$1,000,000,000,000!

$1,000,000,000,000!

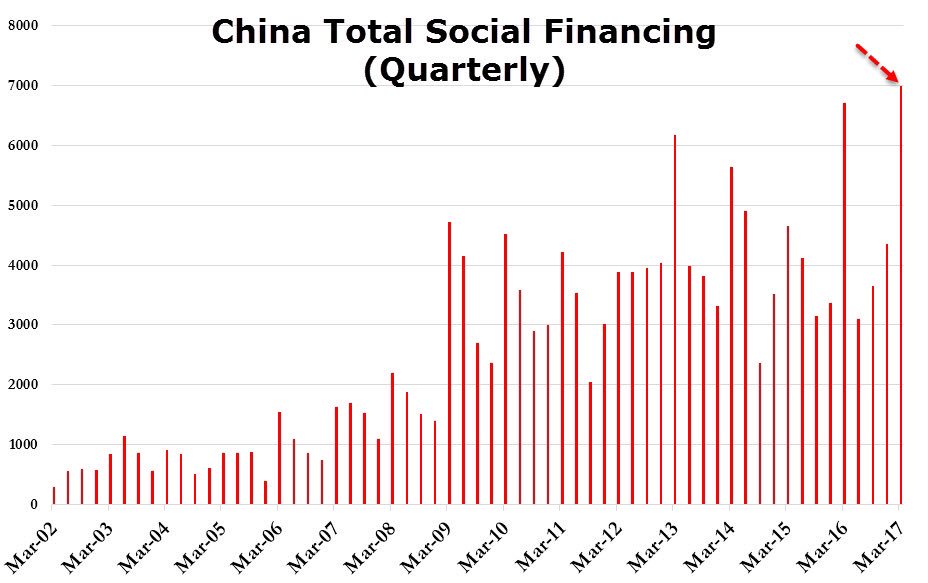

That's a lot of money. It's 1,000 Billion Dollars or one Million Million Dollars and it's how much China spend is just 3 months attempting to keep up appearances while the real economy continues to slow down. Can China keep on spending at a $4Tn annual pace (40% of GDP) for the rest of 2017? Sure they could – because no one seems to give a damn about debt spending anymore – but that doesn't mean they should.

"The Chinese government has a tendency to rely on infrastructure development to sustain growth in the long term," economists at ANZ said in a note. "The question we need to ask is whether this investment-led model is sustainable as the authorities have trouble taming credit. We need to watch closely whether China.’

As you can see from the chart above (priced in Billions of Yuan), China did a similar thing last year in Q1 and then pulled back sharply in Q2 and the boost did very little for the Shanghai Stock Exchange, which opened at 3,550 and finished the year at 3,075 and is now at 3,275 – despite China pouring the entire economy of Mexico into a quarterly stimulus program.

As you can see from the chart above (priced in Billions of Yuan), China did a similar thing last year in Q1 and then pulled back sharply in Q2 and the boost did very little for the Shanghai Stock Exchange, which opened at 3,550 and finished the year at 3,075 and is now at 3,275 – despite China pouring the entire economy of Mexico into a quarterly stimulus program.

