Are we there yet?

Are we there yet?

The average volume trading on SPY, the S&P ETF is 100M shares per day yet this month, the average has been 70M so about 30% less trading than "usual", which was very slow to begin with (down 25% from last year). A lot of times, if you are day-trading and you feel like you're the only one in a position – you are probably right!

As you can see from the above chart, when you see these kind of toppy, sloppy patterns – it's best just not to trade and wise traders go to CASH!!! (have I mentioned how much I like CASH!!! lately?) and wait PATIENTLY for conditions to improve. If that chart looks familiar to you – just check out what the S&P 500 Futures (/ES) have been doing for the past few weeks:

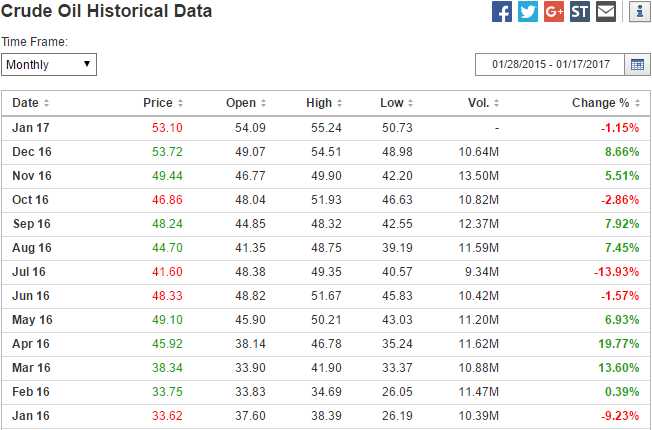

That is what they call a "textbook" example of a market that is not good to trade. That's why we stopped making calls in our morning posts after a fantastic first week of the year: A) We didn't want to ruin our perfect record and B) There were no longer any very obvious trades to call. We did, however, call oil short at $54 on the 6th and it's been up and down but now $53.20, which is still up $800 per contract from where we called it and now we're calling that one short again (/CL) as well as Gasoline (/RB) at the $1.65 line.

Why are we short oil and gasoline? Well oil, in particular, is nothing more than a gigantic fraud of a market that is based on the artificial manipulation of what has always been, historically, a plentiful supply. As we all know, OPEC spent most of last year promising to cut production and, FINALLY, this January they actually did cut production, by 1.5% of Global supply and this morning they spiked oil from $52.20 to $53.20 by releasing a statement from the Secretary General predicting oil prices would stabilize in 2017 and hit $70 by the year's end.

Saudi Arabia has maintained its commitment to a production cut, and Saudi Energy Minister Khalid al-Falih said on Monday that “Many countries are actually going the extra mile and cutting beyond what they’ve committed.”

Yes, that's right, they LOVE production cuts and they are having so much fun that they are cutting even MORE than they said they would – even though it took a full year of negotiations just to get them to agree to cut at all. If only they had known how much fun cutting production was, they would have started long ago, right?

So we have the supply manipulation and that's so blatant that they celebrate it but the other manipulation is more subtle and that's the demand manipulation. Over at the NYMEX for example, where prices are set for US crude, traders there (many of whom are paid by the oil companies that benefit from high prices) PRETEND to want 197 MILLION barrels of crude delivered to them in February, as evidenced by 197,589 open contracts:

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Feb'17 | 52.55 | 52.72 | 52.12 | 52.56 |

04:19 Jan 17 |

– |

0.19 | 157761 | 52.37 | 197589 | Call Put |

| Mar'17 | 53.31 | 53.50 | 52.90 | 53.38 |

04:19 Jan 17 |

– |

0.23 | 89253 | 53.15 | 564955 | Call Put |

| Apr'17 | 54.02 | 54.33 | 53.72 | 54.21 |

04:19 Jan 17 |

– |

0.26 | 17966 | 53.95 | 156021 | Call Put |

| May'17 | 54.87 | 55.04 | 54.44 | 54.97 |

04:19 Jan 17 |

– |

0.29 | 7925 | 54.68 | 130210 | Call Put |

| Jun'17 | 55.45 | 55.63 | 55.02 | 55.50 |

04:19 Jan 17 |

– |

0.23 | 8453 | 55.27 | 251185 | Call Put |

I say pretend for a number of reasons:

- Cushing, OK (the delivery point) is full at almost 70Mb and couldn't possibly hold another 200Mb.

- Cushing can only transmit 6Mb/day in and out so 3M/day in would be 180M in a month – even if they did have room, which they don't.

- Oil Futures settle on Monday and by Monday, at least 180M fake, Fake, FAKE orders will be either cancelled or rolled out to later months. Less than 20M barrels will actually be delivered from the NYMEX in February, causing artificial supply constraints that will defraud and cost American Consumers over $2.5Bn per month for each $5 rise in oil (see: Goldman’s Global Oil Scam Passes the 50 Madoff Mark!).

- Last week, the Energy Information Administration reported a 13.4 MILLION barrel increase in Petroleum Inventories, which is almost 2 full days of US imports (28%) too much in a single week!

