$5,418!

$5,418!

Those same 2 gasoline (/RBV7) contracts we initiated in Wednesday's Live Trading Webinar (which I reminded you of in Friday morning's PSW Report) made another $700 per contract over the weekend and we stopped out with over $5,400 gains at the $1.60 line as Hurricane Harvey seems to have peaked out and Gasoline Futures hit our +5% on the money. That's a big YOU'RE WELCOME to get our week started but our hearts go out to the people of Texas, who are suffering from the after effects of the storm we used to make money on.

If NOT betting gasoline would go up when a hurricane hits the Gulf Coast refineries, then I would have felt bad about the bet but this was one of those essentially sure things you really can't pass up if you want to call yourself a trader. As it stands, about 22% of Gulf Refining Capacity is off-line and that's 1Mb/d our of 5 that's going to get drawn out of inventories for the duration because the rest of US refining has been operating near capacity and can't make up that kind of shortfall – unless they curtail exports, which is possible.

Even if the damage near the refineries is controlled quickly, widespread damage throughout the area will make it hard for refinery workers to get to work — the Shell plant, for instance, has more than 3,000 workers and contractors. As you can see from this handy map, Valero (VLO) is losing 416,000 barrels a day in two hard-hit refineries and Marathon (MRO) will be down 546,000 barrels and, with 1-45 closed, it's likely to be a good week at least before they are full on-line again, probably 2 weeks.

Even if the damage near the refineries is controlled quickly, widespread damage throughout the area will make it hard for refinery workers to get to work — the Shell plant, for instance, has more than 3,000 workers and contractors. As you can see from this handy map, Valero (VLO) is losing 416,000 barrels a day in two hard-hit refineries and Marathon (MRO) will be down 546,000 barrels and, with 1-45 closed, it's likely to be a good week at least before they are full on-line again, probably 2 weeks.

Of course, news is not all bad for VLO, who we're long on, as the refiners are benefitting from a widening crack spread – the cost between the barrels of oil they buy and the price of the refined products they can sell when they "crack" the barrel open. We got aggressively long on VLO in our Aug 18th Butterfly Portfolio Review and we didn't know about Harvey at the time but we did know we expected a stronger than usual hurricane season and, as you can see from this chart, the crack spreads were beginning to rise, so I said to our Members:

VLO – We got a nice pullback to lets buy back the 15 short Jan $67.50 calls at $3.10 ($4,650) AND the 20 short 2019 $75 calls at $3.05 ($6,100) and we'll sell 10 Jan $60 puts for $3 ($3,000). Lower oil prices tend to be good for the refiner at first as gas prices take longer to fall (so their spread increases) and Q3 sales are looking strong per inventories.

As we were buying back short calls we had already sold (for a profit), we were left with just 20 long 2019 $60 calls at $7.44 ($14,880) and already on Friday they had blasted up to $10.35 ($20,700) for a gain of $5,820 (39%) and that's not even including all the money we made selling short puts and calls over the past year we've been in this trade (11/18/16). Our Butterfly Portfolio uses our "Secret to Making Consistent 20-40% Annual Returns" system and is on track for yet another 40% year in 2017.

We'll be watching the storm path closely to gauge the overall impact on energy prices and energy stocks but, as you can see, the storm missed almost all of the deepwater wells as well as the natural gas production and is projected to turn (and weaken) before impacting shale production (shipping was little affected) so oil (/CL) prices have not matched the excitement but we do like it long (/CLV7) into the upcoming holiday weekend off the now $47.35 line with a low of $47.25 this morning.

We'll be watching the storm path closely to gauge the overall impact on energy prices and energy stocks but, as you can see, the storm missed almost all of the deepwater wells as well as the natural gas production and is projected to turn (and weaken) before impacting shale production (shipping was little affected) so oil (/CL) prices have not matched the excitement but we do like it long (/CLV7) into the upcoming holiday weekend off the now $47.35 line with a low of $47.25 this morning.

In Tuesday morning's PSW Report, we picked a long on the Oil ETF (USO) using the Sept $9 calls, which were 0.72 at the time and were only up 10% at 0.80 as of Friday's close and yes, I know a 10% gain in 3 days sounds exciting to people who don't subscribe to our newsletter but it's not a big deal for an option and, if you're lucky, it might pull back a bit on "disappointment" that more oil production hasn't been taken off-line but our premise was jacking up prices for the holidays – and that hasn't been cancelled.

