The Constant Reminder

Courtesy of Michael Batnick

One of the benefits, maybe the only benefit of watching the market as closely as I do, being that I’m not an active trader, is that I’m constantly reminded that I have no idea what’s going to happen.

The S&P 500 (total return) has experienced eight straight years of gains. It’s been five and a half years since a 20% decline. The CAPE ratio is at 28. And a new administration entered the White House. Coming into 2017, I don’t think many people would have predicted we’d experience below-average volatility in the stock market.

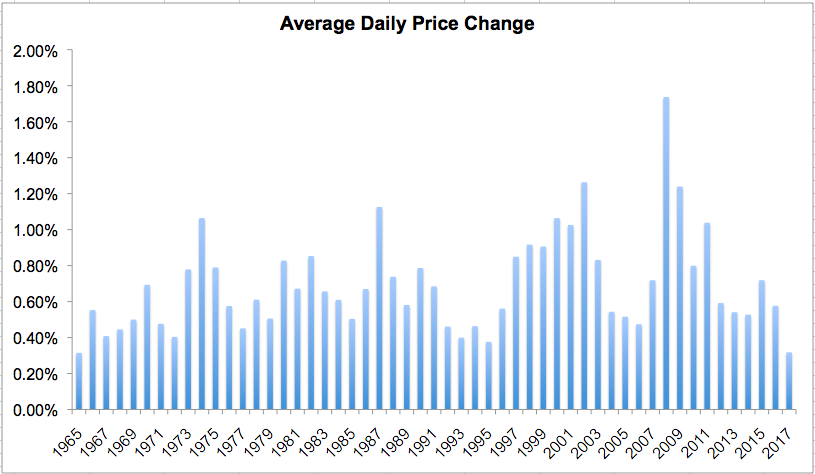

For the first half of the year, the average absolute daily price change, meaning all negative signs are removed, is just 0.32%. If the year ended today, this would be the smallest daily price change since 1965! It’s hard to imagine a period in which there’s been such a wide gap between daily political volatility and daily stock market volatility.

Not only has the market been incredibly quiet, but it has also been incredibly resilient. The S&P 500 has been within 5% of its all-time high for 261 straight days. The last time it was more than 5% away was July 27, 2016. That lasted one day. So going back to March 2016, the S&P 500 has been within 5% of its all-time high for 332 out of 333 days.

Investors have had it easy for the last year and a half. Sure there have been external distractions and reasons to be cautious, but in terms of the market itself, it has been a relative walk in the park. This could change at any time of course, and in fact I would expect it to. It’s hard to imagine the seas staying this calm for much longer, so make sure your portfolio is ready for when things get a little bit bumpy.