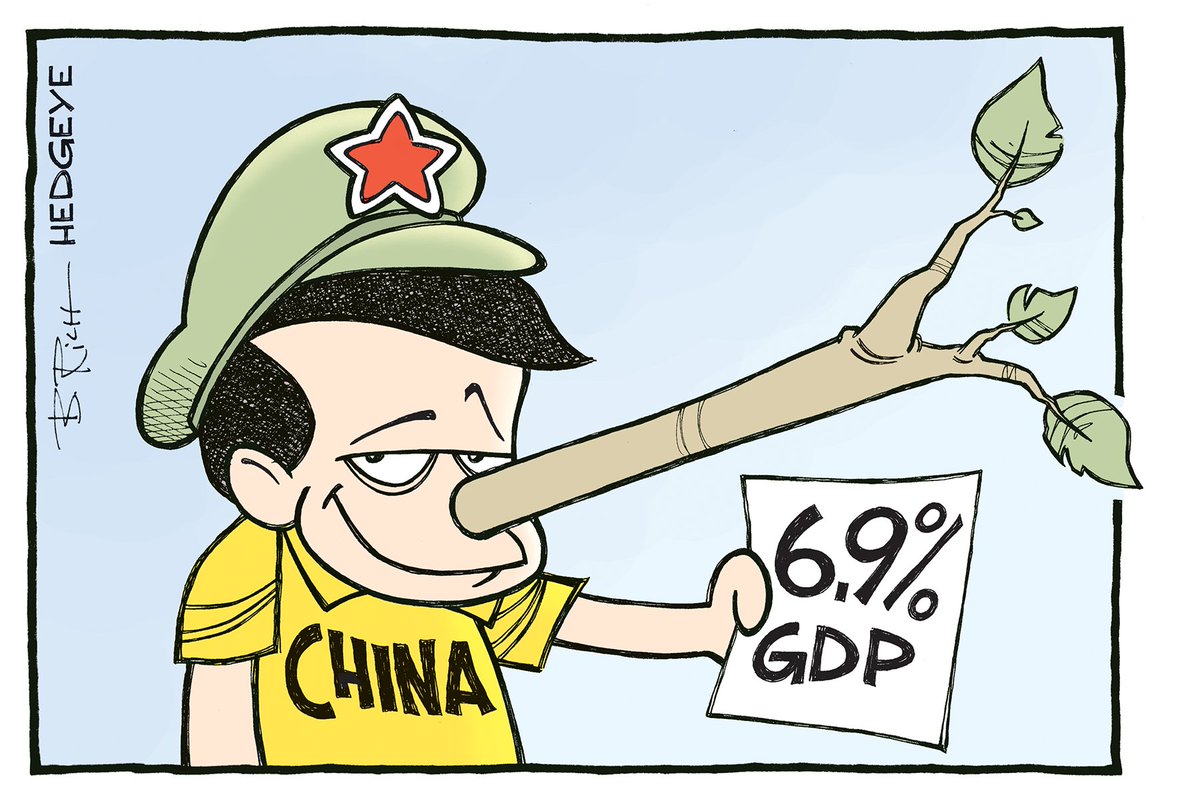

China's true GDP may be overstated by as much as 30% according to Forbes, who point to the alarming collapse of Total Factor Productivity (TFP) since 2010, a pattern reminiscent of the USSR during its protracted period of stagnation preceding its collapse.

Conference Board specialists blame on China’s “socialist-market economy,” which distorts economic incentives, deprives private enterprises of capital, and allocates state investment in favor of state enterprises. Whereas in the 1980s, China’s rates of return on capital were about average for BRICS countries (Brazil, Russia, India, China, and South Africa), current returns have fallen to about half.

Conference Board specialists blame on China’s “socialist-market economy,” which distorts economic incentives, deprives private enterprises of capital, and allocates state investment in favor of state enterprises. Whereas in the 1980s, China’s rates of return on capital were about average for BRICS countries (Brazil, Russia, India, China, and South Africa), current returns have fallen to about half.

As I noted for you on April 3rd, we're shorting China by going long on the ultra-short ETF (FXP) in the following trade (in both our Options Opportunity Portfolio and Short-Term Portfolio):

- Buy 10 FXP May $25 calls for $2.50 ($2,500)

- Sell 10 FXP May $28 calls for $1 ($1,000)

- Sell 3 CHL Sept $55 puts for $3 ($900)

That's net $600 on the $3,000 spread that's $2,000 in the money to start so not a tough bar set to make up to $2,400 (400%) in short order. China Mobile (CHL) is my favorite Chinese stock and I would love to initiate a position on them so it's good cover in case Chinese stocks go higher and, if they don't, we can begin working on a position from there.

Neither FXP or CHL have done very much so far and you can probably still get the spread for about net $600 cash and that's kind of amazing since FXP is over $27.50 which pays $2.50 x 10 contracts ($2,750) if FXP holds that price until 5/19 – barely more than a month away. Even just doing the next $1.50 spread and making $1 is 66% back in a month with no margin required.

