It's fantastic if you are cashing in your longs – an endless stream of suckers coming to buy our shares at ridiculous prices and nothing gets in their way. A Russian Ambassador was killed and the market took a dip and then a truck killed a dozen people in Germany and the market only dipped again and someone shot up a mosque in Switzerland and, well that's white man terrorism – that didn't even get a dip...

The Dow closed yesterday at 19,883, still 117 points away from our 20,000 goal. It's still a good time to cash in your longs ahead of the holidays and I'm bored telling people to be careful and I'm not going to tell you what's wrong in China, etc. – we had a News Tweet this morning and you can check that out if you want to know what's up in the World.

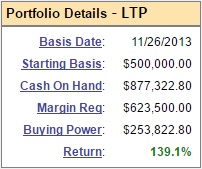

Nope, today is a good day to switch off our brains and enjoy the rally. After all, despite our getting back to mainly CASH!!!, our bullish Long-Term Portfolio is now up almost 140% and we're happy to take the holiday's off with most of our CASH!!! on the sidelines – I'm sure we'll find something to play next year.

Nope, today is a good day to switch off our brains and enjoy the rally. After all, despite our getting back to mainly CASH!!!, our bullish Long-Term Portfolio is now up almost 140% and we're happy to take the holiday's off with most of our CASH!!! on the sidelines – I'm sure we'll find something to play next year.

In fact, if things are so great, then Nike (NKE) should have good earnings this evening. NKE is the worst-performing stock on the Dow and people must be itching to buy it down at $50.85 and they do make about $2.50 per share for a not-so-awful 20 p/e ratio. Would we pay 20x earnings for a shoe company – certainly not in the real world we wouldn't but this is the fake news World we're living in now and 20 times earnings is cheap for a Dow component, where the average p/e is 22.

While I don't love NKE (we have our money on Sketchers (SKX), in fact) I do like it as a hedge against our bearish hedges because, if the Dow is going to march over 20,000 – then NKE should get dragged along for the ride.

To leverage an upside play on NKE, we can begin with the premise that, while we don't love them at $50, at $45 they are pretty likeable so we can sell the 2019 $45 puts for $4.25, which obligates us to buy the stock for $45 and we can consider the $4.25 to be free money – since we're happy to buy NKE for $45 (10% off) anyway. Now we can use that $4.25 to construct the following upside hedge:

- Sell 5 NKE 2019 $45 puts for $4.25 ($2,125)

- Buy 10 NKE 2018 $47.50 calls for $6.95 ($6,950)

- Sell 10 NKE 2018 $55 calls for $3.25 ($3,250)

That's net $1,575 on the $7,500 spread that's over $3,000 in the money to start. If NKE claws back to $55 by Jan of 2018, we will collect $7,500 for a gain of $5,425 (344%) but we'll still be obligated to buy 500 shares of NKE until Jan 2019 and the margin on that should be about $2,250 so it's a nice, margin-efficient way to make $5,425 with relatively low risk.

As I said, earnings are tonight so you could just buy the spread (as it's less volatile) and wait for the results to sell the puts. If earnings are great and NKE flies up 10%, then the spread would be in the money and on the way to a 12-month, 100% gain with no margin at all required. If NKE goes lower, then we'll get a better price for put sales (maybe lower ones) and we can even widen the spread if we want to stick with it (depends why they sell off).

So THAT is a nice preview of what we'll be doing in January – 3,900 companies will announce earnings and there will be endless opportunities to play this game with our sidelined CASH!!! There's always something to trade and this morning we're back on the Silver Futures (/SI) as they test $15.75 against a very strong Dollar (103.50). The charts for both silver and gold (/YG) are very ugly and we talked about playing SLW last week but now let's talk about potential Trade of the Year candidate, Barrick Gold (ABX), who we are already long on in our Member Portfolios. As a new entry, I like:

- Sell 10 ABX 2019 $15 puts for $4 ($4,000)

- Buy 25 ABX 2019 $13 calls for $4.20 ($10,500)

- Sell 25 ABX 2019 $20 calls for $2.10 ($5,250)

Here we're obligating ourselves to own 1,000 share of ABX at $15 ($15,000) while our net cash outlay on the spread is just $1,250 with a potential pay-off at $20 of $17,500 for a 1,400% return on cash and the margin on this one is about $2,800. It takes two years to make 1,400% but still a nice rate of return and it's a great hedge against inflation.

Lot's of nice, relaxing trades to make ahead of the holidays – let's enjoy them – we can worry about the fake and real news next year…