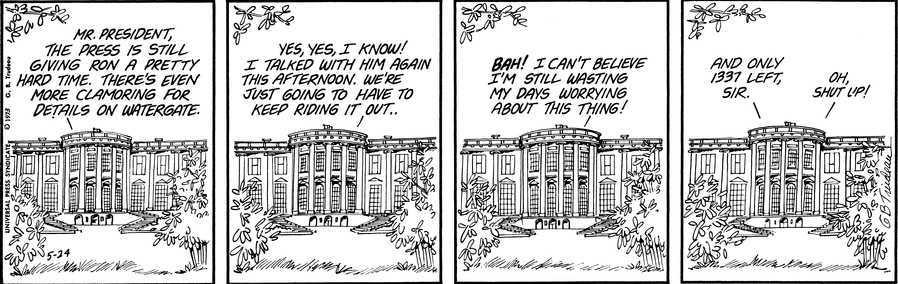

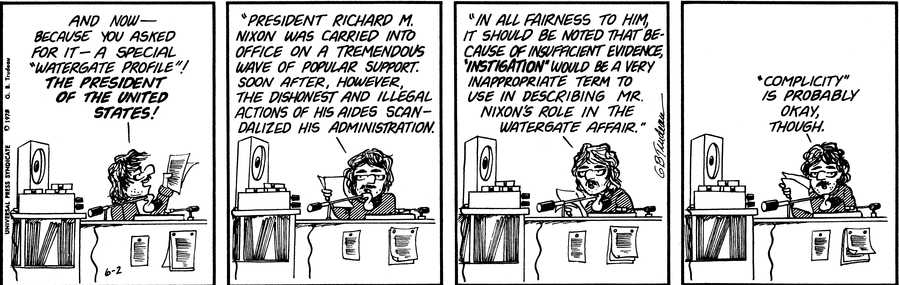

"Don't compare it to Watergate!"

That is the GOP talking point du jour as an Army of Trump apologists storm the media to counter claims that President Trump asked the F.B.I. director, James B. Comey, to shut down the federal investigation into Trump’s former national security adviser, Michael T. Flynn, in an Oval Office meeting in February, according to a memo Mr. Comey wrote shortly after the meeting.

The documentation of Mr. Trump’s request is the clearest evidence that the president has tried to directly influence the Justice Department and F.B.I. investigation into links between Mr. Trump’s associates and Russia. Late Tuesday, Representative Jason Chaffetz, the Republican chairman of the House Oversight Committee, demanded that the F.B.I. turn over all “memoranda, notes, summaries and recordings” of discussions between Mr. Trump and Mr. Comey. Such documents, Mr. Chaffetz wrote, would “raise questions as to whether the president attempted to influence or impede” the F.B.I.

So you see, it's nothing like Watergate, where Nixon was attempting to "stonewall" the investigation – not impede. Totally different this time…

The Watergate incident, like Russia meddling in the US election, took place during the time before the President took office and, like Watergate, Trumpgate is unfolding in May and will likely come to a head in the Summer. In Nixon's case, the break-in happened in June of 1972, Nixon won by a landslide in November of 1972 and a year later, a defiant Nixon said "I am not a crook" and it wasn't until August 8th, 1974 when Nixon finally gave up, two weeks after Congress began impeachment proceedings.

We're still waiting for this generation's "Deep Throat" to step forward and please, be careful if you Google that phrase!

Market-wise, the S&P was at 142 when Nixon was sworn in in January of 1973 and fell 39% to 86 by the time he resigned in August of 1974 as people's faith in the US economy deteriorated along with their faith in it's President. We've all enjoyed the benefits of the "Trump Rally" with the S&P up 317 points (15%) but, as I noted yesterday morning (and 4 Tuesdays before that), 2,400 is a bridge too far for the S&P – no matter how much of Trump's economic BS you choose to believe.

Our shorting lines for the Futures were S&P (/ES) 2,400, Dow (/YM) 21,000 and Russell (/TF) 1,400 and we got a $1,000 per contract drop on /ES, $800 per contract drop on /YM and $1,750 per contract drop on /TF. As I said to our PSW Report readers yesterday:

Once again – we are going to be shorting the indexes at the levels we keep shorting them at and once again, later in the week, I will tell you how much money we made and you will say: "why can't I ever catch trades like that." It's a vicious cycle…

Remember, I can only tell you what the market is going to do and how to make money trading it – that is the extent of my powers.

Playing the Futures is a good way to grab a quick hedge – especially when news moves against your position after hours – like this most recent scandal did. In addition to our Futures shorts (which are great for making quick cash), we just reviewed our hedges in the Short-Term Portfolio (STP) and the Options Opportunity Portfolio (OOP) and we feel that we are adequately covered overall. I will review index hedging in this afternoon's Live Trading Webinar at 1pm, EST.

Playing the Futures is a good way to grab a quick hedge – especially when news moves against your position after hours – like this most recent scandal did. In addition to our Futures shorts (which are great for making quick cash), we just reviewed our hedges in the Short-Term Portfolio (STP) and the Options Opportunity Portfolio (OOP) and we feel that we are adequately covered overall. I will review index hedging in this afternoon's Live Trading Webinar at 1pm, EST.

As you can see from the chart below, this incident has popped the VIX 15% overnight and that will be good for the VIX Short ETF bear put spread idea we shared with you in last Tuesday's PSW Report. It's a little too early to get excited but that spread has a nice $31,000 (344%) upside potential, which would be a massive win for our Options Opportunity Portfolio, which began with just $100,000 in August of 2015 and we're hoping to hit our 2nd anniversary at over $300,000 – up 200% in two years. You can follow the OOP at PSW or over at Seeking Alpha.

In fact, if you want a good laugh, read all the negative commentary I got at Seeking Alpha for daring to call a short on the Short VIX ETF because, as we know, things go up and up forever and never stop, right? That's the problem with a lot of investing sites – they have people there who will talk you out of (or into) any trade and that tends to render them net worthless.

Oops, even as I write this (9am), the markets are taking another leg down and the VIX is taking another leg up as investors are finally starting to realize there is no shiny city on Trump's hill.

Have I mentioned how much I like CASH!!! lately?