Beat crazy!

Beat crazy!

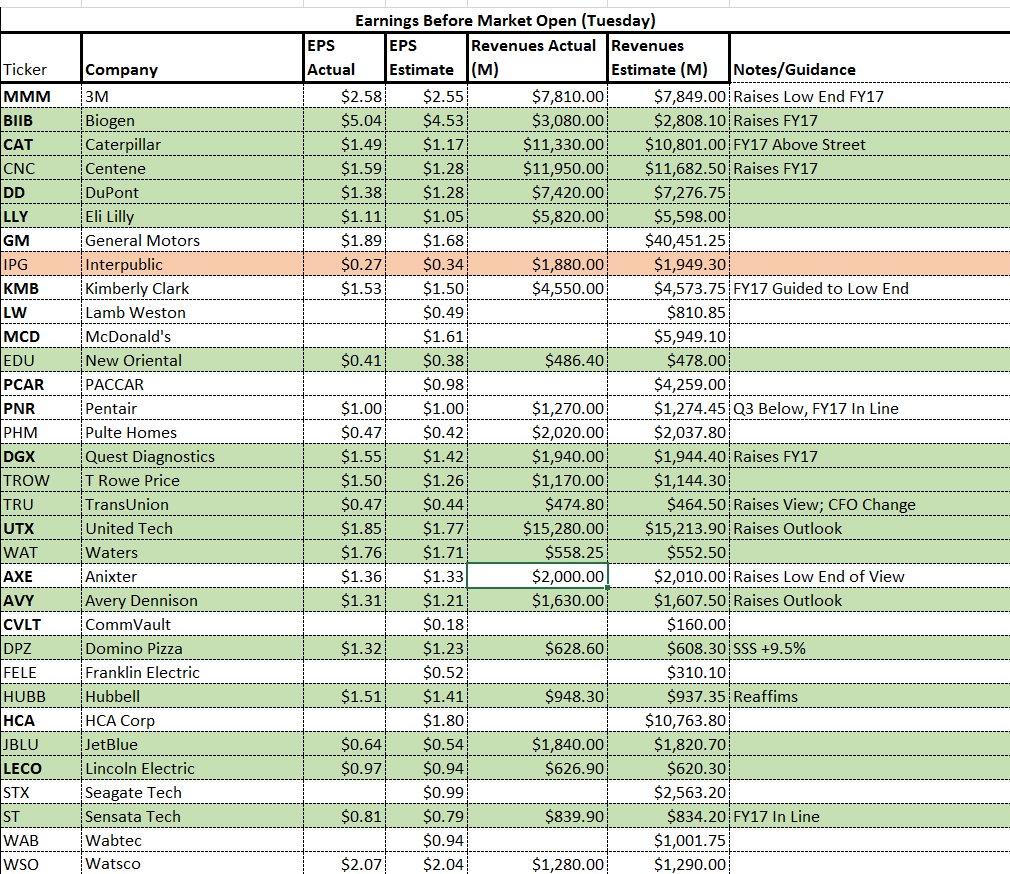

With the very notable exception of Google (GOOGL), who had higher than expected Traffic Acquisition Costs, most of today's reporting companies are nicely green and oil (USO) is back to our shorting line at $47.20 (/CL Futures) after yeasterdsay's failure to turn back down from $46.50, which is a loss of $700 per contract if you did not heed our warning, in yesterday morning's PSW Report, to use tight stops.

Nonethelss, you can be redeemed by doubling down at $47.20, which would raise your short average to $46.85 and then get out of at least half even there and back to tight stops above $47.25, which we shouldn't even see if oil remains weak. That lines up with $49.50 on Brent Oil (/BZ) – which also should be a point of non-futile resistance.

Seagate (STX) just missed and is down 20% and that does not bode well for Amazon (AMZN), who we've been shorting to no avail, as the only place they make any money is cloud storage. That's right, turns out it's not profitable to pack and ship you a $3.99 case of Pepsi overnight – who'd have thought? I was at the post office yesterday, contemplating what a stupid business Amazon really is. Yes, it's nice that they can ship me all that stuff but, even at the post office, shipping costs are expensive and AMZN doesn't MAKE the stuff they ship, they only get a commission on it. Even if they send you a book, where they take 30% of the sale price – by the time they pack, wrap and ship it to you – it's break-even at best.

That's why Amazon doesn't have any real competition – there's no money in their business, why would anyone compete? Don't get me wrong, you can sell the crap out of a service that doesn't make any money because the people will love it but how long before they wise up? For instance, I was at the super market and I saw Starbucks (SBUX) Cold Brew Cofee with cream, cocoa and honey – 3 things I like in coffee so, even though it was $4, I had to buy one and it was good (long SBUX!) but $4 is ridiculous so I went to good old Amazon to see if I could save money by buying in bulk.

