.jpg) Wheeeeeee!

Wheeeeeee!

We love a good sell-off but we cashed in our index shorts with huge gains last Friday (you're welcome) and this morning, the Oil (/CL) Futures longs we kept (also picked for you in Friday Morning's PSW Report) are up $1,000 per contract at $46.50 and Gasoline (/RB) just hit $1.52, which is up $1,260 per contract and we are taking the money and running on both of those while waiting for the bounces to reload our index shorts.

It's really all about the Nasdaq (/NQ) which, so far, has fallen from 5,900 to below 5,700 but we'll be looking for a weak bounce over the 5,700 line (40 points) to 5,740 so going long on /NQ is a no-brainer this morning with tight stops below the line. If we make a strong bounce (5,780) today, then all of Friday's sell-off can be quickly forgotten but failing the weak bounce would be a bearish sign and we'd be looking for other indexes to short as well.

Mondays are, of course, meaningless days in the market, especially in the summer and we'll have to wait until tomorrow to see what's really going on but a huge correction like we had on Friday COULD lead people to contemplate that some of the overbought crap they have in their portfolios may not actually be worth 100 times earnings.

Speaking of Tesla (TSLA), the lock-up period on their secondary offering ends on the 15th (Thursday) and 1.335M shares that were sold for $262 on March 20th can now be sold for $350+ (up 33%) at the same time as the long-term growth prospects of the company are being questioned. On top of that, another 3.2M shares become convertible at $327.50 and bond-holders look at that as a bonus and may be quick to flip a 10% quarterly gain – that's the danger of constantly raising Billions each year to fund your cash burn.

Speaking of Tesla (TSLA), the lock-up period on their secondary offering ends on the 15th (Thursday) and 1.335M shares that were sold for $262 on March 20th can now be sold for $350+ (up 33%) at the same time as the long-term growth prospects of the company are being questioned. On top of that, another 3.2M shares become convertible at $327.50 and bond-holders look at that as a bonus and may be quick to flip a 10% quarterly gain – that's the danger of constantly raising Billions each year to fund your cash burn.

As you can see from the chart on the left, without subsidies Tesla's sales fell off a cliff in Denmark and TSLA's US EV Tax Credits have only until Q1 '18 before they drop in half to $3,750 and, by Q3 '19, they will be down to $1,875 before terminating completely in 2020.

That's an even bigger problem for Tesla as Toyota (TM) hasn't even begun using their credits and Toyota customers will be getting double the rebates Tesla customers get in 2019 and then Ford and BMW will have the advantage in late 2019 and 2020. Being first to market may give you an early advantage but, in this case, it turns into a strong disadvantage down the line.

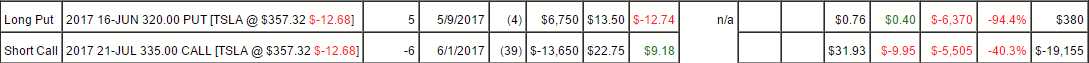

We went short on TSLA back in May and boy that was a disaster (we're still trying to wriggle out of that trade). See: Tesla’s Earnings Miss – Emperor Musk has no Clothes! Still, nothing has changed our mind regarding TSLA's true value being well below $300 and our current position (after rolling our initial loser) in our Short-Term Portfolio is:

So we started with a net $6,900 credit and it's not likely the June puts will go back in the money (Friday is expiration and TSLA would need to drop 10%) so we're just crossing our fingers now and hoping the stock goes back below $335 by July expiration (21st) so we can net out of the whole trade even (from our initial loss in May), though selling those $335 calls now for $32 nets you short at $367 – I love that as a new play! If July doesn't work out, we'll roll the short calls along because, EVENTUALLY, reality will kick in and tank this stock – knowing when is the tricky part…

So we started with a net $6,900 credit and it's not likely the June puts will go back in the money (Friday is expiration and TSLA would need to drop 10%) so we're just crossing our fingers now and hoping the stock goes back below $335 by July expiration (21st) so we can net out of the whole trade even (from our initial loss in May), though selling those $335 calls now for $32 nets you short at $367 – I love that as a new play! If July doesn't work out, we'll roll the short calls along because, EVENTUALLY, reality will kick in and tank this stock – knowing when is the tricky part…

Today is going to be a watch and wait day for the most part, though we usually find something fun to trade during our Live Member Chat room. As I mentioned above, we're long /NQ and looking to reload on Oil and Gasoline as well as our index shorts if the Nasdaq fails it's weak bounce line.

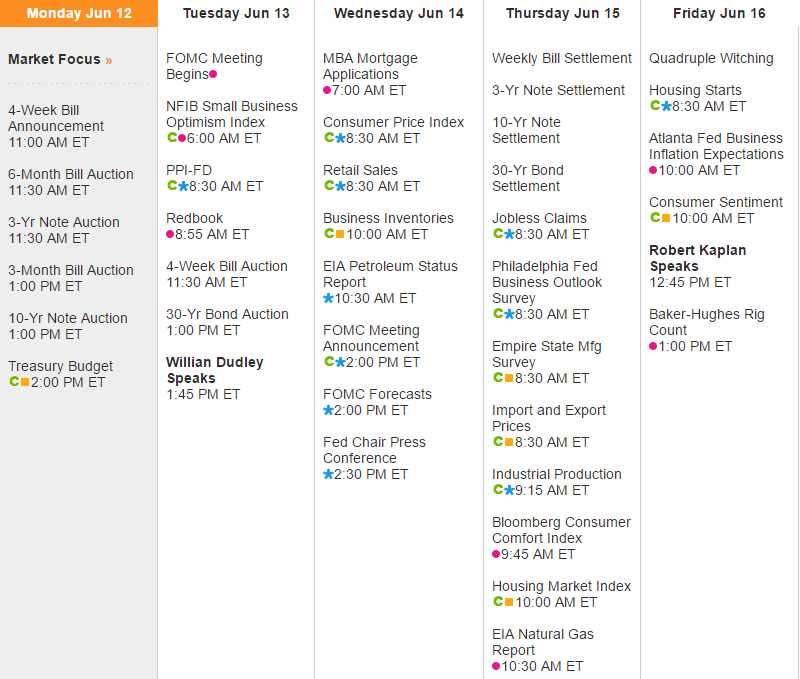

As I noted on Friday, it's a big data week with the Fed Rate Decision on Wednesday (2pm) and, very unusually, Bill Dudley is speaking Tuesday at 1:35, the day before the meeting and Kaplan speaks on Friday so it seems to me they are going to be hiking and feel the need to steer expectations over and above the usual quiet period around a meeting. I don't think enough people are expecting a Wednesday hike – we'll see how that plays out during the week.

Be careful out there.