The Most Powerful Force In The Universe

Courtesy of Michael Batnick, The Irrelevant Investor

Anyone can solve the equation 6+6+6+6. But ask somebody to calculate 6x6x6x6 without a machine and they’re going to look at you cross-eyed. The human brain was designed for linear, not exponential processing.

Anyone can solve the equation 6+6+6+6. But ask somebody to calculate 6x6x6x6 without a machine and they’re going to look at you cross-eyed. The human brain was designed for linear, not exponential processing.

The other day I joked about the Dow reaching 2,000,000 by the year 2099, a one hundred fold gain from today’s prices. I was only kidding, but Morgan Housel told me for that to occur, the Dow would need to compound at 5.7% for the next 83 years. Considering the Dow has grown 7.14% a year for the last 75 years, this seems totally within the realm of possibility.

This example from The Art of Thinking Clearly illustrates why the Dow reaching 2 million was completely beyond my comprehension (emphasis mine): “A piece of paper is folded in two, then in half again, and again and again. How thick will it be after fifty folds?…Take an astronomical guess. What would be a ridiculous number? Well, if we assume that a sheet of copy paper is approximately .004 inches thick, then its thickness after fifty folds is a little over sixty million miles. This equals the distance between the earth and the sun….Linear growth we understand intuitively. However, we have no sense of exponential growth.”

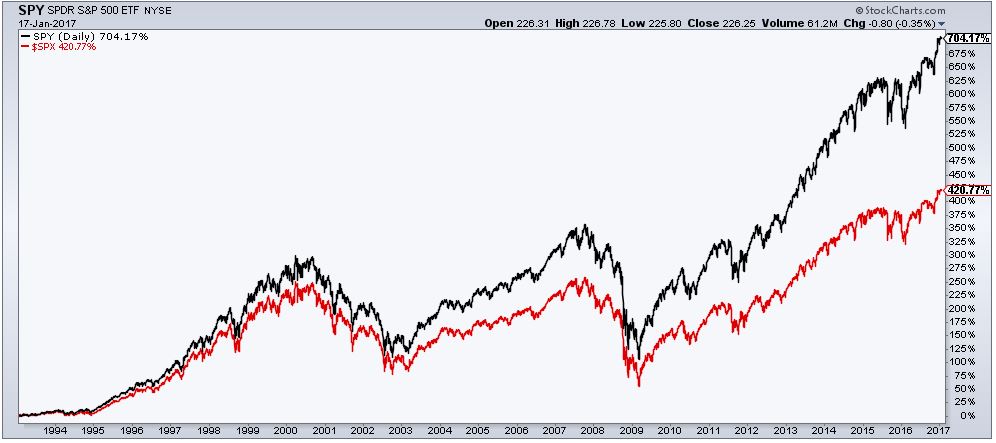

Let’s take a look at what compounding can do in the stock market. The chart below shows SPY since inception, with dividends included, versus the S&P 500 index, price only. The difference in returns over the last 24 years is an astounding 284%!

The cumulative dividend payout over this time is 46%, so this alone isn’t responsible for the gap. The remaining 238% is the magic of compounding; Dividends on top of dividends and returns on top of returns.

The most powerful force in the universe, as Einstein referred to it, is something that eludes many of us for two main reasons. One, most people just don’t understand how it works. For instance, 10% growth for 25 years is not 250%, it’s 985%! The second reason why many fail to take advantage of compounding is because it takes time. Like, a lot of time. Buffett has been rich forever, but 95% of his net worth was earned after his 60th birthday.

Rolf Dobelli said it best: “When it comes to growth rates, do not trust your intuition. You don’t have any.”

Source: