Will today be the day?

Will today be the day?

Yesterday the Dow closed 88 points shy of 20,000 and this morning the Futures are flying up 81 points so far as Europe rallies off of our rally so now we can rally because they are rallying and tomorrow they can rally because we rallied and we don't even need a reason – isn't that great?

We have to hit 20,000 because CNBC has hats in front of all their anchors so the fix is obviously in – the question is what happens next? Earnings, so far, have been decent with companies like JNJ, DD, CNI, CA, EAT, NSC, CP, IBKR and NVS lowering guidance in the past week (3 rails!) while ROK, MKC, BABA, SAP, STX, IBM and NFLX guiding up.

Despite the poor outlook by the rails, material stocks have led the rally this week on expectations of infrastructure spending (a theme I discussed on Money Talk last week). In fact, at last year's Trader's Expo (2/22) in NY, my value investing lecture featured a PowerPoint presentation on Freeport McMoran (FCX) because we saw this coming LONG before Trump got elected. At the time, I said:

- Sell 10 FCX 2018 $5 puts for $2.16 ($2,160)

- Buy 20 FCX Jan $5 calls for $3.15 ($6,300)

- Sell 20 FCX Jan $10 calls for $1.25 ($2,500)

As you can see from the chart, FCX has far exceeded our modest expectations and that trade closed on Friday paying out the full $10,000 for an $8,360 (509%) return on cash in less than a year. I'll be teaching some trading strategies and highlighting some other value picks at this year's Trader Expo on Feb 27th and, before that, we are doing a Live, 2-Day Seminar in Las Vegas on Feb 12th and 13th (sign up here).

Our Oil (/CL) and Gasoline (/RB) Futures shorts are still working. We called those last week in our Live Trading Webinar (Members Only this week) at $53.50 on oil and $1.65 on Gasoline and Oil is all the way down at $52.75 (up $1,250 per contract) and Gasoline is below $1.55 (up $4,200 per contract) as we head into this morning's EIA Inventory Report at 10:30, where another 3Mb build is expected.

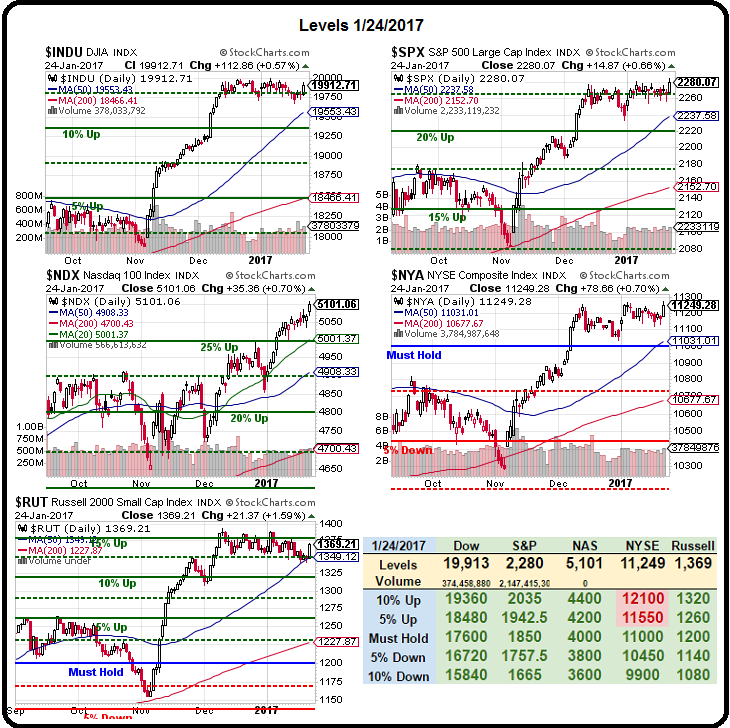

We initially made that call last Tuesday, when I explained how the Oil Market was rigged, which is fine with us since we're betting and it's very nice to know what something is going to do before you bet on it, right? Last Tuesday, the S&P Futures (/ES) were at 2,282 in the morning and now they are at 2,284 so little movement there but the Dow has blasted 300 points off the Thursday lows at 19,650 and the Futures indicated today is the day for 20,000. Very exciting…

This will complete a 2,000-point gain on the Dow from 18,000 since election day and that's about 12.5% and, sadly, it's time for a 2.5-5% correction back to 19,350 or, possibly a bit below 19,000. Since we expect it to happen in short order, we can play the Dow ETF (DIA) short by buying the Feb $199 puts for $1.60, which would pay back $9 at Dow 19,000 for a fat $7.40 (462%) in three weeks.

As a rule of thumb, if your portfolio made $10,000 this month on the Dow's climb and you are too greedy to CASH!!! out, you can hedge against a decline by targeting getting $5,000 back (half your gains) on a 5% pullback to 19,000. Since the puts pay about 5:1, you only need to spend $1,000 on your "insurance" policy to lock in half your gains and let your longs keep riding along.

See, that's all there is to it – now you know how to trade options! The advantage to buying the put is you can't lose more than the $1,120 you spend (in the example) on 7 contracts and 7 contracts pay you back $6,300 at Dow 19,000. The best thing is that having a hedge gives you time to CALMLY unwind your longs as it mitigates the damage during a sell-off. If the market goes higher, you longs will more than make up for the lost insurance bet – especially if you use our patented "Be the House – NOT the Gambler" system!

The weak Dollar has been very supportive of the markets this past week and Trump and his people have been promoting a weak-Dollar policy and talking about trade barriers and immigration bans and sending troops into Chicago and widespread voter fraud etc. etc. – it's enough to make your head spin but it's all talk so far and we are still very much on the sidelines, watching the circus.