Already heavily in the "win" column is last Thursday's FAS trade idea – right from our Morning Report (subscribe here) which took the Ultra-Short Financial ETF (SKF) in a 20 contract May $27/30 bull call spread at $1.60 against 5 short Citibank 2019 $45 puts at $3 for a net $1,700 cash outlay and already, just one trading day later, the May spread is $1.95 ($3,900) and the short puts are $2.95 ($1,475) for net $2,425 – a cash gain of $725 (42.6%) over the weekend – HAPPY EASTER to our readers!

Remember – we can only tell you what the markets are going to do and how to make money trading them – the rest is up to you!

Now both China and the US are heavily embroiled in the North Korea controversy and no, they are not really against each other – mostly the US is leaning on China to do SOMETHING to put a muzzle on NoKo as they rattle their sabers at the rest of the World. Not that this hasn't been going on for decades, of course…

This is why, this morning, you are seeing the markets shrugging off the escalating tensions and oil is calming down again, down under $53 but it's Monday, so we're not going to put much emphasis on today's moves – especially as they are likely to be low-volume affairs as people drift in after the long holiday weekend.

Now it's time to get back to work, I'll be at the Nasdaq on FaceBook Live this morning and we will speak about all sorts of things and then, starting tonight with NetFlix (we're short), we have the start of EarningsPalooza and here are just some of the bigger names that report over the next 5 days:

Data-wise, it's a light week with the Empire State Manufacturing Survey already missing New Orders (7 vs 21 expected) by an Economile (def: "The distance by which Leading Economorons inexplicably miss their projections by on a regular basis."). We have a bit of housing date, Industrial Production Tomorrow (9:15), the Beige Book Wednesday, Philly Fed, Consumer Comfort and Leading Indicators on Thursday and PMI and Home Sales on Friday.

In between that noise we'll have one (1) Fed speaker each day: Fischer, George, Rosengren, Powell and Kashkari and the only reliable hawk (Fischer) is the only one shoved into the evening (5pm) to be immediately negated by George pre-market tomorrow at 9am.

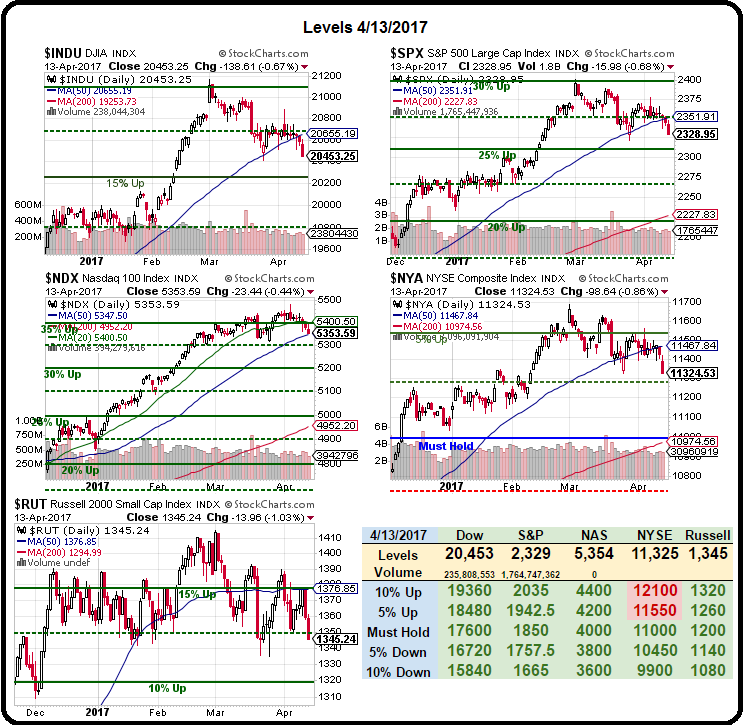

So we know what the Fed wants the market to do this week – now we'll see what it actually does. Meanwhile, as you can see from the Big Chart – we've lost the 50 dma on the Dow, S&P, NYSE and the Russell so, if the Nasdaq fails to hold that 5,347.50 line – look out below!

Oh don't worry, I'm sure Tesla's (TSLA) earnings will justify their market cap being bigger than GM or Ford. ROFL!!! April fools – we're going down!