That's why Amazon doesn't have any real competition – there's no money in their business, why would anyone compete? Don't get me wrong, you can sell the crap out of a service that doesn't make any money because the people will love it but how long before they wise up? For instance, I was at the super market and I saw Starbucks (SBUX) Cold Brew Cofee with cream, cocoa and honey – 3 things I like in coffee so, even though it was $4, I had to buy one and it was good (long SBUX!) but $4 is ridiculous so I went to good old Amazon to see if I could save money by buying in bulk.

Amazon had it all right, but at $28.50 and I was going to buy it but then I realized it was not for a case, but for 4 bottles – that's $7.12 each! $7.12 is much more than $4 – and I have to say that because it's come to my attention we have Conservative readers, who aren't good with facts or math or logic… Anyway, paying 78% more through Amazon is not a habit most can afford and I've come to notice almost everything I buy on Amazon is expensive because I installed the Wikibuy extension to my browser (Chrome), which pops up and tells you what an idiot you are for overpaying for things (it finds you better prices on other sites automatically while you shop).

What happens to Amazon when our phones get smarter and our computers get smarter and they learn how to save you money on everything you order? That will quickly level the playing field for other vendors as your phone is quite happy to check out 1,000 different sites while you wait a few nano-seconds and then it will give you exactly what you want for the lowest price that's shipped when you want it – do you then care who it's actually from?

What happens to Amazon when our phones get smarter and our computers get smarter and they learn how to save you money on everything you order? That will quickly level the playing field for other vendors as your phone is quite happy to check out 1,000 different sites while you wait a few nano-seconds and then it will give you exactly what you want for the lowest price that's shipped when you want it – do you then care who it's actually from?

Amazon is a fast, convenient way for you to buy things and it "knows you" and shows you things you probably want but these are all things that AI will be doing for you shortly and AI will be learning to do it for you personally, learning all your likes and dislikes and, unlike Amazon, your personal AI will be motivated to save you money.

That's because AI's will be sold based on what they can do for YOU, the AI-sellers will make their money by helping you spend less and be more efficient when you shop, work, etc. The best companies already use Artificial Intelligence to maximize efficiency and minimize costs – it will be great for consumers when you have that same power in your hand but not so great for retailers when their magins begin to collapse and absolutely awful for middle-man businesses like Amazon, when their technological advantage disappears.

AMZN is hovering around $1,040 and I'm very surprised they aren't down pre-market off Seagate's poor earnings. I imagine people think AMZN is taking market share from STX but, as I have told our Members for years, ultimately, cloud storage is a commodity and it will ultimately lose it's margins, no matter how big it grows. Amazon announces earnings on Thursday and the January $1,100 puts can be bought for $101.50 and the January $1050 puts can be sold for $72.50 which is net $29 on the $50 spread that's in the money to start. If you are really brave, you can sell the $1,200 calls for $21.50 and that drops the net of the spread to $7.50 with a potential $42.50 (566%) profit if AMZN is below $1,050 come January expirations.

I'm not saying that this particular earnings will be the end of Amazon's 40% run for the year but we do like $1,050 as a pullback level per our 5% Rule™ and the 300-point rally is very likely to give us a 60-point pullback (weak) to $990 or possibly a stronger one to $930, which offered very brief resistance on the way up.

It also helps our cause that, even if AMZN doesn't miss and makes the anticipated $1.42 per share for the Quarter, that only keeps them on track for MAYBE earning $7 for the year which is 1/150th of $1,050 – that's kind of expensive for a tech company and insanely expensive for a retail company and even ridiculous for a storage company. After all, Seagate has a p/e of just 16 yet they just took a 20% hit on their earnings!

