"I regret nothing"

"I regret nothing"

That's what Trump said this weekend in his Financial Times Interview and I wonder if Trump knows that's what Deputy Fuhrer Rudolf Hess said at his Nurenberg trial? Among other non-regrets Trump discussed is his tweet about Obama wire-tapping his phone, which he claims "is being proven" and the TrumpDon'tCare Bill, which he claims is "still in negotiations." Trump doesn't just not learn from his mistakes – he doesn't believe his mistakes actually happened.

It's a very dangerous week in Trumpland as the President meets with President Xi of China at Mar a Lago because nothing says "man of the people" like a 126-room, 110,000 square foot house with 58 bedrooms (but only 33 bathrooms so a real bummer when everyone is getting ready at the same time!). Leading up to the historic meeting with China, Trump decided to open with an ultimatum, saying: "If China is not going to solve North Korea, we will.”

We'll see how that plays out on the World stage, there's already a rumor that North Korea is planning to test another nuclear missile to coincide with the meeting on Thursday and Friday – so expect lots of market turmoil ahead this week as the rumor mill swings into full gear.

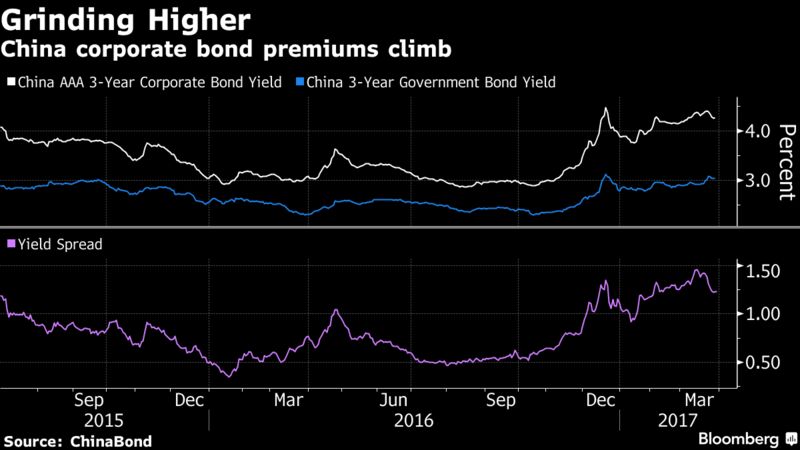

China is very likely to be see as a loser in these talks, even if they win because Team Trump will spin it their way, regardless of reality. Meanwhile, China has bigger fish to fry as bond defaults are ticking up with 9 in the first quarter vs 29 all of last year.

China is very likely to be see as a loser in these talks, even if they win because Team Trump will spin it their way, regardless of reality. Meanwhile, China has bigger fish to fry as bond defaults are ticking up with 9 in the first quarter vs 29 all of last year.

As you can see from this Bloomberg Chart, rates have been rising fast as the PBOC has put the brakes on leverage and, like our Fed and most Central Banks is also seen on a rate-raising path. This has caused about $20Bn worth of bond sales to be scrapped in Q1 due to the "unfavorable" environment but, if the environment continues to be unfavorable – there will be a serious lack of funds and a lot of these companies are juggling the books to stay alive as it is:

“Weak companies can’t sell bonds, which adds to the pressure on their cash flow,” said Liu Dongliang, a senior analyst at China Merchants Bank Co. in Shenzhen. “The pace of defaults will continue. It will be even more difficult for weak companies to sell bonds because corporate bond yields may rise further — the current yield premium doesn’t provide enough protection against credit risks.”

China's ETF (FXI) is a good way to play China short for the week. It's April now so I can't tell you our Member play (free samples are over) but we'll probably buy a put that should make a quick 30-50% by the end of the week. Perhaps though, we'll come up with something more creative using the China Ultra-Short (FXP) – long, of course (now $27.29).

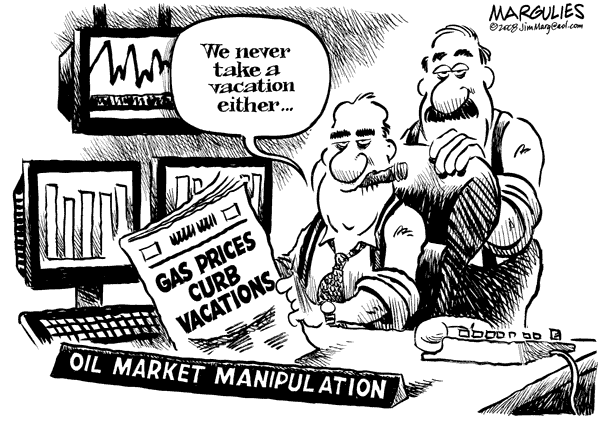

Our only fear is that Morgan Stanley (MS) starts working for China because whenever someone needs a boost (and has a lot of money), MS can find something bullish to say about you. Tesla (TSLA) has been going through the roof on positive analyst spin (and they did deliver over 25,000 cars in Q1, so there's something to it) and now OPEC is getting the MS love with a favorable report saying "less visible" crude stockpiles, including China, Japan and "floating storage around the World" have declined 72Mb this year.