Meanwhile, this has been a catastrophic storm and it's coming back to bite the Texas Republicans, who voted not to help New Jesey when it was hit by Sandy in 2012 – even voting down emergency funding for hurricane victims. Texas Senator and total dick, Ted Cruz was called out by Christie during the election for what he said at the time:

"Emergency relief for the families who are suffering from this natural disaster should not be used as a Christmas tree for billions in unrelated spending," Cruz said in a statement at the time. "The United States Senate should not be in the business of exploiting victims of natural disasters to fund pork projects that further expand our debt."

The Republicans blocked additiona funding for FEMA and, even worse, failed to fund the National Flood Insurance Program, which leaves it with just $5.8Bn to cover what is estimated to be at least $40Bn in damage claims from the current storm. The only way to get aid now would be a bi-partisan Government bail-out – good luck with that! Congress doesn't even come back from vacation until Sept 5th, that's going to run into at least two weeks of agonizing delays for the victims – even if Congress acts right away (LOL).

Sell-offs in private insurance companies are likely to be an over-reaction as flood insurance is a separate policy, mostly covered by the Government but, if the Republican Congress doesn't do a 180 and re-fund the program, then Texas homeowners will be in for quite a shock if private insurance companies begin to assess their insurance needs based on the actual risk if living in a place where this happens:

Of course, the Government should not stand between you and your insurance provider, right? Keep electing heartless representatives who don't care about people and, one day, you may realize you ARE people. Of course, we know how well these Republicans flip-flop when something finally affects them and the Democrats aren't likely to hurt people, even Texans, out of spite so hopefully something will be worked out.

Meanwhile, this will be a good test of the Keynesian notion that even a broken window is good for the economy, as it puts people to work fixing things up. Home Depot (HD) and Lowes (LOW) generally get a nice pop in business following damaging storms and LOW had a recent pullback to $72.50 from $85 so $17.50 is 20% which means we expect a weak bounce of at least $3.50 to $76 and likely a strong bounce to $79.50 thanks to the storm. The LOW Oct $75 calls are $1.70 and would pay at least $4.50 at $79.50 for a $2.80 (164%) potential gain.

See why we're not so excited by USO making us "just" 10% in a week?

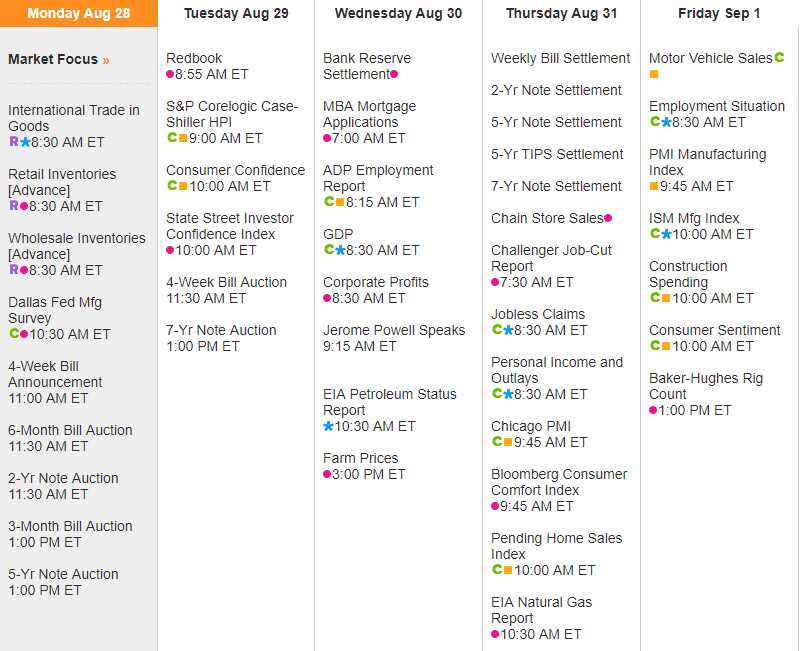

Oddly enough, we get the Dallas Fed Report this week and their projections will all be shot to Hell thanks to the hurricane (and there may be more). It will also affect GDP, which reports Wednesday morning and we have a lot of confidence reports that will also not take into account this major event. Texas is a large part of our nation's economy, Houston in particular, and this will cause waves of chaos for months to come.

The Futures are back to our shorting lines (see last week's posts for charts levels) in the same pre-market pattern we discussed last week and, suprise surprise, here we are again!