You'll get nothing and like it!

You'll get nothing and like it!

That is the new GOP plan for your health care as their 3rd attempt at crafting a replacement for Obamacare goes down in flames. "Republicans should just REPEAL failing ObamaCare now & work on a new Healthcare Plan that will start from a clean slate. Dems will join in!" wrote the Whiner in Chief on Twitter last night. He was right, I am tired of whining…

All this political turmoil (and yes, Russia is still a thing) has not been good for the Dollar, which is down another 0.5% this morning to 94.40 and that is the only thing keeping the indexes afloat at the moment as Europe is down 0.5-1%. The weak Dollar is also boosting commodites and Brent Oil (/BZ) is at $49.40 while Texas Oil (/CL) is $47.15 and back below the $47 line is a great place to short (with tight stops over) as Ecuador has broken ranks with OPEEC and will be pumping more oil AND, much more important, the EIA projects record US shale output in August that will add another 3.5Mb to our bloated inventories.

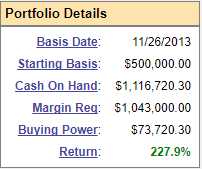

I put out a note to our Members this morning to short /ES at 2,457.50 and we're going to review our Member Portfolios and press our hedges as we made RIDICULOUS gains while I was on vacation and we want to lock them in. In our June 18th Long-Term Portfolio Review, we were at $1,399,805, which was up 180% from our $500,000 start back on 11/26/13 and, as of yesterday's close, we're at $1,639,658 (up 227%). That is up a RIDICULOUS $239,853, which is up 17% from where we were a month ago and a gain of anoither 48% from our $500,000 principle.

I put out a note to our Members this morning to short /ES at 2,457.50 and we're going to review our Member Portfolios and press our hedges as we made RIDICULOUS gains while I was on vacation and we want to lock them in. In our June 18th Long-Term Portfolio Review, we were at $1,399,805, which was up 180% from our $500,000 start back on 11/26/13 and, as of yesterday's close, we're at $1,639,658 (up 227%). That is up a RIDICULOUS $239,853, which is up 17% from where we were a month ago and a gain of anoither 48% from our $500,000 principle.

Not only that, but our Short-Term Portfolio, which we use to hedge our Long-Term Portfolio, also made money. It was "only" up $17,651 for the month but, when your hedges don't lose money while your long positions do – that's unusual and it's something you should certainly take advantage of the situation and either raise more CASH!!! (have I mentioned how much I like CASH!!! lately), lock in your gains or both.

In our Options Opportunity Portfolio, which is tracked over at Seeking Alpha, is a self-hedging portfolio we started with $100,000 back on Aug 8th of 2015. As we approach our 2-year anniversary, that portfolio is now up well over 200% as well and we're well ahead of our original goal to make a more modest 5% per month on our positions (it was originally called the 5% Portfolio but that was deemed "too confusing" by SA). In our 6/18 review, we only made one change – getting more aggressive on Apple (AAPL) on the dip to $140 – and that worked out nicely.

Before I left for vacation on June 27th, we added 4 new bullish positions to the OOP on CSCO, FNSR, GE and TGT (all of which were noted the next morning in our PSW Report for cheapskate readers) and all but GE are already making progress so we'll want to lock in our new gains in the OOP as well. Even as I write this, the indexes are turning down for whatever silly reason and already the /ES shorts are up 5 at 2,452.50, which is good for gains of $250 per contract in just over an hour – a good way to start our day and a great example of the advantage you gain when you learn how to use Futures contracts to hedge your positions, rather than twiddling your thumbs waiting for the regular markets to start trading.

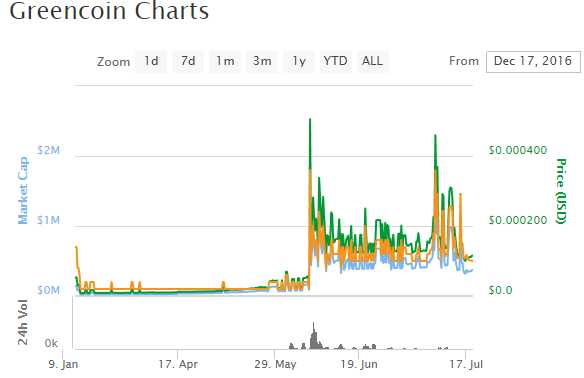

I don't talk about crypto-currencies here but BitCoin has been on a wild ride, falling from $2,555 on the 8th to $1,826 (down 28%) on Sunday and now it's Tuesday and it's back to $2,273, which is up 24% though still a long way back to $2,500 due to the magic of MATH! We have a Digital Currency section over at PSW, so I won't bore you with details but we're still accumulating those GreenCoins and you can see the volume exploding along with our quick 100% gains (so far).

I don't talk about crypto-currencies here but BitCoin has been on a wild ride, falling from $2,555 on the 8th to $1,826 (down 28%) on Sunday and now it's Tuesday and it's back to $2,273, which is up 24% though still a long way back to $2,500 due to the magic of MATH! We have a Digital Currency section over at PSW, so I won't bore you with details but we're still accumulating those GreenCoins and you can see the volume exploding along with our quick 100% gains (so far).

In fact, PSW will soon be accepting GreenCoins as Membership payments so a good way to give yourself a Member discount is to buy GreenCoin on the dips and pay for your subscription on the rips! It's a fun experiment in Digital Currency trading AND it's good for the environment as GreenCoins help create carbon credits – that's a currency with a purpose!

The next step for GreenCoin is to get someone like WFM (soon to be AMZN) to accept them as payments. Anyone with an environmentally-friendly agenda can use the coins as either straight payments or a form of rewards or discounts and that's why we like them as the future of digital currencies will be customized, purpose-driven currencies like this one. BioDeiselChris wrote a nice primer on how to by digital currenies HERE.

To me, there's not much sense in investing $2,273 in a single Bitcoin, hoping it will get to $5,000 for not even a double when I could, instead, buy 11,365,000 GreenCoins (or any other up and coming currency) and hope it catches on and goes to a penny, where they'd be worth $113,650 for a 50x gain. This happens in the Crypto World with alarming regularity among the small plays so think of it as playing roulette – spread some money around and hopefully you pick a winner BUT, keep in mind – it's very easy to lose it all, so fun bets only!

We're waiting on earnings to make some new calls but those calls are still Members Only during the month of July (any earnings month), so I suggest you subscribe to the PSW Report for the bargain price of 15,000 GreenCoins per day!

Isn't trading fun?

Tickers of note: GBTC, BTSC, COIN, BITCF, SPY, USO