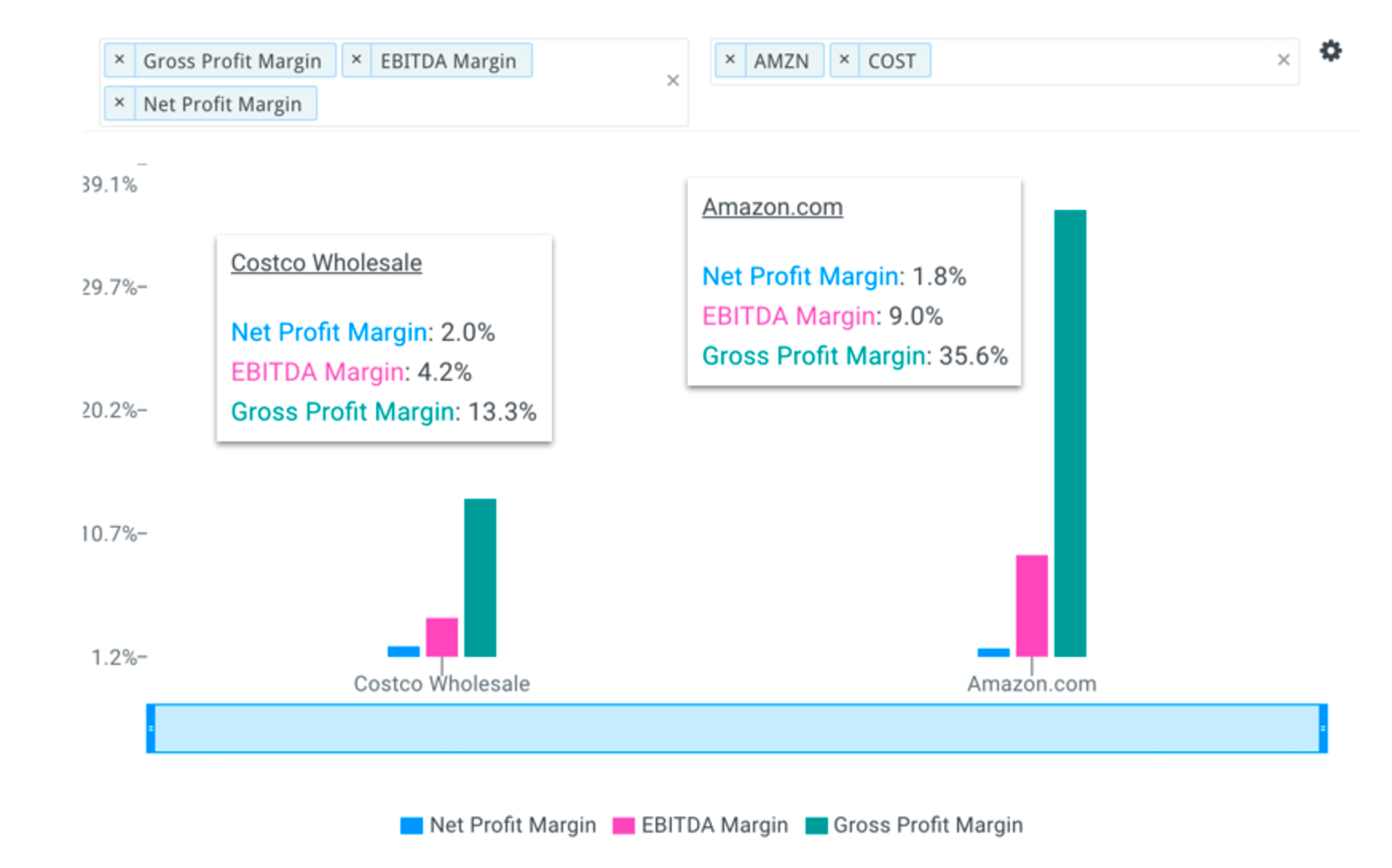

Like CostCo, Amazon makes most of their money selling memberships to their customers, not from selling the actual stuff. Their net profit margins are lower than COST even though their gross profits are higher. That's those packing and shipping costs eating into the margins and they can automate it all they want but it still costs more than having people come by and picking up their own stuff so Big Box Retailers will always have that advantage over Amazon.

Like CostCo, Amazon makes most of their money selling memberships to their customers, not from selling the actual stuff. Their net profit margins are lower than COST even though their gross profits are higher. That's those packing and shipping costs eating into the margins and they can automate it all they want but it still costs more than having people come by and picking up their own stuff so Big Box Retailers will always have that advantage over Amazon.

The mall by my house (Willowbrook) uses a new service called Deliv that, for $5, delivers anything(s) in the mall to your home the same day. Again, once my phone gets smarter and the vendors begin chipping in to make that service free to me – what exactly do I need Amazon for? These are not today problems for Amazon but they are certainly tomorrow problems and you don't pay 150 times earnings for companies with tomorrow problems, do you?

The markets are very enthusiastic into tomorrow's Fed meeting and they certainly haven't let us down in quite a while but I'm more of a mind to short at 5,940 on the Nasdaq (/NQ) and 1,445 on the Russell (/TF) as long as the Dow is below 21,650 (/YM) and the S&P needs to be below 2,480 (/ES). We're long the Dollar (/DX) at $93.50 and long Natural Gas (/NG) at $2.925 so we'll see how those go – along with our Oil shorts (/CL).