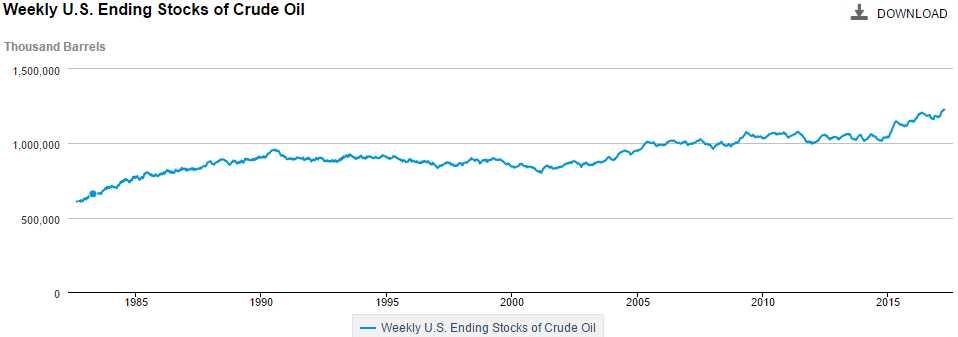

In other words, despite the obviously massive gluts in the US and Europe, on the other side of the World in obscure and unofficial sources, there may be less oil (USO). If MS is having trouble finding the 72M missing barrels (assuming that's not total BS in the first place), they have no further to look than our own EIA report, which shows US oil inventory jumping from 1.181Bn barrels on 12/23/16 to 1.226Bn as of 3/24 – a gain of 45Mb in the US alone in just 3 months.

In other words, despite the obviously massive gluts in the US and Europe, on the other side of the World in obscure and unofficial sources, there may be less oil (USO). If MS is having trouble finding the 72M missing barrels (assuming that's not total BS in the first place), they have no further to look than our own EIA report, which shows US oil inventory jumping from 1.181Bn barrels on 12/23/16 to 1.226Bn as of 3/24 – a gain of 45Mb in the US alone in just 3 months.

We're very happy to be short on oil, just under the $51 mark at $50.75 (/CL) this morning as shuffling a few excess barrels around the globe does nothing to put a dent in our 1.2 BILLION barrels of oil sitting in inventory in the US (6 months worth of imports and 80% of our imports are from Mexico and Canada, not OPEC). You will be reading a LOT of articles today pumping oil because they are desperate to get the price higher ahead of the April sell-off but it's the sell-off (into contract rollovers) we're betting on.

After that, we'll be happy to go long into July 4th and, after that, short again because nothing OPEC says or does will really help them address the massive supply/demand imbalance that exists in the World. Think about it, the only way they have cut 1.5% of global production is to have 18 months worth of historic meetings that led up to a 6-month agreement and now, 3 months into it, they are declaring victory – even though they've done nothing to actually end the glut – they have merely stopped adding to it.

"Yes, sir, your family is still drowning at the bottom of the pool but we've cut back on filling it by 1.5% so nothing to worry about, right?" A glut is "an excessively abundant supply of something" and no one is denying we have an oil glut at the moment. Stopping your excessively abundant supply from getting more excessive and more abundant does not solve the problem and, even as I write this – I can't believe I have to try to make this clear to people…

"Yes, sir, your family is still drowning at the bottom of the pool but we've cut back on filling it by 1.5% so nothing to worry about, right?" A glut is "an excessively abundant supply of something" and no one is denying we have an oil glut at the moment. Stopping your excessively abundant supply from getting more excessive and more abundant does not solve the problem and, even as I write this – I can't believe I have to try to make this clear to people…

All that oil has to be stored and the storage eats into profits, which makes speculating on oil less profitable and speculating is about 60% of the price of oil. That's why you are seeing so many oil-positive article this weekend and that's why firms like Morgan Stanley are pitching in to bail out their oil clients – whatever it takes to bring some money off the sidelines. They'll promise you anything and they will say anything but, behind the curtain, there's 1.2Bn barrels of US oil they need to unload.