Let the witch hunt begin!

Let the witch hunt begin!

Direct from Central Casting we now have former FBI Director, Robert Mueller III playing the role of Special Counsel to investigate what the President alleges are non-existent ties between Russia and Team Trump as well as to determine the extent to which Russia worked to undermine the US elections.

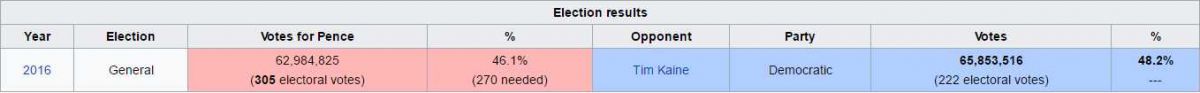

A lot of people are saying if we end up impeaching Trump then Pence will become President but if we're impeaching Trump because the Russians helped him steal the election – why would we then put his running-mate in charge? I guess we'll cross that bridge when we come to it but clearly Mike Pence couldn't get elected dog catcher in 80% of this country. Even now, when I went to the Wikipedia page to check on some Pence facts, I am reminded of the fact that the people had already spoken and they did not vote in favor of him or Trump:

America is one of the only remaining countries on the planet that doesn't elect their leaders using the popular vote and look what a mess we have already – just 112 days into Trump/Pence. Clearly the markets were not pleased with the speed at which this Administration is coming apart at the seams and, of course, as toppy as they were – they were ripe for a nice fall anyway.

A fall is certainly what we got yesterday, with both the Nasdaq (QQQ) and Russell (IWM) falling over 2.5% on the day. According to our 5% Rule™, it it more likely we follow through for another 2.5% drop today and tomorrow than recover and that suits us just fine as we're bearish anyway (and congrats to all who used our bearish index hedges or SVXY hedge from Tuesday morning's PSW Report, which you would never miss by subscribing here).

For the morning, we're looking to see if we get a weak bounce off yesterday's drop and, in the Futures, the Nasdaq (/NQ) fell from 5,700 to 5,550 which is 150 points so the bounce should be 20% of the drop or 30 points, back to 5,580 for a weak bounce and then 5,610 would be a strong bounce and over that line we can say we're putting all this nonsense behind up and, failing that – look out below!

You can see how the weak bounce into the close yesterday failed and gave us a lower low, that's those Pavlovian "buy the dippers" who think every pullback is just another buying opportunity and, so far, that's what hit has been during the Trump Error. At this point, however, we're looking for a more proper correction of 5-10% but we took the short-term 2.5% money off the table and now we patiently wait to see if the bounce lines fail or not.

The way it works for our Futures hedges (our index hedges remain in place regardless – see yesterday's Live Trading Webinar for details) is we "Short the Laggard", which means we set 5 watch lines and, once 3 are crossed to the downside, we short the next two with tight stops and if ANY of the 5 get back over the line – we stop out with a quick loss. The lines we're playing today and tomorrow are:

- Dow (/YM) 20,500 with 20,600 (weak) and 20,700 (strong) bounce lines.

- S&P (/ES) 2,350 with 2,360 (weak) and 2,370 (strong)

- Nasdaq (/NQ) 5,550 with 5,580 (weak) and 5,610 (strong)

- NYSE (no futures) 11,400 with 11,450 (weak) and 11,500 (strong)

- Russell (/TF) 1,350 with 1,360 (weak) and 1,370 (strong)

This is very much a bot-driven sell-off so we can expect our 5% Rule™ to be obeyed but that means it is far more likely we leg down to Dow (/YM) 20,000, S&P (/ES) 2,300, Nasdaq (/NQ) 5,400 and Russell (/TF) 1,300 and THEN we'll see if we get any bounces. By the way, the amount of the strong bounce in stage one is the amount of the weak bounce in stage two so we could predict, for instance, that the S&P will find support at 2,320 on the way down as that will be the weak bounce line off 2,300.

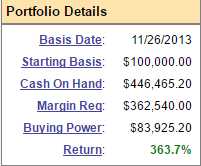

You can see how we used the 5% Rule in June of 2014 to accurately predict the next two years worth of index moves in "Charts from the Future – Updating our Big Chart". Once we have a correction, it will be time to update our charts again but first – we're going to give this long-overdue pullback a chance to play out. As you can see from yesterday's close on our Short-Term Portfolio, it didn't take much of a dip for us to gain 37% ($37,423) since our Tuesday review, when I said to our Members:

You can see how we used the 5% Rule in June of 2014 to accurately predict the next two years worth of index moves in "Charts from the Future – Updating our Big Chart". Once we have a correction, it will be time to update our charts again but first – we're going to give this long-overdue pullback a chance to play out. As you can see from yesterday's close on our Short-Term Portfolio, it didn't take much of a dip for us to gain 37% ($37,423) since our Tuesday review, when I said to our Members:

Short-Term Portfolio Review (STP): Another month another $24,000 in losses at $426,277 but the LTP has made a BOATLOAD of money. I don't know how much exactly because SLW is screwed up but we were at $1,297,315 on April 9th and now, without SLW, which was a big winner, we're still at $1,345,something. So, all in all, our paired portfolios are performing perfectly and the STP is costing us right about 1/3 of our gains – exactly as it should be doing.

The key is whether or not the STP keeps us in neutral on the way down but, sadly, there's no way to tell BECAUSE THIS RIDICULOUS MARKET NEVER GOES DOWN!!!

We finally got our wish and got a live test of a market pullback and we did a quick review of the Long-Term Portfolio in yesterday's Live Trading Webinar. So far, it's holding up well at $1,326,538 so we lost about $18,something while the STP, which hedges it, gained $37,something. That is EXACTLY how our hedges are supposed to work and, if we get them just right, we actually make net money (+$19,000ish, in this case) in both directions. Why, because, underneath each bet we are BEING THE HOUSE and selling premium to suckers who are betting on more extreme moves than the ones we're hedging against.

Speaking of hedges, it's very last minute with options expiring tomorrow but you're welcome for last month's quick hedging ideas:

- 30 S&P Ultra-Short ETF (SDS) May $13 calls at 0.30 ($900) are now 0.45 ($1,350) – up $450 (50%)

- Oil ETF (USO) July $12 calls are still 0.10 and we still like them.

- Oil Futures (/CL) at $48.50 are now $48.85 – up $350 per contract.

- 10 Gasoline ETF (UGA) July $24/27 bull call spreads at net $1.30 ($1,300) are now $1.50 ($1,500) – up $200 (15%)

- Gasoline Futures (/RB) at $1.55 are now $1.58 – up $1,260 per contract.

These are just the free samples folks, this morning report is perhaps 20% of what we do inside every day at Philstockworld – just a simple overview of the markets so we can get ready for our trading day. I'll see you inside for some more trade ideas or I'll see you tomorrow,

– Phil