Here we are again:

- May 9th: Toppy Tuesday – Yet Again

- May 2nd: Toppy Tuesday – Can Earnings Sustain S&P 2,400?

- April 25th: Terrific Tuesday – Markets go Through the Roof

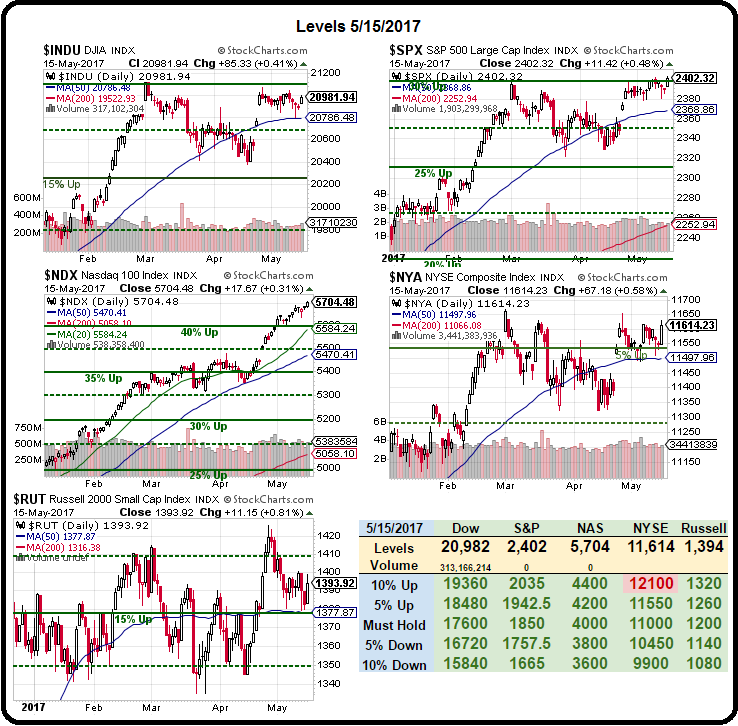

It seems like every Tuesday I have to point out that Mondays are meaningless and, so far, we've made good money shorting the S&P Futures (/ES) at 2,400 as well as Dow (/YM) 21,000 and Russell (/TF) 1,400 but the Nasdaq (/NQ), now 5,708 keeps going up and up, which is no surprise with Apple (AAPL) at $156 – up 10% since April 25th and AAPL is 15% of the Nasdaq by itself.

That adds 1.5% to the Nasdaq and the rest of the Nasdaq's 3% move came from the Dollar falling from 100 on the 25th to 98.35 this morning (-1.65%) and that's the story of how we got here. The fact that the S&P STILL can't get over 2,400 DESPITE the weaker Dollar and the stronger Apple does not give me the warm fuzzies about the strength of this weekly rally so, once again – we are going to be shorting the indexes at the levels we keep shorting them at and once again, later in the week, I will tell you how much money we made and you will say: "why can't I ever catch trades like that." It's a vicious cycle…

Remember, I can only tell you what the market is going to do and how to make money trading it – that is the extent of my powers.

Yesterday morning, for example, in our PSW Report, we picked FEYE as a nice play since the news was all about cyber security and FEYE is a company we've had our eye on. Despite the strong open (our Members get the report long before the market opens) on the stock, the 2019 $12 puts were barely affected and, as late as 2:10 pm, people were still filling the short puts at our $2 target price and they finished the day at $1.84, up 8% for a nice start (see yesterday's post for details on the trade idea).

On Friday it was Cheniere Energy (LNG), based on news of more and more LNG exports opening up and our trade agreement with China (this is not complicated folks, we read the papers and we make a trade) and LNG popped from $47.14 to $49.35 (+4.7%) and the short 2019 $40 puts we sold for $4.50 can already be bought back for $4.20 for a gain of 6.6% in two trading days.

As I explained over at the Nasdaq yesterday (and see the clip for our trade idea on Fiat/Chrysler (FCAU)), using short puts and option spreads can both leverage your cash and DECREASE your risk as a well-balanced spread gives you a hedge when the underlying stock moves against you. Selling short puts to initiate a position is Options 101 over at Philstockworld, where we teach our Members to use options to their advantage.

As I explained over at the Nasdaq yesterday (and see the clip for our trade idea on Fiat/Chrysler (FCAU)), using short puts and option spreads can both leverage your cash and DECREASE your risk as a well-balanced spread gives you a hedge when the underlying stock moves against you. Selling short puts to initiate a position is Options 101 over at Philstockworld, where we teach our Members to use options to their advantage.

Our prior Nasdaq spread on Gilead (GILD), is up 8% in 3 weeks (we just began tracking our Nasdaq picks as they want us to teach people more about options trading) and GILD has gone nowhere during that time. Why is that? Because we are "Being the House – NOT the Gambler". By selling premium instead of buying it, we are participating in what is the only sure bet offered by the market – the fact that, over time, premiums will always end up at zero!

The stock doesn't have to go anywhere for us to make money, we bought 10 2019 $60 ($11.75)/70 ($7.30) bull call spread for net $4.45 ($4,450) back on 4/24, when GILD was trading at $66.25 and yesterday they closed at $65.95, down 0.30 (0.45%) but the 2019 $60 calls are $11 and the $70 calls are $6.20 so the spread is now $4.80 ($4,800) for a $350 gain (7.8%). If GILD finishes at $66, the $60 calls will be worth $6 ($6,000) and the short $70 calls will be worth $0 and the gain would be $1,550 (34.8%) despite the stock not going anywhere at all. If it does go up a bit – to $70 or better, our max gain is $5,550 (124.7%) over the next 600 days.

Despite the never-ending market rally, we now have 25 stocks on our Watch List and I'm sure, in this week's portfolio reviews, we'll have plenty of stocks that are good for a new trade – so there's no lack of opportunity to participate in whatever is left of this rally – just please have the sense to hedge your bets – and keep plenty of CASH!!! on the side – just in case…