- Oil is already up 104% from last January's lows and again, that's because OPEC cut Global Production by 1.5% – this is clearly a ridiculous over-reaction that has no basis in reality.

Now, here's a problem, the Energy Sector is 10% of the S&P 500 and it's up 20% since the election (and why shouldn't it be – half the new cabinet members are oil people) and oil is 25% higher than the November lows but what if we've gone too far and oil and the energy sector begin to correct – that will drag down the whole market.

Of course, having American Consumers spend $54 for the 19M barrels of oil per day they consume ($374.5Bn/yr) vs $33 last January ($228.8Bn) is a surcharge of $145Bn/yr or $10Bn a month and that's more money than Trump has pledged to spend on Infrastructure ($100Bn) and it comes right out of Consumers' after-tax spending money, which means it's money that's being taken away from fast food, supermarkets, retail, etc.

So higher oil prices are bad for the Consumers and the broad economy while lower oil prices are bad for the oil stocks (but retail stocks would eventually pick up). Either way, have I mentioned how much I like CASH!!! lately?

The British Pound staged a huge rally this morning jumping 2.5% off it's lows as PM Therasa May gave her big Brexit speech. That sent the Dollar down 1.25%, which is silly since the Dollar is a 20x bigger currency than the British Pound but currency traders are, in fact, silly people.

Oil is priced in Dollars so, when the Dollar goes down 1.25%, oil goes up at least 1.25% so we had the double-whammy of the OPEC announcement that they love production cuts so much that they are over-indulging and the exuberance over the Pound because it turns out the UK Government does have some sort of plan for leaving the EU. Unfortunately, the UK's FTSE market is priced in Pounds so the stronger pound has sent them down 1% this morning, but that's the way the currency bounces, I suppose.

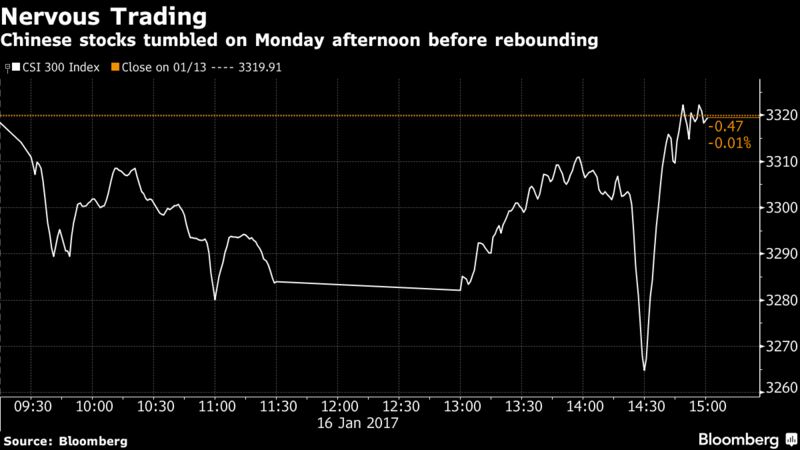

Meanwhile, over in Davos, China's Premier Li warned against trade wars that could destablize Global commerce. As noted by Kevin Smith of Crascat Capital, China’s attempts to prop up the yuan are tightening domestic monetary conditions and making a credit crisis increasingly likely. That means shares of banks and other “zombie” companies may be the first dominoes to fall as China faces a reckoning after years of debt-fueled growth.

Meanwhile, over in Davos, China's Premier Li warned against trade wars that could destablize Global commerce. As noted by Kevin Smith of Crascat Capital, China’s attempts to prop up the yuan are tightening domestic monetary conditions and making a credit crisis increasingly likely. That means shares of banks and other “zombie” companies may be the first dominoes to fall as China faces a reckoning after years of debt-fueled growth.

While China falters, the IMF has slashed their forecasts for Brazil, Mexico and Saudi Arabia, noting that the impact of a Trump administration is one of the biggest unknowns facing the Global Economy. That's not something that will be settled on Friday, when Trump is sworn in as our 45th President – that's a story that will unwind over the course of 2017.

As you can see from the IMF chart, they see oil up 20% in 2017 and we averaged less than $40 last year so $50 is a stretch – let alone $53.20! They also only have the US growing at 2.3%, Europe 1.6% and Japan 0.8% so I'm not really seeing where all this demand is supposed to be coming from but we'll see.

Meanwhile CASH!!! is your friend during inauguration week and we have plenty of earnings to keep us warm so plenty of fun things to bet on from the sidelines – even in this short week:

Yellen also speaks twice this week. After the Beige Book tomorrow at 3pm (BBook is 2pm) and again Thursday at 8pm. There are 6 other Fed speeches this week including 3 today and Dudley already said this morning that the Fed remains market-friendly and expects the current expansion to continue – that is rallying the markets (and oil) as we speak and sending the Dollar down to 100.43, all we'll coordinated to give the markets a great open this morning – let's hope they don't blow it (again).