Wheeeeeee – This is fun!

Dow 22,000 is our shorting spot (predicted last week) and we hit that that yesterday after Apple (AAPL) announced their earnings and popped $10 after hours, adding 85 points to the Dow. This gave institutional sellers the perfect cover to dump everything else and the index is back below 21,950, despite Apple's help. 50 points on the Dow (/YM) Futures is $250 (you're welcome) but we can do much better than that and we will be taking advantage of today's pop to add to our hedges (while it's cheap) and that's for Members Only but, for you, the cheapskate reader, we can give you a new hedging idea using the Dow Ultra-Short (DXD), which is a 2x inverse ETF:

- Buy 100 DXD Oct $11 calls for 0.45 ($4,500)

- Sell 100 DXD Oct $13 calls for 0.12 ($1,200)

- Sell 5 AAPL 2019 $120 puts for $4 ($2,000)

DXD is at $11.24 so in the money and $13 is $1.66 away or 15% so a 7.5% drop in the Dow will pay you back $2 x 10,000 options (100 per contract) or $20,000 and the net cost of the spread is $1,300. That's a profit of $18,700 (1,438%) if the Dow drops 7.5%, and stays down, into the October expirations. You are obligating yourself to buy 500 shares of AAPL at $120 ($60,000) so make sure you REALLY want to own AAPL if it drops 20% but, chances are your will be safe with that bet if the Dow stays up and, if the Dow falls and puts AAPL in the money, then you have an extra $20,000 to buy the shares with!

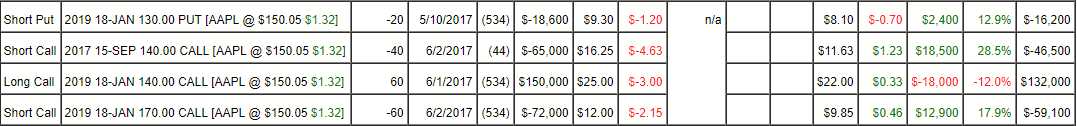

Meanwhile, we could not be more pleased with the AAPL options we do have. AAPL is the largest holding in our Options Opportunity Portfolio and we had already gained $15,800 on our net $5,600 credit position so up $21,400 but that's nothing as our profit potential for AAPL is $185,600 so we're merely "on track" to our goal of $170. No wonder the Options Opportunity Portfolio is up 200% in two years!

We will have to roll out the short callers but, for now, they serve as protection for our long-term gains. We also have AAPL in our Long-Term Portfolio and our Butterfly Portfolio, which is not surprising as AAPL was our pick for Stock of the Year in 2013, 2014 and 2015 – when it was a whole lot cheaper than it is today and it remains our largest holding, despite the fact that we keep taking profits and cutting back our positions. In fact, just yesterday, in our Live Member Chat Room, we added this AAPL play ahead of earnings:

As a new trade, I really love that AAPL 2019 $140 ($21.50)/$175 ($8) bull call spread for $13.50. It's a great way to get into AAPL at $150. If AAPL goes up, then you are on track to getting $35 back (+159%) and, if it goes down, then you can sell puts and widen the spread.

Although it was a nice, conservative way to play Apple, it's well on track for a 159% gain already. That spread required no margin, just $1,350 cash per contact (100 options per contract) and you will get back $3,500 if AAPL is over $175 in January of 2019. Options are not complicated AND we didn't have to tie up $15,000 on 100 shares of stock AND we limited our downside risk (can't lose more than $1,350) – aren't options great?

.jpg) Futures are great too, as evidenced by our $7,400 net gain on Oil Futures (/CL) after a very bumpy ride. For those of you who came in late, reading yesterday morning's PSW Report, the shorting line was $50 and a move to $48.50 was good for gains of over $1,500 per contract for the day. This, however, was our trade from last Wednesday's Webinar and, although it made $21,240 for the day, the net gain after a week was "only" $7,400 and we took it off the table a bit higher at $48.50, where we called for a bounce in our Live Chat Room.

Futures are great too, as evidenced by our $7,400 net gain on Oil Futures (/CL) after a very bumpy ride. For those of you who came in late, reading yesterday morning's PSW Report, the shorting line was $50 and a move to $48.50 was good for gains of over $1,500 per contract for the day. This, however, was our trade from last Wednesday's Webinar and, although it made $21,240 for the day, the net gain after a week was "only" $7,400 and we took it off the table a bit higher at $48.50, where we called for a bounce in our Live Chat Room.

If you go back to last Thursday's morning Report, you can see why we had the conviction to stick with our short oil positions, adding to them on the way up but it was rough sledding and a real nail-biter as we crested $50. As our Member Craigs620 said:

CL -Phil it amazes me how you call these right more often than not but that was indeed a rough ride. Thanks for reassuring yesterday so I could hang in for most of that ride. I stopped out at 48.90 with a nice profit as I just couldn't handle the thought of a quick spike up.

This morning, we're back to shorting oil again at $49.20 (our strong bounce line) and we'll see what happens at the 10:30 inventory report but very tight stops over $49.25 – if oil is still weak, it shouldn't be over that line. The Dollar is still in the doldrums and we like it long here (92.75 on /DX) and, for the Futures-challenged, you can buy the Dollar ETF (UUP) Sept $24 calls for 0.35, which make a quick 0.65 (185%) if UUP is back over $25 but I'd get 1/2 out at 0.70 and then it's a free ride on the other half.

President Trump could buy $3.5Bn worth of those UUP calls, then resign and probably get $20B back for a gain of $16.5Bn – just a suggestion…

Appple will give us a hell of a boost at the open but then we'll see what sticks. Likely big funds will take this opportunity to start selling off shares while AAPL supports the indexes so look for the Russell (/TF) to sell off first, followed by the large caps.