Courtesy of Declan.

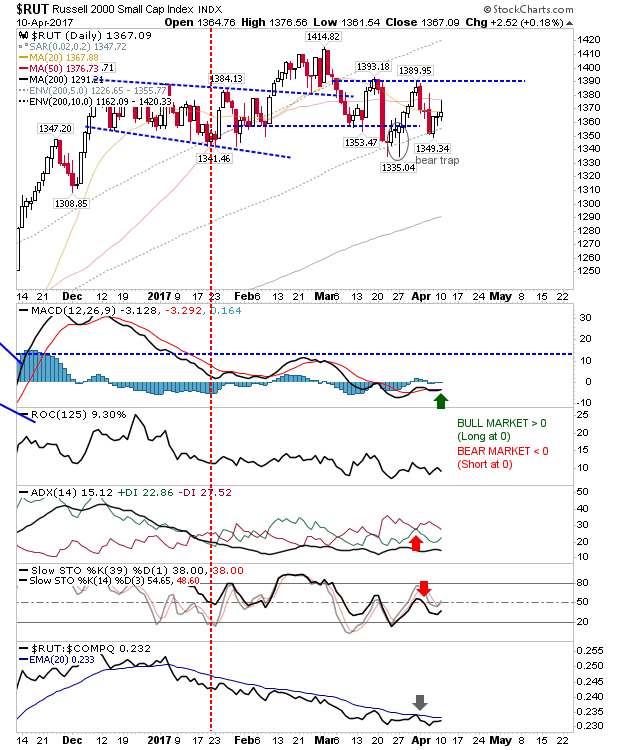

There wasn’t the reaction two days of narrow trading had presented into Monday’s open, but the Russell 2000 made a good attempt at trying to rally. However, it tagged the 50-day MA, then headed back to its starting point. The only change on the day was the MACD trigger ‘buy’. With two spike highs in less than a week the next move to look for is a challenge on the ‘bear trap’.

The S&P posted a third successive doji with the 50-day MA holding as support. Volume has steadily dropped, which runs the risk of seeing prices head lower in the absence of buyers (not necessarily active selling). There is a squeeze coming up with channel resistance converging with the fast rising 50-day MA.

The Nasdaq had a similar day to the S&P, instead, it has the support of the 20-day MA to lean on. Key resistance at 5,930 is the line to cross to generate a breakout – and the 20-day MA is putting the squeeze on.

For tomorrow, look for breakouts in the Nasdaq (for longs), or a drift below the 50-day MA in the S&P and Russell 2000 (for shorts).

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.