The Ignorance of The Future

Courtesy of Michael Batnick, The Irrelevant Investor

“Three causes especially have excited the discontent of mankind; and, by impelling us to seek remedies for the irremediable, have bewildered us in a maze of madness and error. These are death, toil, and the ignorance of the future” – Charles Mackay

People spend a lot of time thinking about the future, it’s part of what makes us human. The problem is we’re not very good at dealing with uncertainty. We assume too many constants and not enough change. We underestimate progress and we overestimate failure. The way that this manifests itself in many investors is thinking about how much companies will earn and how much the market will pay for them.

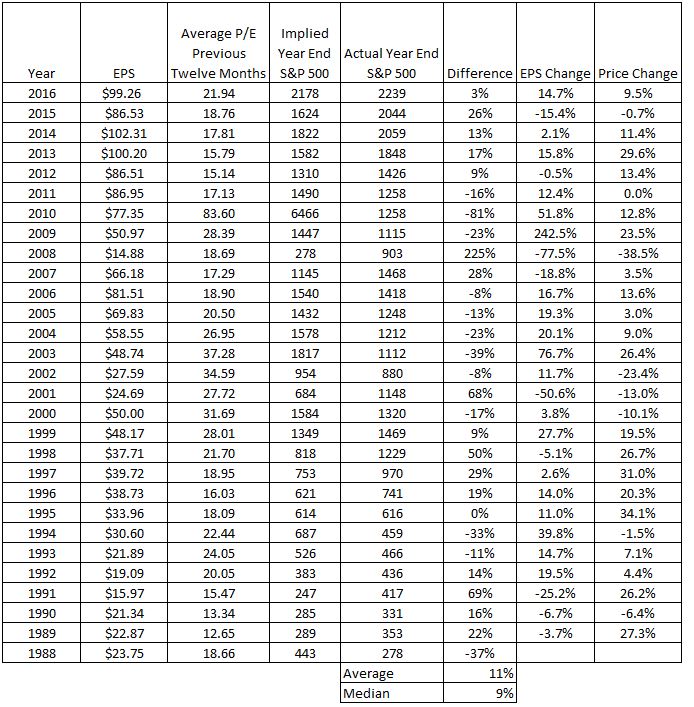

In general (hedging my words), earnings are what drive stocks. But knowing them ahead of time would not necessarily help us make money, at least not in the short-term. Take a look at the table below. The second column shows the full year earnings for the S&P 500 and the third column shows the average price-to-earnings ratio over the previous twelve months. The fourth column is the product of these two; what we would expect the S&P 500 to be at year-end if we knew how much it will earn and assuming that investors moods (P/E) are roughly constant.

The fact that the fourth and fifth column are different by an average of 11% tells you a lot about the difference between theory and reality. Sure, there are times when knowing what the S&P 500 will earn over the next twelve months told you all you needed to know. For instance, if at the beginning of 2008, you knew that they would drop 77.5%, a 38.5% decline would have been avoided. But that was the outlier. Earnings fell 25% in 1991 and stocks gained 26%. By and large, even investors with perfect information are hardly guaranteed perfect results.

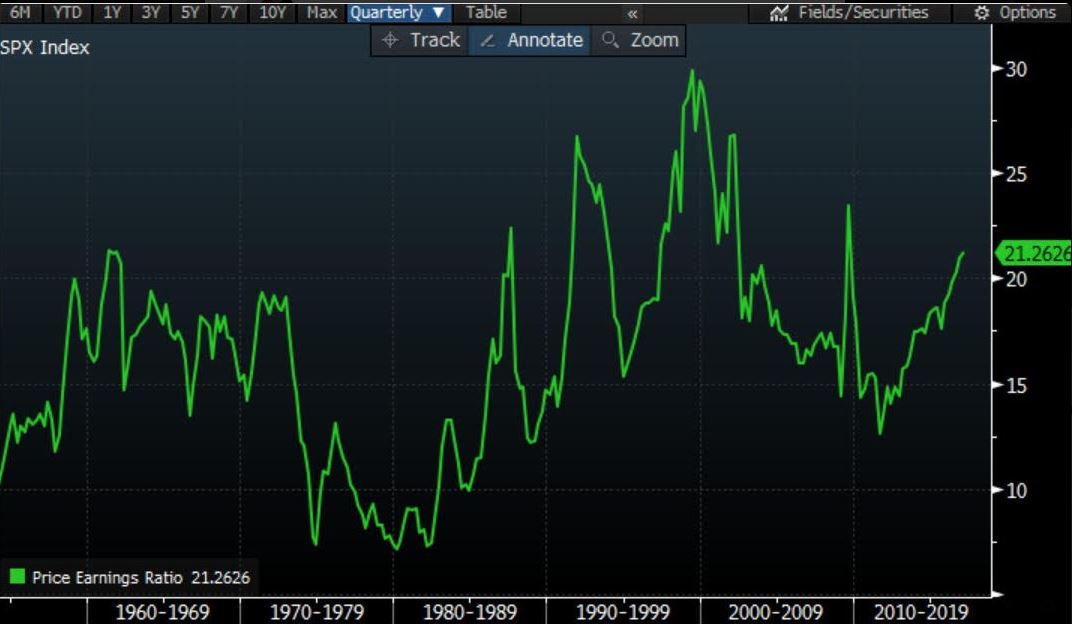

Below is the reason why there is a permanent wedge between the implied year-end price and the actual year-end price.

There is no model that will ever consistently predict “Mr. Market’s” mood. Here’s why: Individuals have to worry about how much they’re spending and how much they’re saving. Whether they can pay their bills today and how they’ll pay their bills tomorrow. Whether their children have the right clothes and will be able to go to (the right) college. Being financially independent is something 99% of us will struggle with at some point in our lives.

Businesses have to worry about their products and services; their current and future customers. What is their competition doing? What if technology makes them obsolete? What if their client’s preferences change? What if, in the case of a public company, their shareholder base turns against them? Running a successful business is extremely difficult.

Governments have to worry about spending and borrowing, keeping prices steady, making sure the roads are paved and that their citizens are protected. Running the government is basically impossible.

Mash all of this together a few million times over and it makes sense why the green line is so erratic.

Nobody, dead or alive, has ever been able to predict how much companies will earn and how much investors will pay for those earnings. Investors should instead worry about getting the big things right:

- Spend less than you make. This is the single most important piece of financial advice.

- Have enough cash for a rainy day, whether that be in life or in the markets. If stocks go on a 50% sale, having cash will allow you to (choose your favorite Warren Buffett quote).

- Make sure your asset allocation is appropriate. Strike the right balance of having enough risk assets that you don’t chase in a good market, but also not too much that you sell in a lousy market.

Source: