So far, so good.

After a quick rejection, the Dow is drifiting along under the 22,000 line and it LOOKS bullish but let's remember that it took big moves by Caterpillar ($10), Goldman Sachs ($10), JP Morgan ($8), Boeing ($30) and Apple ($7) on earnings to give the Dow it's last 500 points. That's a tough act to follow for sure.

And it's been a sort of a feedback loop because each earnings win pops the index, which raises all the Dow components and then the next one hits and reinforces the gains from the last win and then the index makes a new high and more money pours into the ETFs, etc. All very nice if you are bullish but the rally, on the whole, has come on fairly low volume and, now that earnings are over, we'll have to wonder what catalysts is going to take us over 22,000 (our shorting target), let alone hold us up here.

Over in Europe, they have earnings too and the Europeans were not as impressed with earnings as the US investors were. In fact, Germany's DAX is down 5% from their June highs along with the Euro Stoxx Index, which fell from 3,650 to 3,450 while the S&P added 50 points (2%).

Major Global Indexes don't usually diverge from each other that much and the Nikkei has been trending down as well so someone is delusional and it's probably the country that elected a reality show host to be their President – I'm just saying…

The Dow is up 600 points since it's June high and that's 2.8% but, more importantly, since the election, the Dow is up from 18,000 so 4,000 points is 22% and I have to ask you – has Trump made things 22% better in 9 months? And we're not taking about a 22% rebound after a sell-off, the Dow had already gained 50% since 2012 (4 years) from 12,000 to 18,000 so this 22% is just a cherry on top of all that fudge and whipped cream that was already piled on the QE sundae that had already taken us from 6,000 to 12,000 in the 4 years before that.

Granted we were at 14,000 (which was a silly high) in 2007 so let's call 12,000 a fair base and conside the drop an abberation. That still makes the run since 2012 from 12,000 to 22,000 (66.6%) an average of 12% a year and earnings are in no way justifying that kind of move – THAT is why I object to these market levels. Perhaps we are simply going to have to accept the fact that, from now on, we pay 25 times earnings for stocks instead of the historic 18 average but we KNOW this appetite for risk is artificial and based very much on the lack of risk-free alternatives.

Speaking of risk, I see Tesla (TSLA) is blasting up $20 after earnings and that's nice but they did burn $1.1Bn in cash this Q, leaving them with $3Bn to go from producting 30 Model 3s to 125,000 per quarter. Shouldn't be difficult, right? At $350, TSLA's market cap is $57.5Bn and perhaps the Model 3 is the greatest car ever made and will sell 500,000 every year of a single model and perhaps Elon Musk is a genius who has figured out how to make cars for 10% profits (vs 5% at industry leader GM) but, even if we give him those huge benefits of doubt:

- 500,000 $40,000 cars = $20Bn

- 10% of $20Bn = $2Bn

- $2Bn is 1/28th of $57.5Bn

This is why we shorted Tesla as it neared $400 (see "Tesla's Emperor Musk Has No Clothes!"). This is the point ($350) at which the valuation gets silly – even if you think that everyting Musk is trying to do works out perfectly. Goldman Sachs agrees with me and warns that TSLA can drop 45% as the Government Subsidies ($7,500 per car) run out and sales trail off.

GM, by the way, sells $164Bn worth of cars, makes $9Bn and is only valued at $50Bn, 13% less than Tesla! Guess which one we own?

Musk, for his part, maintains that TESLA has 465,000 net deposits on the Model 3 and that's nice but doesn't that mean that $465M of their $3Bn in remaining cash is deposits, and not theirs to play with? We're not shorting Tesla again yet – they burned us last time we started too soon, but we will grab a short position as they close in on $400 again – because it's just silly.

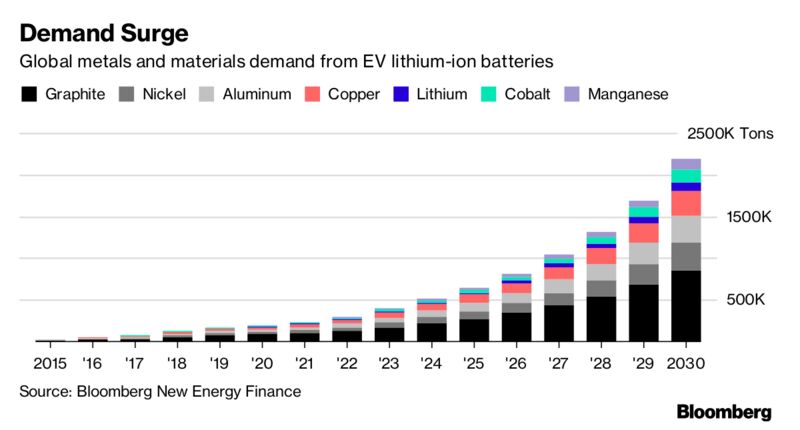

Meanwhile, if you want to make big money on electric cars, buy copper! Copper, Graphite, Nickel, Aluminum, Lithium, Cobalt and Manganese – that's what electric cars are made of and, currently, there are only 2M of them on the roads but by 2030, there should be over 100M and adding 50M or more annually after that.

As you can see from the chart, we're talking about MAJOR increases in those materials over the next decade and this is one of those macro investments that you can be very comfortable making long-term bets on. Over the next few weeks, we will be examinging the electric car sector because, whether it's from Tesla or not, that revolution is coming and it's a change we can certainly bet on.